Introduction

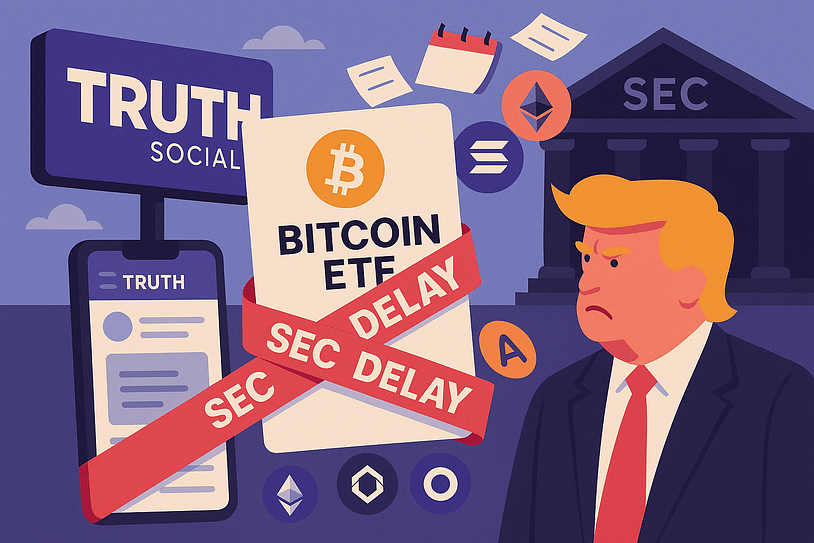

As soon as once more, america Securities and Trade Fee (SEC) has postponed a vital determination on approving cryptocurrency exchange-traded fund (ETF) functions. Among the many most watched is the Fact Social Bitcoin ETF, linked to former President Donald Trump’s social media enterprise. Whereas some market contributors see this delay as an peculiar step within the bureaucratic course of, others—notably contrarian buyers—view it as a robust sign of latent alternative. These delays underscore regulatory skepticism, but additionally mirror the growing disruption that cryptocurrencies pose to conventional monetary techniques. For forward-thinking buyers, these regulatory pauses provide greater than momentary frustration—they’ll function strategic entry factors within the evolution of institutional Bitcoin entry.

The Function of Regulatory Selections in Crypto Markets

Regulation has at all times performed a pivotal function in shaping the trajectory of the cryptocurrency market. The SEC’s involvement is particularly vital as a result of its overarching affect over U.S. capital markets. Any determination it makes reverberates not solely domestically, however internationally as nicely. Within the context of ETFs, notably spot Bitcoin ETFs, SEC choices usually result in market-wide implications. Approvals can spark bullish rallies, whereas postponements or rejections would possibly trigger short-term downturns.

This reactionary dynamic creates a compelling atmosphere for contrarian buyers. When markets pull again as a result of regulatory uncertainty—not due to deteriorating fundamentals—it usually introduces value-buying situations. The SEC’s continued delay in approving a Bitcoin ETF, particularly one tied to a politically charged model like Fact Social, signifies the broader systemic friction between old-guard monetary governance and emergent crypto-fintech paradigms. That friction is the very catalyst savvy buyers search for when figuring out underappreciated development sectors.

Additional, it’s important to acknowledge that the extreme scrutiny from the SEC just isn’t indicative of crypto stagnation—it’s proof of its growing relevance. Regulatory our bodies don’t focus their consideration on fringe applied sciences with restricted upside. As an alternative, the scrutiny is proportional to potential influence. The SEC’s repeated delays present us that Bitcoin and different cryptocurrencies are now not speculative outskirts—they’re turning into central gamers.

Understanding the Fact Social Bitcoin ETF and Its Delays

The proposed Fact Social Bitcoin ETF is a singular providing, not simply because it’s tied to Donald Trump’s media platform, however due to what it represents: the intersection of retail-friendly branding, political affect, and digital finance. For hundreds of thousands of Individuals—particularly these outdoors of typical crypto demographics—this ETF may act as their first sign to put money into Bitcoin by way of acquainted, regulated channels.

The delay in approval, whereas unsurprising, is critical for the implications it carries. It might mirror hesitancy by the SEC to mix high-volatility belongings with politically delicate entities. But, delaying approval doesn’t equate to dismissal. In truth, such functions not often see outright rejections; they’re usually tabled a number of occasions as regulatory frameworks scramble to meet up with technological innovation.

For buyers, particularly these monitoring political and regulatory developments, the Fact Social Bitcoin ETF serves as a bellwether. Its eventual approval may open floodgates for related ETFs—with optimized branding and built-in audiences—slashing the friction that deters retail participation in the present day. Launching a Bitcoin ETF beneath a high-visibility banner throughout an election yr may create a hype-fueled, attention-grabbing second, which can have sufficient magnetism to attract in large-scale cash flows—each retail and institutional.

Moreover, preserving tabs on the mum or dad entity—Digital World Acquisition Corp—and its submitting behaviors can function a number one indicator. Refiled paperwork, up to date phrases, or strategic PR campaigns may point out a shift in readiness or strategic timing aligned with regulatory home windows. By following these breadcrumbs, buyers get hold of informational alpha that helps them anticipate market strikes earlier than public opinion shifts.

Historic Context: Bitcoin ETFs and Market Psychology

The SEC has an extended and complex historical past with Bitcoin ETF submissions. Because the first submitting in 2013 by the Winklevoss brothers, the regulator has systematically delayed and denied spot-based ETFs as a result of “market manipulation” considerations and lack of oversight in crypto exchanges. Nonetheless, the tide has slowly turned. In late 2021, the Fee accepted the primary Bitcoin futures ETF, marking a major milestone in bridging legacy finance with digital belongings.

That mentioned, spot ETFs have remained elusive. This separation between futures-based and spot-based devices is usually seen as arbitrary by crypto proponents. Nonetheless, the incremental openness to futures-based merchandise is encouraging. It suggests a trajectory towards broader acceptance—and as soon as the primary spot-based ETF is accepted, historical past suggests there might be a domino impact.

Previous market cycles reinforce this sample. The approval of latest monetary devices tied to Bitcoin has routinely led to inflection factors within the broader crypto cycle. Whether or not it is CME’s futures launch in 2017 or Coinbase’s public itemizing in 2021, legitimization triggers capital influx. The launch of a brand-powered ETF—notably in a peak political interval—may serve the same operate within the coming cycle.

Contrarian Funding Methods Amid Regulatory Drama

- Purchase Throughout Concern: Regulatory delays sometimes sow market-wide uncertainty. Whereas many buyers pull capital, contrarians accumulate throughout these “worry occasions.” If digital asset fundamentals stay unchanged whereas costs drop as a result of SEC headlines, the chance turns into much more compelling.

- Monitor Official Knowledge Sources: Actual-time entry to filings on platforms just like the SEC’s EDGAR database can present early perception into market-moving occasions. Equally, sources from revered crypto publications like CoinDesk, CoinTelegraph, and The Block usually publish immediately when new ETF information hits the wire.

- Search Different Publicity: Whereas awaiting ETF readability, take into account gaining publicity by crypto-friendly establishments offshore, decentralized finance platforms, or investing in crypto mining shares and exchanges. These correlated performs can seize upside whereas minimizing direct regulatory danger.

- Maintain a Clear Lengthy-Time period Thesis: Reacting day-to-day invitations noise; creating a multi-year funding thesis that considers coverage, innovation developments, adoption charges, and macroeconomics is crucial. Use historic Bitcoin bull and bear cycles as a basis, and overlay regulatory timelines to establish possible surge factors.

- Leverage Political Catalysts: The political local weather throughout an election yr can significantly influence crypto notion. If high-profile advocates enter the crypto dialog, costs could climb purely on hypothesis—contrarians profit most by positioning earlier than such catalysts.

The Institutional On-Ramp Is Being Constructed

It’s necessary to view the SEC’s delays inside a bigger context. Every delay just isn’t a denial, however a stutter-step towards eventual regulatory readability. As infrastructure round custody options, on-chain analytics, and compliance requirements turns into extra sturdy, the case towards Bitcoin ETFs weakens. Ultimately, regulators could discover themselves with no viable purpose to disclaim functions.

In the meantime, massive establishments—from BlackRock to Constancy—proceed quietly constructing publicity, refining ETF proposals, and establishing partnerships. These gamers wouldn’t be allocating sources to crypto initiatives until they believed approval was inevitable. The longer the delay, the higher the pent-up demand upon launch. Establishments are inclined to front-run these occasions, and contrarian buyers may do the identical by aligning with the trajectory earlier than it turns into consensus.

Conclusion

The SEC’s ongoing pushback towards the Fact Social Bitcoin ETF and related proposals shouldn’t deter forward-looking buyers. In truth, this sort of regulatory bottleneck usually precedes breakthrough, notably in rising markets with disruptive potential. For these working by a contrarian lens, uncertainty equates to alternative. The place conventional buyers see pink tape, contrarians see the runway for future development being paved in actual time.

If historical past tells us something, it’s that early believers—with conviction and perception—reap the biggest rewards. Hold tabs on ETF filings, watch political developments, and preserve a disciplined funding thesis knowledgeable by the cyclical nature of crypto markets. As at all times on this area, persistence and positioning are all the pieces.

Keep alert. Keep knowledgeable. Keep contrarian.