For many of my life, the limiting think about bringing my concepts to life has been code. I’ve at all times had a transparent imaginative and prescient for the instruments I needed to construct, however the execution hole was actual. The concepts stayed on whiteboards, in notebooks, or in half-finished PhotoShop mockups.

That barrier not exists.

AI has collapsed it.

In simply 9 days, I constructed two totally functioning client functions designed to equip shareholders with the leverage they’ve by no means had: the flexibility to advocate—cleanly, credibly, and at scale, for Bitcoin on the company steadiness sheet.

These instruments weren’t commissioned. Nobody instructed me to construct them. They aren’t fancy, intricate, or technically difficult. They got here from a easy remark: 1) firms management nearly all of international capital, and a pair of) shareholders deserve a frictionless approach to push these firms towards strategic, long-term Bitcoin adoption.

1. The Bitcoin Treasury Simulator

The Bitcoin Treasury Simulator solutions a query that ought to be trivial however wasn’t:

How would an organization have carried out if it had allotted even a portion of its treasury to Bitcoin?

Retail traders can now enter a ticker, select a time-frame, and immediately see the opportunity cost of holding cash instead of Bitcoin—expressed in clear, defensible phrases that anybody can perceive.

For the primary time, shareholders have a factual, data-driven instrument they will convey to boards, IR groups, and fellow traders to point out precisely what’s at stake.

🤖 Strive the simulator: simulator.bitcoinforcorporations.com

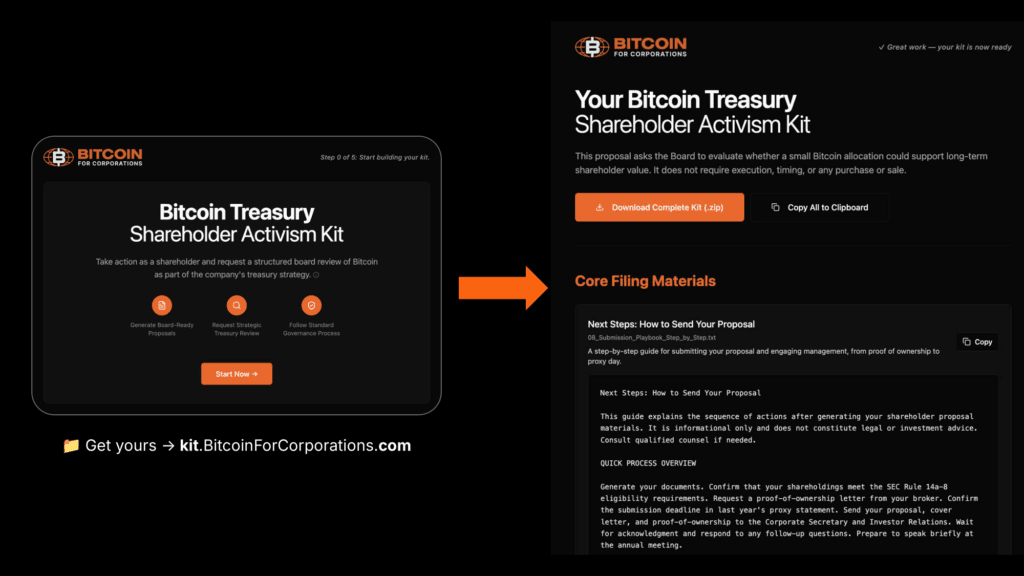

2. The Bitcoin Treasury Shareholder Activism Package

Shareholder activism has at all times been highly effective, but it surely’s been inaccessible to most traders. The principles are advanced. The legalese is intimidating. The whole course of appears like a wall you solely get previous if you happen to’re a lawyer or a billion-dollar fund.

So I constructed a generator that removes all of that friction.

The Bitcoin Treasury Shareholder Activism Package walks any verified shareholder—step-by-step—via producing a professional, SEC-compliant proposal asking an organization to evaluate or adopt a Bitcoin treasury strategy. It produces the documentation, the language, the submitting construction, and the directions wanted to get the proposal included within the firm’s proxy.

One thing that after felt prefer it required attorneys and institutional sources can now be accomplished in 2 minutes.

🤖 Create your package: kit.bitcoinforcorporations.com

Why These Instruments Exist

Company Bitcoin adoption doesn’t occur by chance. It occurs as a result of somebody—inside or exterior the corporate—pushes for it with readability, precision, and persistence.

These instruments are constructed for the individuals prepared to make that push.

They offer shareholders:

- Clear information.

- A reputable submitting pathway.

- A structured approach to change company conduct.

- And the arrogance to take motion without having permission.

What Comes Subsequent

That is only the start. Each instruments will evolve, develop, and combine extra deeply into the broader Bitcoin For Firms ecosystem. However the necessary half is that this: AI has made technical hurdles of those initiatives a lot simpler to beat.

And if sufficient individuals determine to construct the long run they need—one instrument at a time—we speed up company Bitcoin adoption far quicker than anybody expects.

Disclaimer: This content material was written on behalf of Bitcoin For Corporations. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to amass, buy or subscribe for securities.