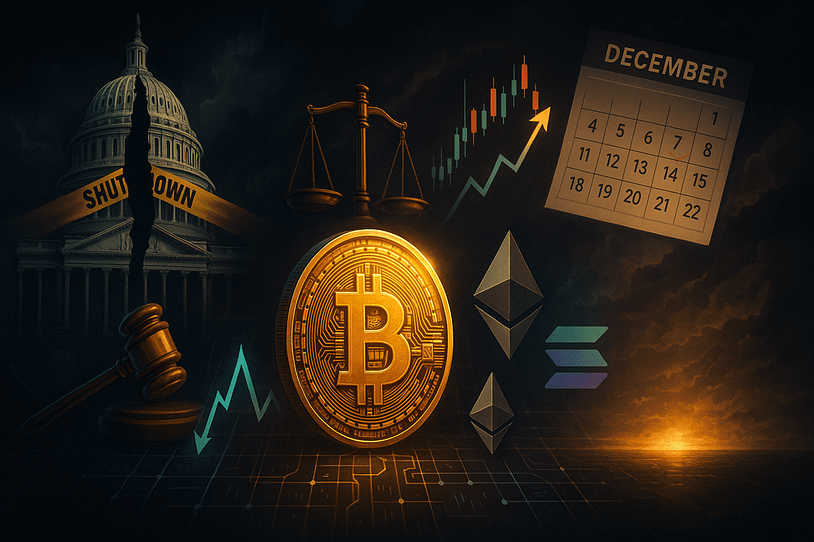

A broadly adopted macro roadmap circulating on X early Friday, November 7, units an express sequence of coverage and market triggers that might outline crypto’s trajectory into December—and body positioning into 2026. The thread, posted by macro analyst Alex Krüger is unambiguous concerning the instant constraint: “cautious stance till [the government shutdown is] resolved.” It’s equally express concerning the upside if Washington finds a path ahead, calling the shutdown’s resolution “bullish” for risk assets and saying for bitcoin to “Anticipate BTC +5% or extra inside 48 hours of deal.”

The near-term hinge, in different phrases, is binary. A shutdown that lingers retains threat pared again; a deal, in contrast, opens the door to what the thread characterizes as a fast reduction transfer. The creator’s base case on timing—“estimated to be resolved someday between the top of subsequent week and Thanksgiving”—extends that window into the again half of November. That framing issues for crypto as a result of the identical roadmap argues the December calendar is stacked with coverage and circulation headwinds that might complicate any rally that begins late this month.

Crypto Outlook For Yr-Finish Of 2025

On the heart of December sits the Federal Open Market Committee. The thread presently tags the December 10 FOMC consequence “hawkish,” explaining that “most Fed officers favor a pause as of now, which isn’t priced in in the intervening time,” whereas additionally acknowledging that “officers could change their stance on charges as financial knowledge is available in and the month progresses.” The nuance is necessary: the coverage sign, as at present envisioned, is tighter than markets are discounting, but the signal itself could possibly be revised as knowledge crystallizes—if it arrives in any respect.

Associated Studying

That caveat leads right into a second uncommon function of this year-end: a possible knowledge vacuum because of the ongoing US authorities shutdown. “Omitted all upcoming financial knowledge releases from the checklist as a consequence of uncertainty on launch dates,” the thread notes, citing the shutdown’s influence on statistical businesses. It provides, “Will probably see no official financial knowledge in November, and knowledge resuming in December, with payrolls (jobs) on Dec//5 (a vital knowledge level for the FOMC choice).” An prolonged blackout adopted by a compressed burst of releases would enhance occasion threat round any single print, particularly nonfarm payrolls, and will amplify volatility throughout threat belongings, crypto included.

A separate political appointment could intersect with the December assembly as properly. The roadmap flags the “New Fed Chair nomination,” “estimated to be introduced earlier than the following FOMC, to affect the FOMC choice (it may be quickly after); bullish to very bullish.” Even when the timing slips to simply after the assembly, the signaling impact round management and coverage response features would, on this framework, skew supportive for threat.

Tax-based flows complicate that image for crypto belongings particularly. The thread characterizes “Tax loss promoting (crypto solely)” as “bearish; all December, primarily final two weeks,” reasoning that crypto’s relative underperformance versus equities this 12 months leaves room for harvesting that’s “of explicit significance given relative stocks-crypto efficiency.”

Seasonal stress late within the month can be in keeping with prior years by which crypto noticed localized December-to-January pivots as promoting abated and re-risking emerged with the calendar reset.

Associated Studying

One other macro wildcard sits exterior financial coverage. The creator highlights the “Supreme Court docket’s choice on Tariffs: more than likely someday in December, in any other case January, timing fluid,” and frames market odds as pointing to a ruling “in opposition to Trump, which might be extraordinarily bullish IMO, though some argue such a ruling can be bearish.” The purpose is much less a few one-way commerce and extra concerning the breadth of believable paths: relying on the ruling and the way forward-looking positioning is into the occasion, crypto might both prolong a policy-led risk-on transfer or face a whipsaw if the result collides with consensus.

Past 2025’s ultimate weeks, the roadmap sketches a decidedly constructive macro backdrop subsequent 12 months, at the least at the beginning. “2026: very bullish first half of the 12 months, pushed by accommodative fiscal and financial insurance policies.” For crypto, that ahead anchor issues as a result of it underwrites the notion that any December drawdowns from tax results or a hawkish-leaning FOMC could possibly be transient if the coverage impulse turns simpler into 2026.

Tactically, the thread even proposes a short-term commerce expression across the shutdown endgame: “For BTC, I believe you possibly can most likely promote a spike into the shutdown decision round $108k-$109k (~20 DMA) then take pleasure in a king’s vacation and are available again in by 12 months finish.”

At press time, the full crypto market stood at $3.36 trillion.

Featured picture created with DALL.E, chart from TradingView.com