Each bitcoin price bull market up to now has adopted a well-known sample of explosive upside adopted by sharp drawdowns, with every cycle delivering decrease proportion positive aspects than the final. This phenomenon, generally known as diminishing returns, has grow to be one of the crucial persistent narratives in Bitcoin. The query now could be whether or not this cycle will comply with the identical trajectory or if the maturation of Bitcoin as an asset class may bend the sample.

Bitcoin Value and Diminishing Returns

Thus far this cycle, we have now witnessed roughly 630% BTC Growth Since Cycle Low to the latest all-time excessive. That compares to greater than 2,000% within the earlier bull market. To match the final cycle’s magnitude, Bitcoin would want to succeed in round $327,000, a stretch that appears more and more unlikely.

Evolving Bitcoin Value Dynamics

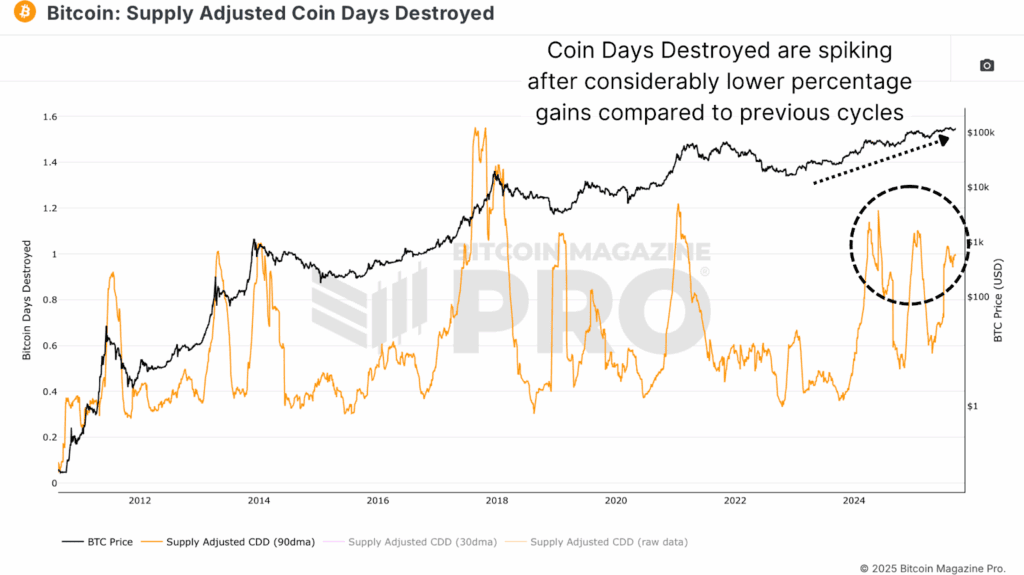

One cause for the much less explosive upside positive aspects may be seen within the Supply Adjusted Coin Days Destroyed (CDD) metric, which tracks the speed of older cash shifting on-chain. In previous cycles, such because the 2021 bull market, long-term holders tended to promote after Bitcoin had already appreciated ~4x from its native lows. Nevertheless, on this cycle, related ranges of profit-taking have occurred after simply 2x strikes. Extra just lately, spikes in CDD have been triggered by even smaller value will increase of 30–50%. This displays a maturing investor base: long-term holders are extra keen to understand positive aspects earlier, which dampens parabolic advances and smooths out the market construction.

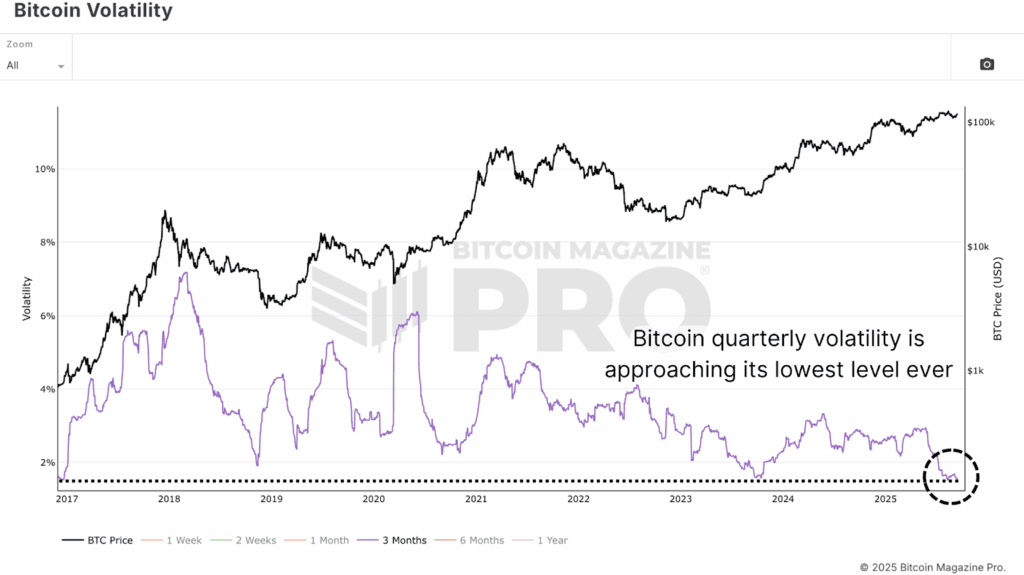

One other issue is Bitcoin Volatility. Bitcoin’s quarterly volatility has trended steadily decrease. Whereas this reduces the chances of utmost blow-off tops, it additionally helps a more healthy long-term funding profile. Decrease volatility means the capital inflows required to maneuver value develop bigger, but it surely additionally makes Bitcoin extra engaging to establishments looking for risk-adjusted publicity.

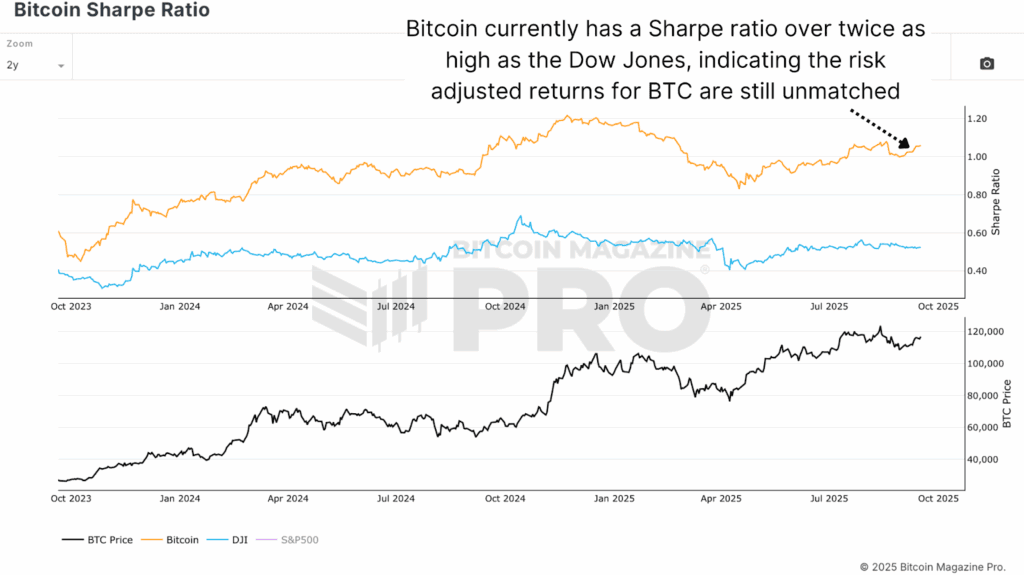

This exhibits up within the Bitcoin Sharpe Ratio, the place Bitcoin at the moment scores greater than double that of the Dow Jones Industrial Common. In different phrases, Bitcoin nonetheless provides superior returns relative to its threat, even because the market stabilizes.

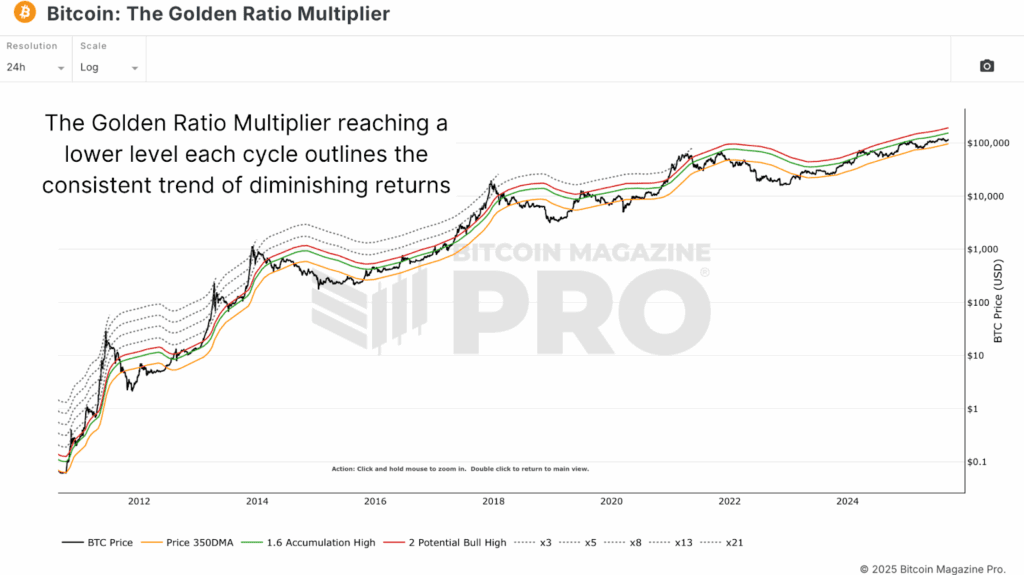

Bitcoin Value and the Golden Ratio

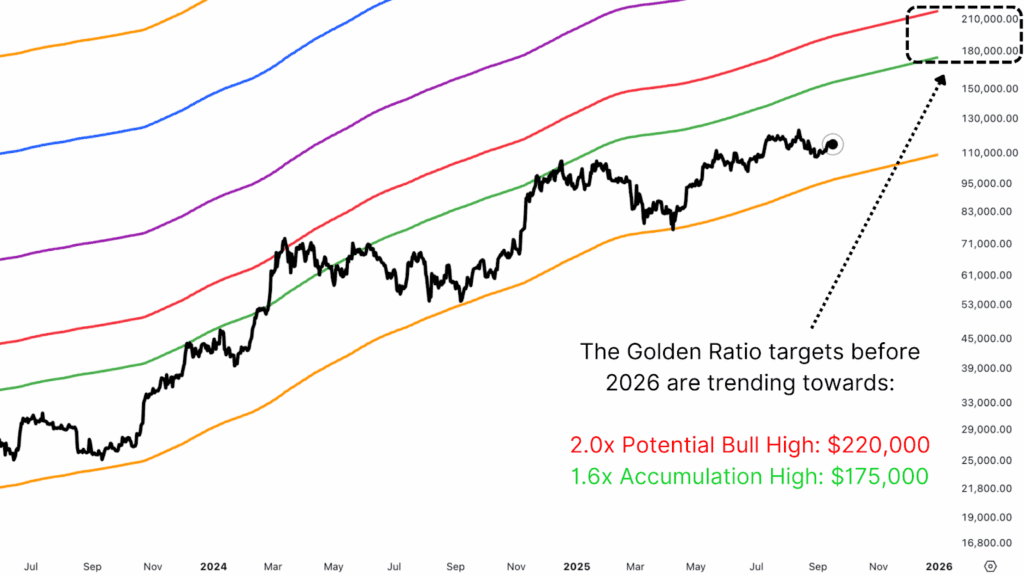

From a technical perspective, The Golden Ratio Multiplier offers a framework for projecting diminishing returns. Every cycle high has aligned with progressively decrease Fibonacci multiples of the 350-day shifting common. In 2013, value reached the 21x band. For the 2017 high, it reached the 5x band, and in 2021, the 3x band. This cycle, Bitcoin has to this point tagged the 2x and 1.6x bands, however a push again towards the 2x ranges stays doable.

Projecting these 1.6x and 2x ranges ahead, primarily based on their present trajectory, suggests a goal between $175,000 and $220,000 earlier than the tip of the yr. In fact, the info gained’t play out precisely like this, as we’d see the 350DMA transfer extra exponentially to the upside as we closed in on these higher targets. The purpose is these ranges are ever-changing and consistently pointing in direction of greater targets because the bull cycle progresses.

Bitcoin Value in a New Period

Diminishing returns don’t scale back Bitcoin’s attractiveness; if something, they improve it for establishments. Much less violent drawdowns, doubtlessly lengthening cycles, and stronger risk-adjusted efficiency all contribute to creating Bitcoin a extra investable asset. Nevertheless, whilst Bitcoin matures, its upside stays extraordinary in comparison with conventional markets. The times of two,000%+ cycles could also be behind us, however the period of Bitcoin as a mainstream, institutionally held asset is simply simply starting, and can probably nonetheless present unmatched returns within the coming years.

For deeper knowledge, charts, {and professional} insights into bitcoin value traits, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding selections.

The content published on Finance Insider Today is for informational and educational purposes only. It does not constitute financial advice, investment advice, or any other form of professional advice. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. Finance Insider Today is not responsible for any financial losses resulting from decisions made based on information published on this website. Past performance is not indicative of future results. Financial markets carry significant risk. Never invest more than you can afford to lose.