Introduction

The world of actual property is experiencing a seismic shift, and it’s being powered by the ascent of cryptocurrency, notably Bitcoin. As digital currencies turn into extra broadly accepted and acknowledged, a rising variety of landlords throughout the globe are embracing Bitcoin as a legitimate cost methodology for hire. This shift is not only a quirky development—it is a part of a broader motion redefining how we take into consideration cash, investments, and property possession. Bitcoin, with its decentralized nature, cryptographic safety, and restricted provide, is transitioning from a speculative asset to a sensible monetary software, enabling better flexibility and autonomy for each tenants and landlords. In reality, paying hire in Bitcoin is more and more being seen as a viable, environment friendly, and even strategic transfer—particularly for contrarian investors who favor early adoption alternatives in rising monetary ecosystems.

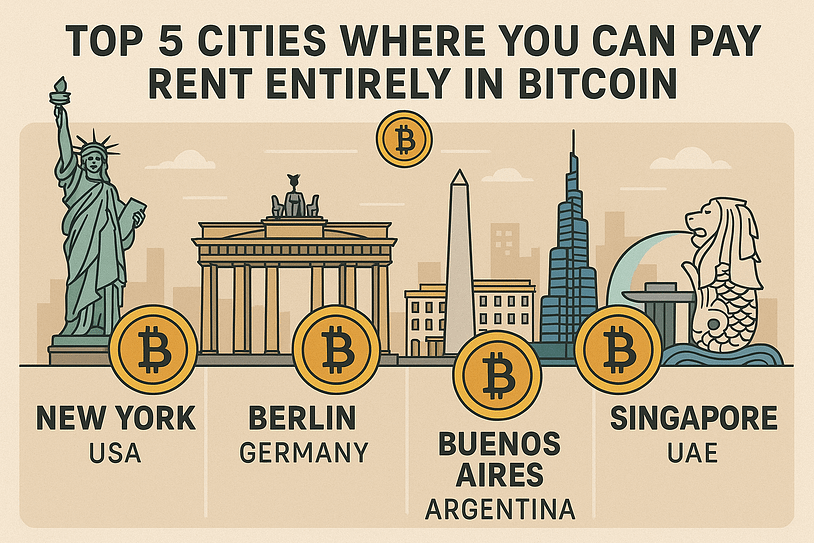

Whereas some international locations are steadily adopting regulatory frameworks for digital currencies, forward-leaning cities are already positioning themselves as pioneers in crypto-based actual property transactions. This text delves into the highest 5 international cities the place paying hire in Bitcoin is just not solely potential but in addition a part of a thriving ecosystem. We’ll additionally talk about the important thing advantages and challenges of this new rental paradigm, offering you with a complete understanding of the place this subject is headed and how one can navigate it.

High 5 Cities The place You Can Pay Hire in Bitcoin

Numerous cities all over the world are embracing cryptocurrency-fueled rental markets. In these city hubs, each landlords and tenants are experimenting with decentralized finance in sensible, day-to-day eventualities. These cities function superior technological infrastructure, bold fintech startups, and open-minded insurance policies that encourage innovation in digital funds.

1. Berlin, Germany

Berlin stands out as one in all Europe’s most progressive cities in relation to cryptocurrency adoption. Town’s cultural vibe of openness and rebel aligns completely with Bitcoin’s decentralized ethos. In districts like Kreuzberg and Friedrichshain—identified for his or her younger, worldwide populations and startup presence—landlords have began providing rental contracts priced in Bitcoin. These neighborhoods are residence to blockchain collectives, co-living startups, tech incubators, and occasions like Blockchain Week Berlin, all contributing to town’s crypto-forward status.

Moreover, Berlin’s authorized panorama is comparatively favorable for private use of cryptocurrencies. Bitcoin is acknowledged as non-public cash in Germany, which provides one other layer of credibility for crypto transactions akin to hire funds. Native property managers generally even provide hire reductions in trade for tenants paying in Bitcoin, seeing it as a profitable funding or hedge towards inflation. For buyers in search of a singular mix of cultural capital and cutting-edge monetary tendencies, Berlin’s actual property panorama is fertile floor.

2. San Francisco, USA

As the worldwide headquarters of innovation, San Francisco has been on the forefront of the crypto revolution since Bitcoin’s inception. It’s a metropolis stuffed with tech entrepreneurs and startup veterans well-versed within the mechanics of decentralized finance. Many property house owners, notably within the tech corridors of the Bay Space, are snug accepting hire in Bitcoin, both through direct pockets transactions or platforms like BitPay.

Within the wake of the distant work revolution, flexibility in cost strategies has turn into more and more useful. The widespread data and acceptance of blockchain expertise in San Francisco make it a great testing floor for actual property use circumstances involving cryptocurrencies. Tenants can select to signal leases which are priced both in BTC instantly or pegged to USD with month-to-month conversions. This flexibility brings an added layer of confidence to each landlords and tenants navigating Bitcoin’s risky worth chart.

Buyers who imagine within the convergence of actual property with fintech improvements ought to look no additional than San Francisco, the place sensible use circumstances of blockchain—together with hire funds—proceed to flourish.

3. Ljubljana, Slovenia

Ljubljana could also be a comparatively small capital metropolis, nevertheless it punches nicely above its weight within the cryptocurrency house. It’s residence to Bitstamp—one of many first and most respected cryptocurrency exchanges on the planet—and has embraced digital currencies throughout retail, hospitality, and actual property sectors. The BTC Metropolis purchasing and enterprise advanced in Ljubljana is a landmark achievement, the place over 500 shops, service suppliers, and property managers settle for Bitcoin funds.

Slovenia’s pro-startup and crypto-friendly rules allow a broader tradition of experimentation with digital belongings, attracting builders, digital nomads, and forward-looking buyers. Renters will pay for lodging, leases, and companies totally with Bitcoin, making it possible to stay a crypto-powered life-style on this European gem. The price of dwelling and hire is aggressive in comparison with different EU capitals, and the tech scene is vibrant but accessible, offering profitable alternatives for individuals who wish to diversify into each tech and property investments at early-stage valuations.

4. Dubai, UAE

Recognized for its futuristic skyline and innovation-driven governance, Dubai is aggressively working to place itself as a world hub for blockchain and cryptocurrency innovation. As early as 2018, actual property giants like Emaar Properties started accepting Bitcoin for luxurious actual property transactions. Since then, town has seen important growth in BTC-based leases, notably in upscale districts like Dubai Marina and Downtown Dubai.

The federal government’s dedication to changing into a “Blockchain-powered” metropolis, mixed with zero capital beneficial properties tax and powerful investor incentives, creates a high-growth atmosphere for crypto landlords and tenants alike. A number of crypto-oriented property administration platforms have emerged, permitting worldwide shoppers to lock in leases and property purchases utilizing Bitcoin and Ethereum. Whole condo complexes and rental buildings at the moment are itemizing models with a Bitcoin price ticket, interesting particularly to rich expats and location-independent employees.

Dubai’s favorable tax atmosphere, fast infrastructure improvement, and institutional assist for blockchain initiatives make it a magnet for buyers in search of real-world utility for his or her crypto holdings. Curious concerning the long-term profitability of investing in properties through Bitcoin? Right here’s a considerate Bitcoin price prediction information that can assist you make knowledgeable choices.

5. Buenos Aires, Argentina

In Argentina’s capital, Bitcoin has swiftly turn into a sensible necessity slightly than a speculative funding. As a result of power inflation, foreign money devaluation, and restrictive foreign money trade controls, each landlords and tenants have turned to Bitcoin in its place monetary medium. Residents of Buenos Aires more and more depend on platforms like Lemon Money and Buenbit to transform pesos into crypto for every day transactions.

Some landlords now promote hire costs in Bitcoin or tether them to USD, with month-to-month settlements made in BTC. Others provide reductions for funds in crypto, which they view as a safer retailer of worth in comparison with the fluctuating Argentine peso. Importantly, Buenos Aires has a younger, well-educated inhabitants that embraces digital change, making it fertile floor for widespread cryptocurrency use in on a regular basis life—together with housing.

For international buyers, the Buenos Aires property market presents an intriguing alternative: actual property prices far much less in USD phrases than comparable international cities, but the demand for crypto transactions is rising quickly. It is a uncommon and probably profitable market pairing: undervalued actual property with surging digital foreign money adoption.

Advantages of Paying Hire in Bitcoin

- Quick and environment friendly transactions: Bitcoin transactions, notably utilizing the Lightning Community, can course of inside seconds or minutes, eliminating conventional banking delays that may span days.

- Diminished transaction charges: Conventional cost gateways and banks cost processing charges, wire charges, and foreign money conversion charges. Bitcoin funds usually incur solely minor community charges.

- World accessibility: Bitcoin eliminates the necessity for worldwide banking techniques, enabling international tenants and landlords to transact with out conversion delays or institutional boundaries.

- Blockchain transparency: Funds made on the blockchain present immutable, verifiable transaction histories that provide authorized safety for each events and scale back the danger of fraud.

- Privateness and safety: Bitcoin transactions don’t require sharing delicate private data with intermediaries, providing enhanced monetary privateness for digital-native customers.

Challenges and Issues

As promising as Bitcoin hire funds could sound, varied roadblocks nonetheless stop widespread adoption. These embrace each technical and financial limitations:

- Worth volatility: The fluctuating worth of Bitcoin introduces uncertainty for each tenants and landlords. Events in search of stability usually flip to stablecoins or automated pockets conversions to mitigate publicity.

- Restricted acceptance: Regardless of rising adoption, paying hire in crypto remains to be area of interest and customarily restricted to cities with mature crypto communities and progressive landlords.

- Taxation complexity: In international locations just like the U.S., the IRS treats Bitcoin as property. This implies every rental transaction could set off capital beneficial properties tax occasions, requiring meticulous monetary reporting.

- Lack of authorized readability: Whereas some jurisdictions enable cryptocurrency contracts, others lack frameworks recognizing such agreements, making enforcement and regulation sophisticated.

- Technological literacy: Not all landlords or tenants are snug with crypto wallets, non-public keys, or decentralized functions—leaving room for consumer errors and miscommunications.

Should you’re navigating the tax implications or planning on liquidating crypto for rental revenue, right here’s a comprehensive guide on how to sell Bitcoin safely and successfully for max ROI.

Conclusion

The following frontier for Bitcoin isn’t simply