What to Know:

- Stripe’s stablecoin arm, Bridge, has utilized for a US nationwide belief financial institution constitution underneath the GENIUS Act, becoming a member of Circle, Ripple, Paxos, and Coinbase.

- The GENIUS Act introduces federal oversight for stablecoin issuers, requiring 100% money or Treasury reserves and month-to-month public disclosures.

- This might mark the beginning of ‘Stablecoin Season,’ as regulated issuers bridge the hole between banks and blockchain funds.

- Finest Pockets ($BEST) stands to learn, providing customers safe custody, presale entry, and as much as 80% APY staking rewards.

Stablecoins are going legit, and fairly quick.

Stripe’s stablecoin arm, Bridge, simply filed an utility with the US Workplace of the Comptroller of the Foreign money (OCC) to type a nationwide belief financial institution underneath the newly enacted GENIUS Act.

It’s the most recent transfer in what’s shaping as much as be ‘Stablecoin Season’: a full-blown regulatory dash to convey digital {dollars} underneath federal oversight.

If accredited, Bridge’s constitution would let Stripe situation, redeem, and custody stablecoins straight underneath the OCC, as a substitute of juggling dozens of state-level money-transmitter licenses.

Which means its whole stablecoin enterprise would sit underneath on federal framework, full with 100% money or Treasury-backed reserves and month-to-month public disclosures, as required by the GENIUS Act.

Bridge now joins Circle ($USDC), Ripple ($RLUSD), Paxos ($USDP), and Coinbase ($COIN) in chasing nationwide belief licenses – a race that marks a historic pivot for the US digital asset market.

Collectively, these corporations are positioning stablecoins because the regulated spine of worldwide funds, somewhat than gray-zone fintech experiments.

The timing is smart. Stablecoins already account for over $315B in circulating value, and Commonplace Chartered analysts estimate they may pull $1T in deposits away from conventional banks over the following three years.

For customers and retailers, that shift would make stablecoins the default settlement rail of the web. They’re quicker, cheaper, and now, lastly, compliant.

For Striple, Bridge isn’t nearly compliance; it’s additionally an infrastructure play.

The corporate not too long ago unveiled Open Issuance, a service that helps apps launch their very own stablecoins utilizing Bridge’s back-end.

Wallets like Phantom ($CASH), MetaMask ($mUSD), and Hyperliquid ($USDH) already depend on Bridge as their issuance accomplice.

All indicators level to a regulated on-chain financial system, the place digital {dollars} transfer underneath federal supervision and mainstream adoption lastly takes maintain.

So the actual query for buyers turns into: if stablecoins are about to change into the rails of this new system, which tokens will seize consumer circulate on the edge?

That’s the place Best Wallet Token ($BEST) enters the image, powering one of many fastest-growing Web3 wallets constructed to bridge the hole between regulated stablecoins and on a regular basis customers.

From Stablecoins to Pockets Wars – the New On-Ramp Race

The race for federal belief charters isn’t nearly who prints the following digital greenback; it’s about who controls the gateway to it. Stripe, Circle, Ripple, and Coinbase are combating for issuance and compliance. However on the consumer degree, a special warfare is breaking out… the battle for wallets.

Below the brand new GENIUS framework, stablecoins can lastly plug into conventional finance with clear oversight from the OCC. That unlocks direct settlement with banks, cross-chain interoperability, and compliant collateral for lending protocols. That is the pipeline for a regulated DeFi financial system.

And that is the place crypto wallets are available. They’re not simply storage apps. They’ve change into tremendous apps.

MetaMask now provides staking, Phantom integrates stablecoin rails, and new gamers like Best Wallet are going additional by mixing funds, presales, and rewards inside one safe, Fireblocks-powered interface.

Finest Pockets Token ($BEST) – The Token Fueling a Web3 Tremendous App Constructed for the Stablecoin Period

As stablecoins edge nearer to federal recognition, pockets ecosystems have gotten the frontlines of adoption. Best Wallet is positioning itself at that intersection as a non-custodial wallet app that merges safety, yield, and discovery into one seamless platform.

Constructed on Fireblocks’ MPC-CMP framework, the identical institutional-grade tech utilized by main custodians, Finest Pockets provides customers safe on-chain management with out sacrificing usability.

It’s a spot to retailer tokens, purchase into new crypto presales, stake belongings, and shortly, spend crypto money by way of the Finest Card. That card will ship cashback and charge reductions to anybody staking the native $BEST token.

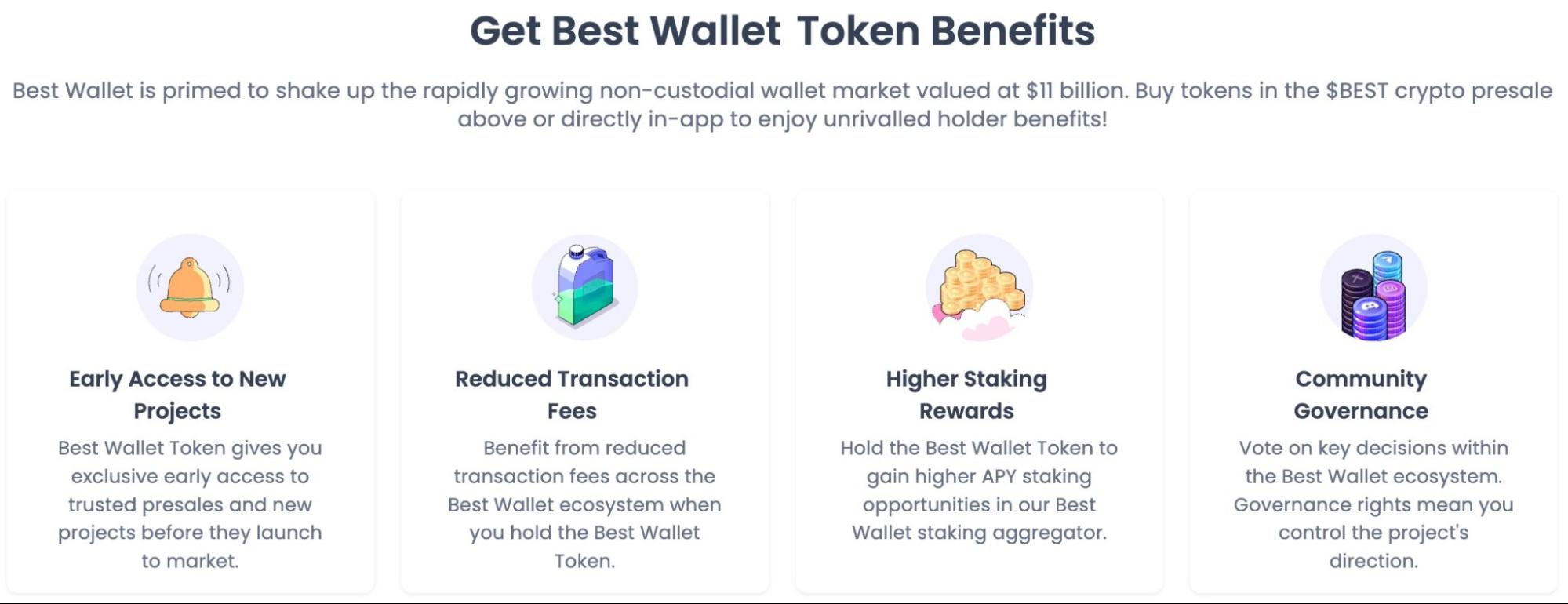

And that token is what powers all the ecosystem. Holding $BEST unlocks lowered transaction charges, larger staking rewards, and early entry to new token launches by way of the in-app ‘Upcoming Tokens’ characteristic.

Uncover how to buy Best Wallet Token in our step-by-step walkthrough.

As stablecoins come underneath the OCC’s watch, wallets integrating compliant rails and institutional safety will stand out. Finest Pockets is constructed exactly for that world, connecting regulated stablecoin infrastructure with DeFi native alternatives.

In that sense, the GENIUS Act units the stage for wallets like Finest Pockets to change into the banks of the long run,

Join the $BEST presale and stake now for as much as 80% APY.

This text doesn’t represent monetary recommendation. Crypto carries inherent dangers, so please do your personal analysis (DYOR) and by no means make investments greater than you might be prepared to lose.

Authored by X, NewsBTC — www.newsbtc.com/news/stablecoin-season-stripe-bridge-impact-best-wallet-token