Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain knowledge exhibits Tron (TRX) noticed a big profit-taking spike earlier within the month. Which sort of holder was accountable for the transfer?

Tron SOPR Noticed A Large Spike Earlier In The Month

In a CryptoQuant Quicktake post, analyst Maartunn has talked concerning the current pattern within the Spent Output Profit Ratio (SOPR) of Tron. The SOPR refers to an on-chain indicator that tells us about whether or not the TRX traders are transferring or promoting their cash at a revenue or loss.

The indicator works by going by means of the switch historical past of every coin being moved to see what value it was final transacted at. Cash which have this value foundation above the present spot value are contributing to loss realization, whereas these with the alternative setup to revenue realization.

Associated Studying

The SOPR takes the ratio between the spent worth and value foundation, and sums it up for all cash being bought on the blockchain to discover a web scenario for the market as a complete.

When the worth of the indicator is bigger than 1, it means the traders are, on common, realizing a revenue by means of their transactions. Then again, the metric being below this threshold suggests the dominance of loss realization available in the market.

Now, right here is the chart shared by the quant that exhibits the pattern within the Tron SOPR over the previous yr:

As displayed within the above graph, the Tron SOPR noticed an enormous spike above the 1 mark earlier within the month, implying traders took half in a major quantity of profit-taking.

From the chart, it’s additionally seen that there have been different revenue realization spikes in the course of the previous yr, however the present one stands out for its scale. The most recent peak within the metric noticed its worth go to 4.74, akin to a revenue margin of 374%.

“With TRX priced at $0.268 on the time, the typical acquisition value for these cash would have been round $0.0566,” explains Maartunn. Apparently, Tron hasn’t seen prolonged intervals round this value mark since late 2022, that means that the tokens would have been held for an excellent whereas earlier than being lastly transacted this month.

Normally, when dormant hands break their silence, it’s prone to be for selling-related functions. That stated, it’s not the one cause they might achieve this. “The exercise could possibly be tied to early traders realizing positive factors, inner transfers, or reallocation choices,” notes the analyst.

Associated Studying

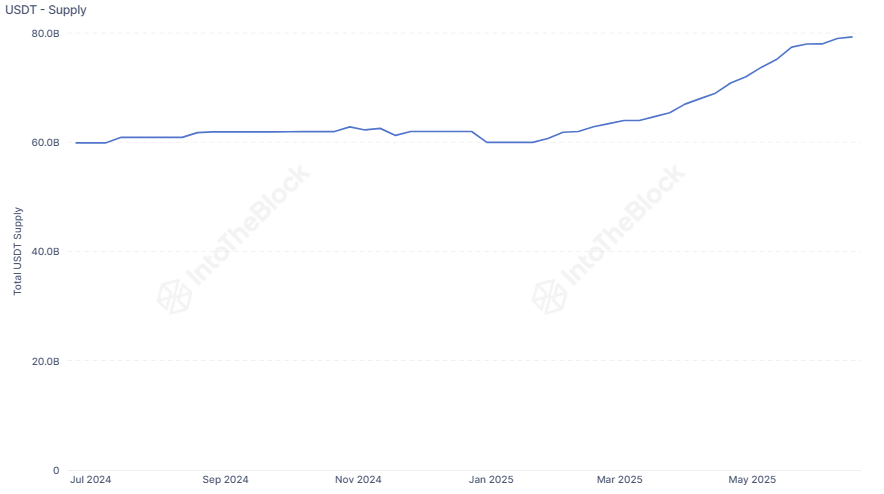

In another information, the USDT provide on the Tron community has reached a brand new milestone, as institutional DeFi options supplier Sentora (previously IntoTheBlock) has identified in an X post.

There’s now over $80 billion in USDT provide circulating on Tron, the second-most out of any cryptocurrency community.

TRX Worth

On the time of writing, Tron is buying and selling round $0.273, up 0.5% over the past 24 hours.

Featured picture from Dall-E, IntoTheBlock.com, CryptoQuant.com, chart from TradingView.com