Veteran chartist Peter Brandt is flagging what he calls a “potential double prime” on XRP’s weekly chart, a basic reversal setup that, if confirmed, would argue for materially decrease costs — at the same time as different merchants level to a washed-out weekly RSI studying that has traditionally aligned with prior backside zones.

Peter Brandt Flags XRP Double Prime Sample

Brandt posted the chart to X on Dec. 17 and didn’t hassle softening the message for XRP’s on-line trustworthy. “I do know prematurely that every one you Riplosts $XRP will eternally remind me of this submit — ask me if I care,” he wrote, earlier than including: “This can be a potential double prime. Positive, it could fail, and I’ll take care of this if it does. However for now this has bearish implications. Adore it or not — you have to take care of it.”

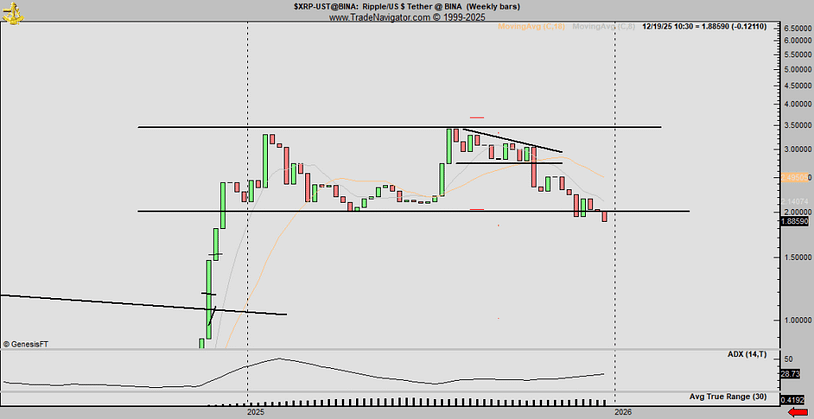

The chart exhibits XRP-USDT on Binance in weekly bars, with two highs clustered round $3.40 and $3.66 and a clearly marked help shelf close to $2.00. In classical chart phrases, that $2 area capabilities because the neckline: lose it with follow-through, and the market is not in “pullback inside a variety” territory — it’s in “failed construction” territory.

Associated Studying

That distinction issues as a result of double tops are usually much less concerning the second peak itself and extra about what occurs on the midpoint low between the 2 peaks. Brandt’s framing displays that: the sample is “potential” till both help holds and value reclaims prior ranges, or the neckline breaks and the market accepts decrease.

On this case, Brandt’s chart is already exhibiting XRP buying and selling beneath the $2.00 line, with the newest marker round $1.8859. That places the main focus squarely on whether or not the breakdown turns into a sustained weekly close-and-hold beneath help, or whether or not the transfer will get reversed shortly sufficient to deal with it as a bear lure.

Or Is The XRP Backside In?

Not everybody studying the identical tape is leaning into the bearish conclusion. Dealer Cryptollica posted a separate XRP/USD weekly chart (Bitstamp) on Dec. 15 highlighting the weekly RSI at roughly 33, accompanied by the remark: “$XRP WEEKLY RSI : 33 💥”. The chart highlights that, up to now 5 circumstances, equally low readings in XRP’s weekly RSI have tended to happen round market bottoming zones.

Brandt was receptive to the conditional logic — particularly, the concept that a failed double prime can flip from bearish to bullish if the breakdown doesn’t stick. Responding, he wrote: “Yea, if this dbl prime fails then this might develop into thrilling. I agree. I’m not championing a bear case — simply exhibiting charts for what they’re.”

Associated Studying

That change captures the precise stress right here. Momentum measures like RSI can establish stretched circumstances and recurring historic zones, however they don’t, on their very own, invalidate a price-structure breakdown.

Notably, Brandt didn’t present a value goal in his remark. However the chart he shared comprises sufficient construction to deduce the usual “textbook” projection many technicians would use. With peaks close to $3.60 and a neckline close to $2.00, the sample peak is about $1.60. The traditional measured transfer subtracts that peak from the neckline after a break, implying a goal within the neighborhood of $0.40 if the setup totally performs out.

That’s not a forecast, and it’s not a promise the market will cooperate — it’s merely the arithmetic implied by the sample Brandt is pointing at. The extra rapid query is whether or not XRP can reclaim the $2.00 area decisively sufficient to show the breakdown right into a failed transfer. If it could actually’t, the chart dialog shifts from “potential double prime” to “confirmed break,” and the draw back math stops being hypothetical in merchants’ positioning fashions.

At press time, XRP traded at $1.83.

Featured picture created with DALL.E, chart from TradingView.com