Earlier than placing actual cash in danger, merchants use crypto backtesting to see how a method would have carried out beneath previous market circumstances. It’s the quickest option to check concepts, spot weaknesses, and refine what works with out emotional or monetary strain. This information walks you thru learn how to backtest step-by-step, from setting guidelines and amassing knowledge to measuring efficiency like a professional.

What Is Backtesting in Crypto Buying and selling?

Backtesting is the method of testing a buying and selling technique towards historic market knowledge to see how it could have carried out prior to now. As a substitute of risking actual capital, merchants simulate trades utilizing previous value actions to grasp how a strategy behaves beneath completely different market circumstances.

In crypto, backtesting usually depends on OHLCV knowledge—open, excessive, low, shut, and quantity—to recreate the value motion over a particular interval. By making use of your technique’s entry and exit guidelines to this dataset, you’ll be able to measure hypothetical outcomes equivalent to win charge, drawdown, and whole returns.

The aim isn’t to foretell the long run completely, however to confirm whether or not your strategy has a constant logic and threat profile earlier than shifting to reside buying and selling. When completed correctly, backtesting helps merchants establish weak assumptions early and refine methods for higher real-world efficiency.

Why Backtesting Is Vital for Crypto Merchants

Backtesting offers merchants a option to consider whether or not a method is more likely to work earlier than actual cash is on the road. It transforms buying and selling concepts into measurable outcomes, exhibiting how a plan would have carried out beneath completely different market circumstances.

By reviewing efficiency metrics equivalent to whole return, win charge, or most drawdown, merchants can establish if their technique is constant or too dangerous. These metrics spotlight strengths and weaknesses that aren’t apparent from a single commerce or a brief live-testing interval.

Extra importantly, backtesting encourages disciplined decision-making. It replaces guesswork with knowledge, serving to merchants concentrate on refining what works and discarding what doesn’t. A well-tested technique offers confidence and construction—two issues each crypto dealer wants when the market will get risky.

Totally different Methods to Backtest a Crypto Technique

Crypto merchants can backtest in a number of methods, relying on their abilities and objectives. Every technique presents a trade-off between velocity, accuracy, and suppleness.

Guide Backtesting with Spreadsheets or Charts

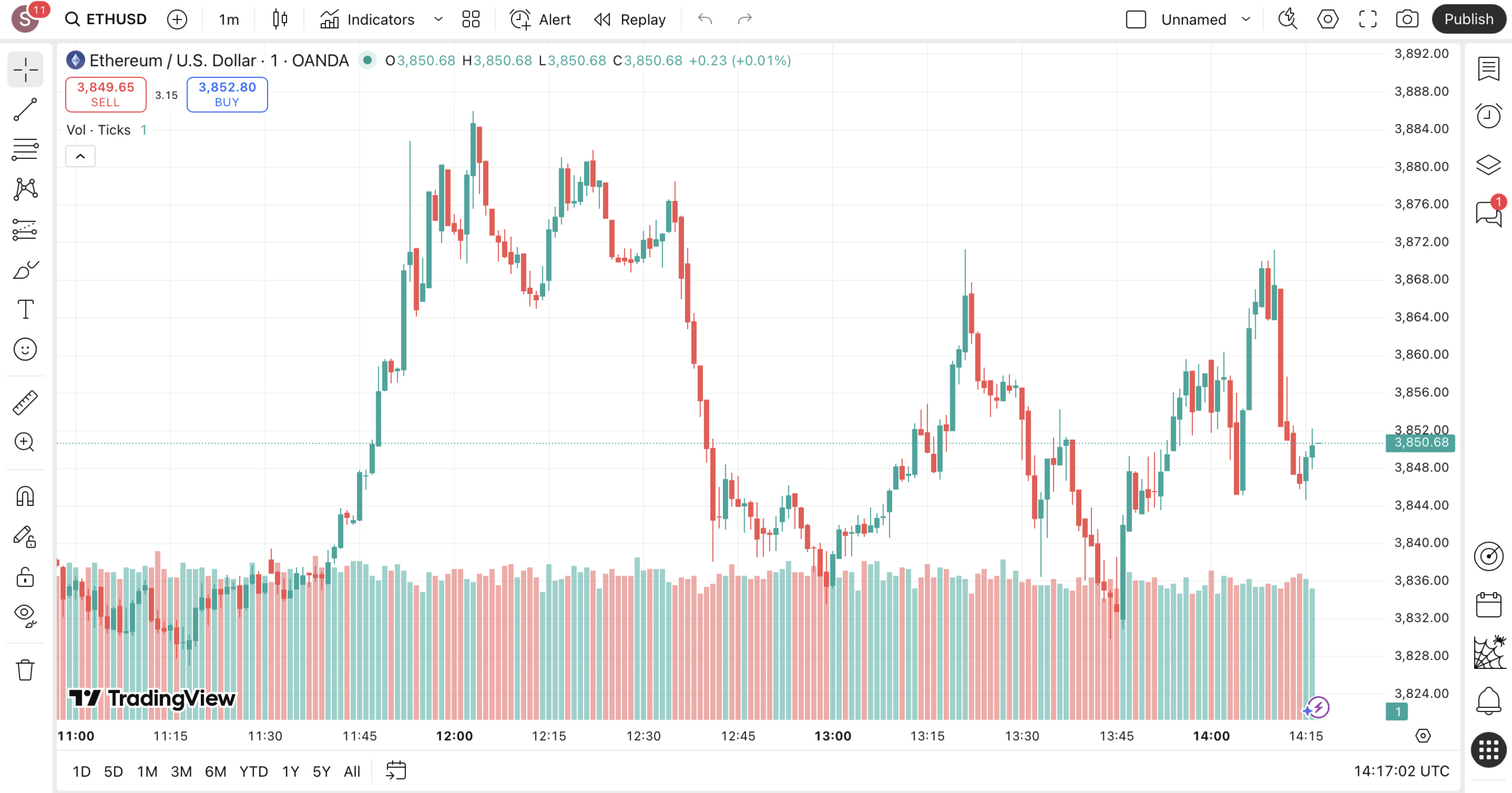

That is probably the most simple technique. You scroll by means of historic value charts (often candle-by-candle) and mark the place your entry and exit alerts would set off. Every simulated commerce is logged in a spreadsheet with its open value, shut value, revenue or loss, and notes in regards to the setup.

Guide testing helps you perceive market construction and the way your guidelines behave in numerous circumstances. Nevertheless, it’s time-consuming and liable to bias since merchants can subconsciously skip dropping trades or modify alerts after seeing outcomes. It’s finest for validating easy methods earlier than shifting to automated instruments.

Backtesting with TradingView Scripts or Bots

TradingView permits customers to code methods in Pine Script or use built-in templates. As soon as written, a script routinely checks your logic on years of historic knowledge and produces charts exhibiting entry/exit factors, win charges, and drawdowns.

Behind the scenes, these instruments use an event-driven backtester—a system that reacts to every new value “occasion” (like a candle close) and triggers simulated trades accordingly. This makes outcomes extra correct and reproducible. Merchants can even forward-test these bots in reside mode to verify efficiency in actual markets.

Automated Backtesting Instruments (No Coding Wanted)

No-code platforms like Coinrule, Kryll, or 3Commas let customers design methods visually by means of logic blocks (e.g., “if RSI < 30, then purchase”). These providers run your logic on historic value knowledge and report revenue curves, commerce counts, and common returns.

They usually use a vectorized backtester, which means the system processes historic knowledge in bulk arrays as a substitute of step-by-step. This strategy permits quick testing throughout many cash and timeframes. It’s nice for non-technical merchants who need effectivity however can’t customise execution as deeply as with code-based options.

Utilizing Python (for Superior Customers)

Python backtesting presents most flexibility. Merchants can construct or use open-source frameworks like Backtrader, Zipline, or vectorbt to simulate any crypto technique. This setup permits integration of reside knowledge, complicated indicators, and a number of exchanges.

Extra importantly, it permits optimization: adjusting parameters equivalent to stop-loss ranges, indicator thresholds, or lookback intervals to seek out probably the most strong combos. Python backtesting can even embody superior methods like walk-forward validation and Monte Carlo simulations, giving merchants the identical analytical energy utilized by quantitative funds.

Learn how to Put together Earlier than You Backtest

Begin by defining your entry alerts, the exact circumstances that set off a purchase or promote. These could possibly be primarily based on indicators like shifting averages, RSI thresholds, or value breakouts. Simply as vital are your exit alerts, which inform you when to shut a place. Constant, rule-based alerts take away emotion and make efficiency simpler to measure.

Subsequent, determine the way you’ll deal with risk management. Set guidelines for optimum place dimension, stop-loss ranges, and revenue targets. This ensures your technique stays sustainable even throughout drawdowns.

Lastly, doc each rule earlier than testing. A well-prepared backtest mirrors actual buying and selling self-discipline, permitting you to concentrate on enhancing logic as a substitute of improvising throughout evaluation.

Keep Secure within the Crypto World

Learn to spot scams and shield your crypto with our free guidelines.

Step-by-Step Information to Backtesting a Crypto Technique

Now, let’s speak about backtesting itself. It really works finest when completed systematically. Comply with these steps to make sure your outcomes are dependable and repeatable.

Step 1: Outline Your Technique

Begin by outlining the logic behind your buying and selling concept. Determine which indicators you’ll use to generate purchase or promote alerts, equivalent to shifting averages, RSI, or quantity filters. Then, determine the precise circumstances that set off a commerce. Readability right here prevents confusion when you begin testing.

Step 2: Get Historic Crypto Worth Information

Acquire high-quality market info from respected sources or exchanges. Along with candles and quantity, superior customers could embody order guide knowledge to simulate liquidity and slippage. Clear, full knowledge ensures your backtest mirrors real looking buying and selling circumstances.

Step 3: Run the Backtest (Manually or Utilizing Instruments)

Apply your guidelines to the historic knowledge utilizing your chosen platform: guide spreadsheets, TradingView scripts, or automated software program. The backtest will simulate how your trades would have unfolded over time.

Step 4: Report Trades and Outcomes

Observe each place, together with entry value, exit value, revenue or loss, and notes about market conduct and context. Visualize commerce efficiency over time with an fairness curve—a chart exhibiting how your account stability would have modified. It helps you see volatility, drawdowns, and total consistency.

Step 5: Test Key Efficiency Metrics

Analyze your outcomes utilizing key statistics like return and max drawdown. Return reveals how worthwhile the technique is, whereas drawdown reveals how a lot threat it carries. A very good system balances each—regular features with manageable declines.

Learn how to Measure Backtesting Outcomes

After working a backtest, the next move is to guage efficiency objectively. Past fundamental returns, merchants use ratios to grasp how a lot threat was taken to attain these outcomes.

The Sharpe Ratio measures how a lot extra return your technique produced per unit of whole volatility. A better Sharpe means extra constant efficiency relative to threat.

The Sortino Ratio refines this by focusing solely on draw back volatility—penalizing losses however not secure or constructive returns. It’s typically higher for crypto, the place markets are risky however trend-driven.

Collectively, these metrics present whether or not your technique’s earnings come from talent or from taking extreme threat, serving to you evaluate completely different approaches on an equal footing.

Widespread Backtesting Errors to Keep away from

Even robust methods can produce false confidence if the backtest isn’t real looking. Maintain these factors in thoughts.

- Utilizing dangerous or incomplete knowledge. Lacking candles, gaps, or incorrect timestamps distort outcomes. At all times confirm that your historic knowledge is correct and full earlier than testing.

- Overfitting your technique to previous outcomes. Overfitting happens when a mannequin is tuned too intently to historic knowledge and fails in reside markets. Maintain methods easy and validate them on contemporary datasets.

- Ignoring slippage, charges, or market influence. Slippage adjustments buying and selling outcomes when execution differs from anticipated costs, and buying and selling charges cut back returns. Embody these prices to mirror real looking efficiency.

- Mistaking short-term luck for long-term efficiency. Keep away from look-ahead bias and make sure outcomes throughout a number of market cycles. A worthwhile backtest over just a few months doesn’t assure future consistency.

Greatest Instruments for Crypto Backtesting

Skilled merchants depend on dependable software program instruments to simulate methods beneath previous market circumstances and consider previous efficiency earlier than risking capital. The suitable platform helps you accumulate knowledge, check concepts shortly, and refine setups that result in buying and selling success.

Important instruments embody:

- TradingView: Very best for visible technique testing and efficiency monitoring. Nice for each novices and superior customers.

- Backtrader or vectorbt: Python frameworks that allow merchants automate the backtesting course of with full management over knowledge and execution.

- Coinrule, Kryll, and comparable no-code platforms: Let customers design and check buying and selling logic with out coding, helpful for quick experimentation.

- Paper buying and selling: A important step after backtesting. It permits merchants to simulate reside execution with digital funds, confirming {that a} technique performs as anticipated in actual market circumstances.

What to Do After Backtesting Your Technique

Backtesting is only one a part of technique growth. When you’ve confirmed {that a} setup performs effectively, the subsequent step is to validate it beneath new circumstances and refine the way you handle threat.

Use walk-forward evaluation to check your technique throughout completely different time intervals or market phases. This technique reveals whether or not efficiency holds up when circumstances change, serving to you filter out programs that solely labored throughout particular traits.

Then overview your place sizing. Even a worthwhile technique can fail if commerce sizes are inconsistent or too giant. Making use of a transparent sizing mannequin retains outcomes secure and prevents impulsive choices throughout volatility. Skilled merchants typically preserve a number of methods to diversify efficiency and cut back drawdowns.

Remaining Ideas: Is Backtesting Value It?

Backtesting isn’t about predicting the long run. A well-designed check reveals whether or not your buying and selling logic is sound, your assumptions real looking, and your dangers beneath management.

When mixed with disciplined threat administration and ahead testing, crypto backtesting helps merchants refine their edge with out emotional or monetary strain. It turns uncooked concepts into structured programs, making success measurable as a substitute of unintended.

Briefly: backtest totally, handle threat fastidiously, and let knowledge information your technique.

FAQ

Can I backtest a crypto buying and selling technique with out realizing learn how to code?

Sure. Many platforms now supply visible builders or automated instruments that allow you to check methods with out programming. They deal with knowledge, execution, and reporting for you.

What are the dangers of relying an excessive amount of on backtesting outcomes?

Overconfidence is widespread. Information snooping bias (whenever you tweak a method till it suits previous knowledge) could make outcomes look robust however fail in actual buying and selling.

Is it value backtesting easy methods like RSI or shifting common crossovers?

Completely. Easy methods are straightforward to check, interpret, and enhance. Even fundamental programs can reveal how completely different market circumstances have an effect on efficiency.

What’s the very best timeframe to make use of when backtesting a crypto technique?

It depends upon your objectives and knowledge frequency. Scalpers use minute-level knowledge, whereas swing merchants depend on 4-hour or every day charts for extra secure outcomes.

Is 100 crypto trades sufficient for backtesting?

Normally, no. Dependable testing requires bigger pattern sizes throughout each in-sample and out-of-sample intervals to verify constant efficiency.

Disclaimer: Please word that the contents of this text will not be monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.