Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin merchants in all places will likely be watching their feeds intently, keen the world’s largest crypto to carry regular at or close to its present $107K mark.

$15B in Bitcoin choices expire at the moment, a significant portion of the roughly $40B in choices excellent.

If $BTC’s worth falls to $102K or under, the market would endure a real ‘ache level.’ So long as that doesn’t occur, Bitcoin seems set to press on with enterprise as regular – setting the stage for additional progress of the ecosystem and the primary meme coin providing direct $BTC publicity, BTC Bull Token ($BTCBULL).

Narrowing Volatility Signifies Optimistic Outlook

The $BTC volatility index has narrowed in latest days, drawing extra intently to the historic volatility and usually indicating that merchants don’t anticipate dramatic worth strikes both means – up or down.

That was supported by Deribit Chief Business Officer Jean-David Péquignot, who stated:

‘Low open curiosity in perps and pretty depressed Bitcoin implied volatility and skew are indicative of restricted expectations for sharp worth actions…’

The place does that depart Bitcoin? Nonetheless wanting bullish. Crypto treasury methods are nonetheless increasing, including 1000’s of $BTC tokens to long-term reserves and growing demand. Metaplanet just added 1,234 $BTC, bringing its whole portfolio north of 12K $BTC.

And it isn’t simply direct Bitcoin purchases; the ecosystem around the globe’s main crypto continues to gas demand.

ETFs Notch 13 Days Consecutive Inflows, Bitcoin Overtakes Google

Bitcoin ETFs are constructing on a 13-day stretch of constructive inflows. Monday to Thursday, daily cumulative inflows amounted to:

Optimistic inflows level to long-term curiosity from retail and institutional traders, relatively than short-term merchants, and contribute to underlying shopping for stress.

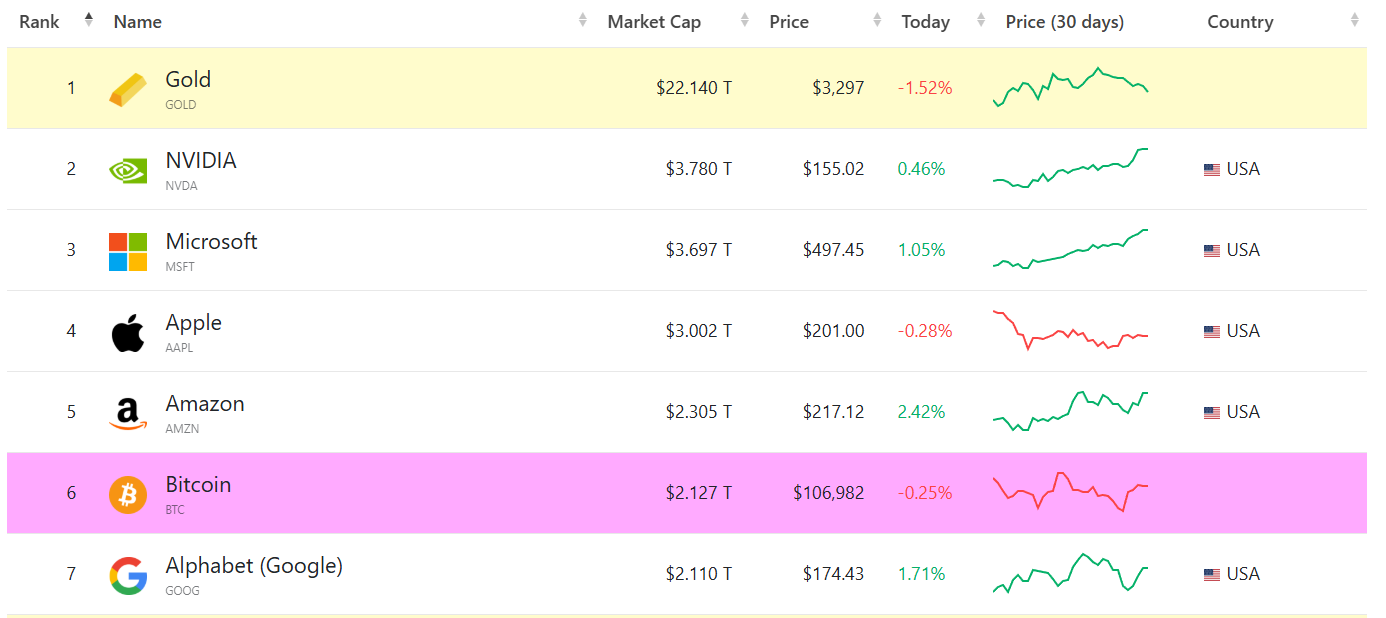

And with the biggest Bitcoin ETF, BlackRock’s iShares Bitcoin Belief, holding over $70B in whole belongings, Bitcoin took benefit of weakening Alphabet inventory to overthrow Google because the world’s sixth-largest asset.

It’s a mixture of basically constructive components, reinforcing a bullish case for $BTC – and the meme coin constructed on that case.

BTC Bull Token ($BTCBULL) – Meme Coin Trusting $BTC to Hit $250K and Past

BTC Bull Token ($BTCBULL) is assured that Bitcoin will sooner or later attain $250K and extra – so assured that the undertaking is constructed round key Bitcoin worth milestones.

- Bitcoin $125K: The undertaking burns $BTCBULL tokens to exert deflationary stress on the value.

- Bitcoin $150K: BTC Bull token traders who maintain their tokens within the Best Wallet app obtain a free $BTC airdrop.

- Bitcoin $175K: One other $BTCBULL token burn.

- Bitcoin $200K: One other $BTC airdrop!

- Bitcoin $225K: A ultimate $BTCBULL burn.

- Bitcoin $250K: A large $BTCBULL airdrop.

The mix of token burns and airdrops encourages constructive momentum for BTC Bull Token, following Bitcoin’s upward trajectory.

Visit the BTC Bull token website today.

BTC Choices Expire, However Outlook Is Bullish for Bitcoin

With $15B in Bitcoin choices expiring, narrowing volatility, and constant ETF inflows, Bitcoin’s basis seems stronger than ever.

For traders trying to capitalize on Bitcoin’s momentum, BTC Bull Token provides a daring, milestone-based roadmap aligned with $BTC’s rise to $250K. However be warned – there’s mere days left within the presale, so the window to affix is closing quick.

All the time do your personal analysis. This isn’t monetary recommendation.