What to Know:

- Crypto cycles have more and more tracked macro information, with sturdy jobs and PMI figures tightening liquidity, whereas weaker prints typically revive risk-on demand.

- Buyers now intently watch unemployment and PMI thresholds, utilizing them as alerts to find out when to rotate between high-beta altcoins and extra defensive, utility-heavy allocations.

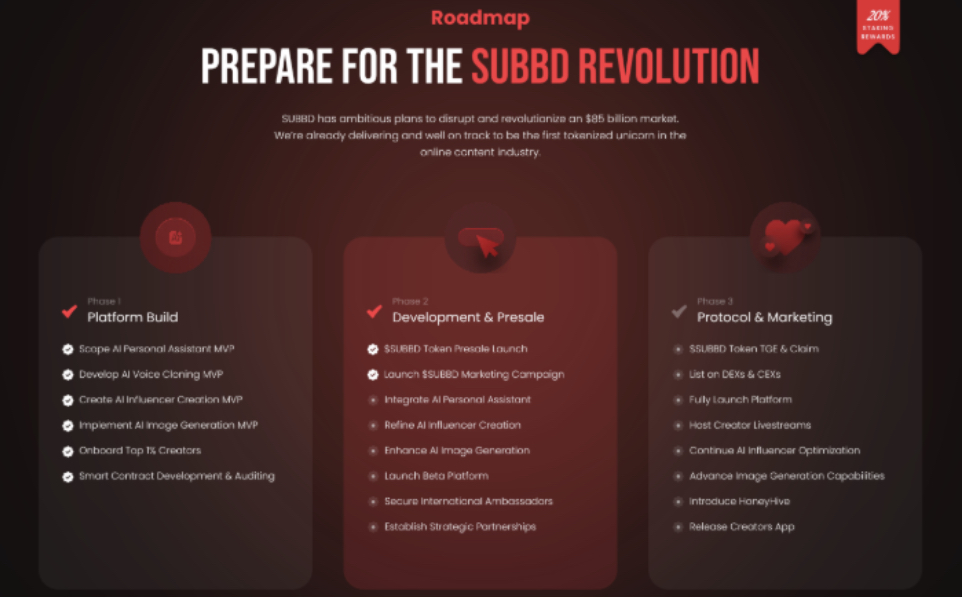

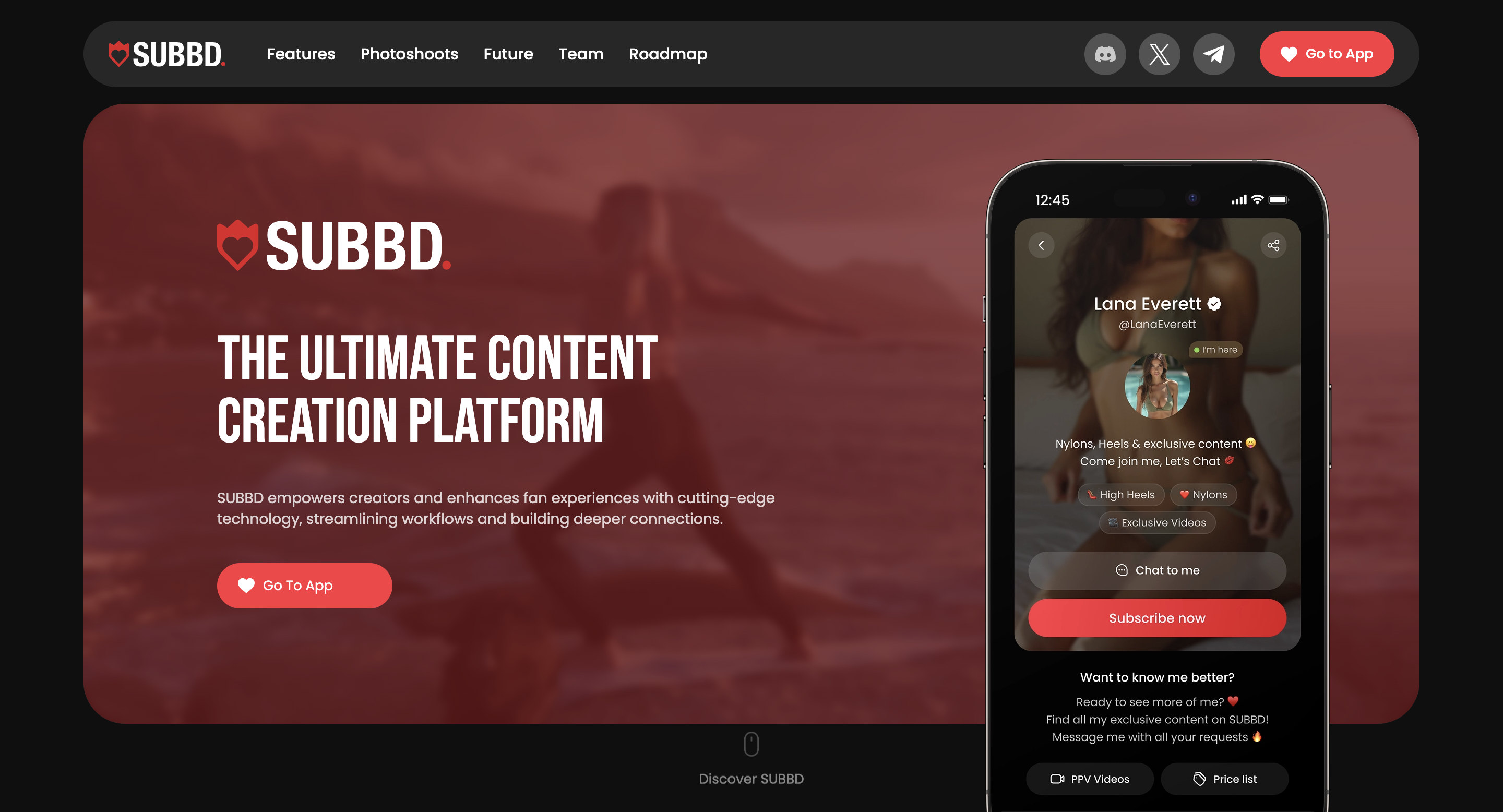

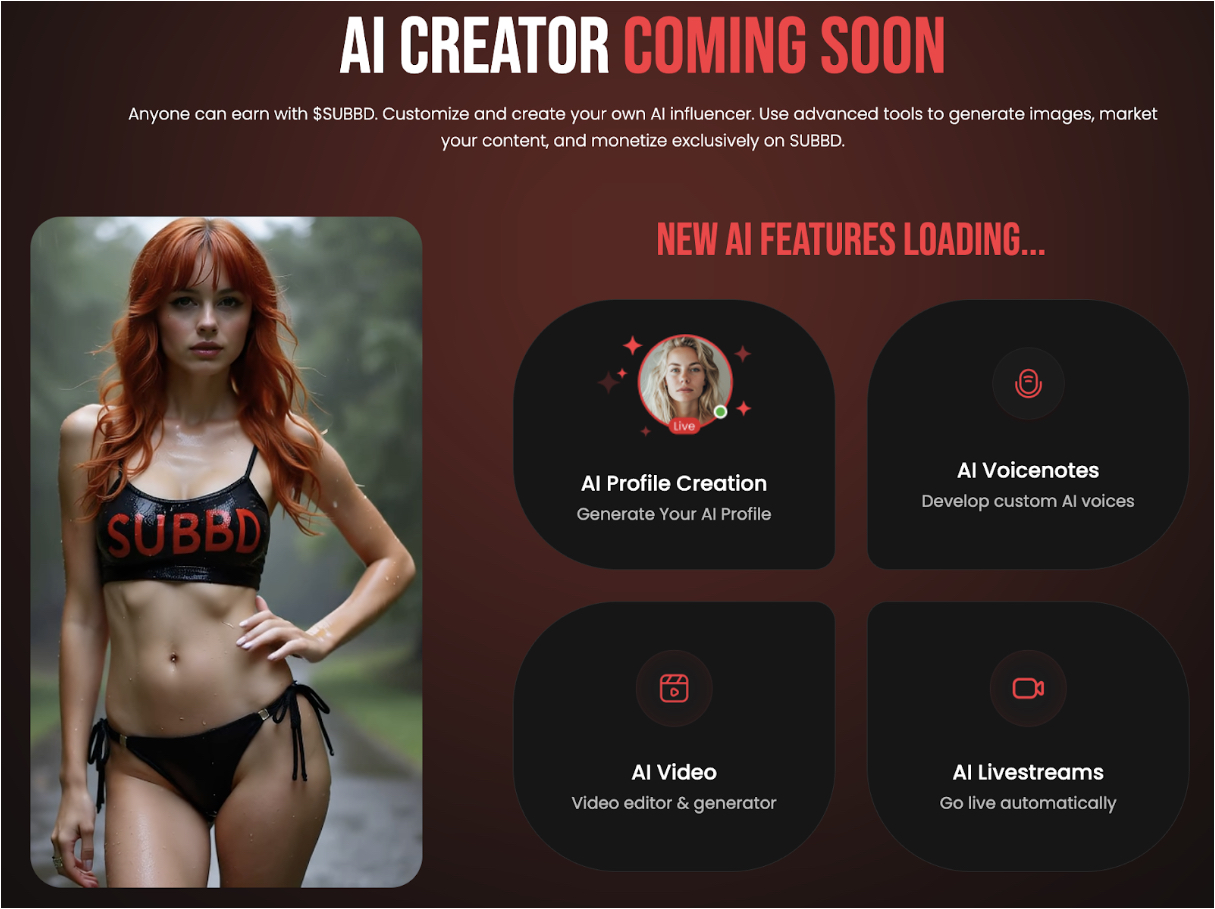

- AI-driven creator platforms are rising as a structural theme, remodeling fragmented content material instruments and opaque revenue-sharing fashions into on-chain, programmable economies.

- SUBBD targets extreme creator‑platform charges, arbitrary bans, and fragmented AI stacks by merging Web3 funds, governance, and superior AI instruments right into a single tokenized ecosystem.

Macroeconomic information has quietly was one among crypto’s greatest temper swings. One minute, Bitcoin is surging increased on a smooth US jobs report, the following it’s plummeting on a hotter-than-expected inflation print, as merchants continuously regulate their expectations for charges, liquidity, and threat urge for food.

Again in 2023, when unemployment flirted with 3.4% and PMI readings hovered near the 50 expansion line, markets reacted like all the things was lastly calming down.

Bitcoin and Ethereum surged, whereas higher-beta sectors took off, and even AI and creator-economy tokens skilled outsized flows as buyers chased momentum.

Then you might have the opposite aspect of the coin. A stronger payrolls report or a shock rebound in manufacturing can ship bond yields flying, push the greenback increased, and suck liquidity out of speculative belongings.

You will have most likely seen it play out 100 instances, with majors swinging 10 % round Non-Farm Payrolls or PMI information. Altcoins with out actual utility often get hit twice as laborious.

That’s why extra merchants are beginning to migrate towards tasks with tangible use instances and actual consumer demand. SUBBD suits neatly into that shift.

The token powers an AI content material creation platform aimed on the $85B creator financial system and continues attracting consumers even throughout uneven macro circumstances.

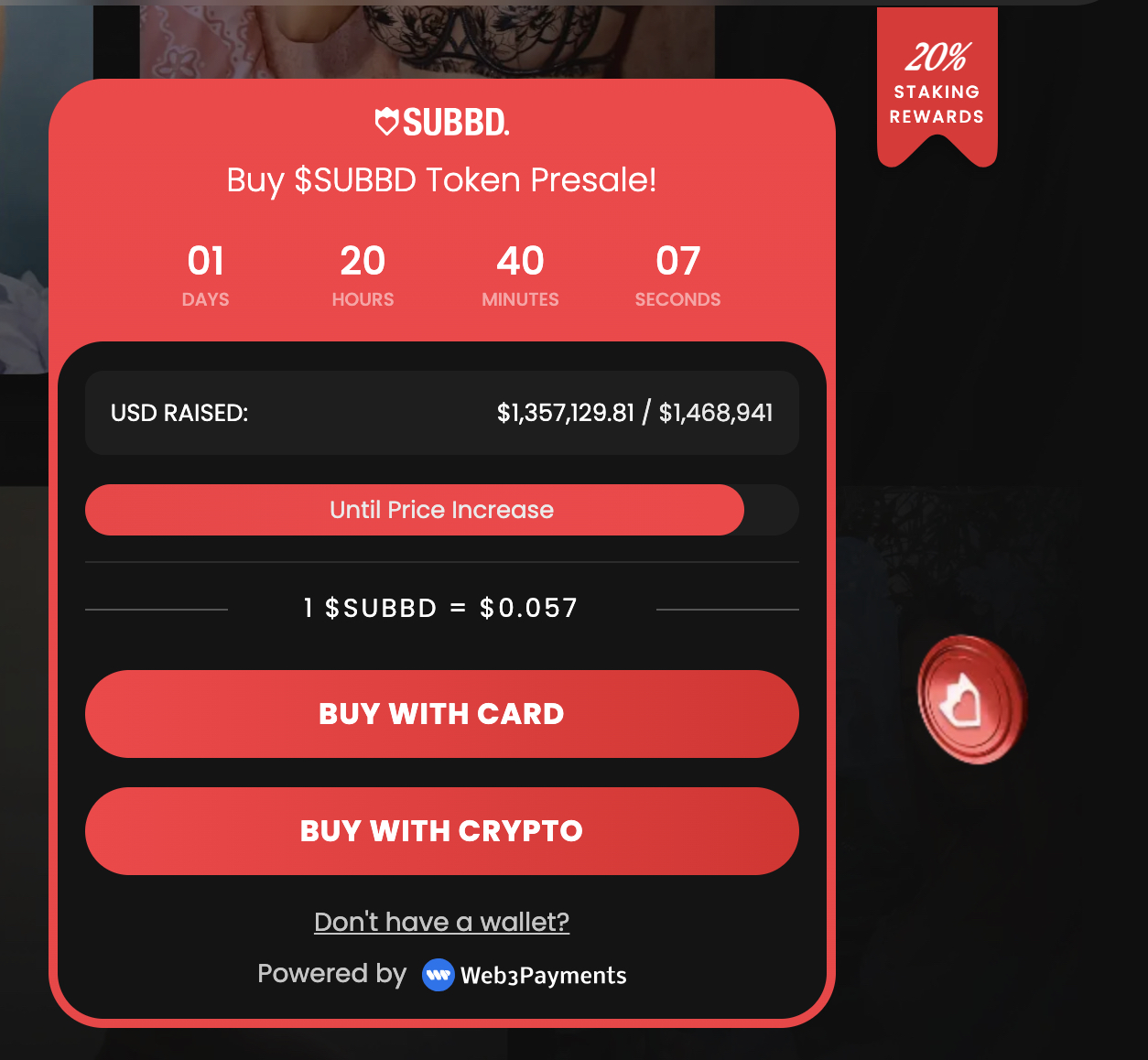

The presale has already raised $1.3M; every SUBBD is presently priced at $0.057, and staking gives a 20% APY, which helps assist long-term participation, no matter whether or not the following information print sends markets right into a risk-on or risk-off section.

For a deeper dive into market drivers and long-term development potential, you possibly can discover our full SUBBD token price outlook.

How Jobs And PMI Knowledge Steer Crypto Liquidity Cycles

If you happen to zoom out and take a look at main crypto tops and bottoms since 2020, they line up neatly with shifts in world liquidity. Extremely-loose coverage, near-zero charges, and trillions in stimulus helped gas the 2020 to 2021 bull run.

As soon as central banks started mountain climbing aggressively in 2022 to battle sticky inflation, Bitcoin slid greater than 70 % from its all-time excessive, and speculative capital dried up throughout the board.

US employment and PMI information sit proper on the middle of that macro image. Robust payroll development and PMI readings comfortably above 50 often sign a wholesome financial system. That offers central banks cowl to maintain coverage tighter for longer, which pushes actual yields increased and makes threat belongings much less interesting.

Softer information has the alternative impact; it revives fee minimize bets, eases monetary circumstances, and sometimes pulls contemporary liquidity again into crypto.

In this sort of stop-start setting, buyers have been rotating towards AI and creator financial system performs that really remedy issues, from Render and Livepeer in compute and streaming, to Web3 social tasks which can be rebuilding the social graph.

SUBBD is making an attempt to sit down in that very same lane, a content-focused AI and Web3 stack that goals to draw actual creators and viewers, not simply short-term hypothesis. That positioning can matter when the following payroll or PMI print flips sentiment from threat on to threat off in a single session.

Why SUBBD’s Utility Story Issues When Macro Turns Danger Off

When liquidity tightens after a sizzling payroll report or a stronger PMI studying, tokens with weak foundations and no actual income paths are often the primary to bleed. SUBBD is constructed on a distinct thesis.

The undertaking combines Web3 rails with AI creator tooling to problem platform charges that may attain 70 % on legacy creator apps, whereas giving each creators and followers safety from arbitrary bans and geography-based restrictions.

On the middle of the ecosystem is the SUBBD AI Private Assistant, a toolkit that automates fan interactions, manages chats, handles primary assist, and powers AI voice cloning and full AI influencer creation. All of those options are straight related to crypto funds, token-gated content material, and on-chain governance.

Because the platform grows, transactional demand for the SUBBD token grows with it, no matter whether or not the following PMI print lands at 48 or 55.

Whereas many AI creator tasks cease at easy chatbot performance, SUBBD stacks a number of monetization routes on prime. Creators can earn from subscriptions, pay-per-view content material, NFT drops, and tipping, whereas customers acquire XP multipliers and extra rewards by way of the token.

The presale has already raised over $1.3M with every SUBBD priced at $0.057, which means that buyers are prepared to again a utility-driven mannequin lengthy earlier than the total platform goes dwell.

On the reward aspect, staking begins with a 20% APY within the first 12 months, then shifts right into a mannequin the place stakers unlock platform advantages that embrace unique livestreams, in-house content material, and each day behind-the-scenes drops.

In a macro local weather the place yields on conventional belongings can shift after each jobs report, this mix of predictable on-chain rewards and actual product utility is an interesting setup for buyers who’re comfy taking measured threat.

A easy transfer, not a chance, is usually the smarter play, and the SUBBD presale offers early members an opportunity to place earlier than the platform reaches scale.

This text is for informational functions solely and doesn’t represent monetary or funding recommendation.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/will-pmi-and-jobs-data-move-crypto-subbd-token