After this historic week through which bitcoin skyrocketed previous its January all-time excessive and set a brand new one, the asset’s value has retraced following Friday’s tariff statements by the POTUS.

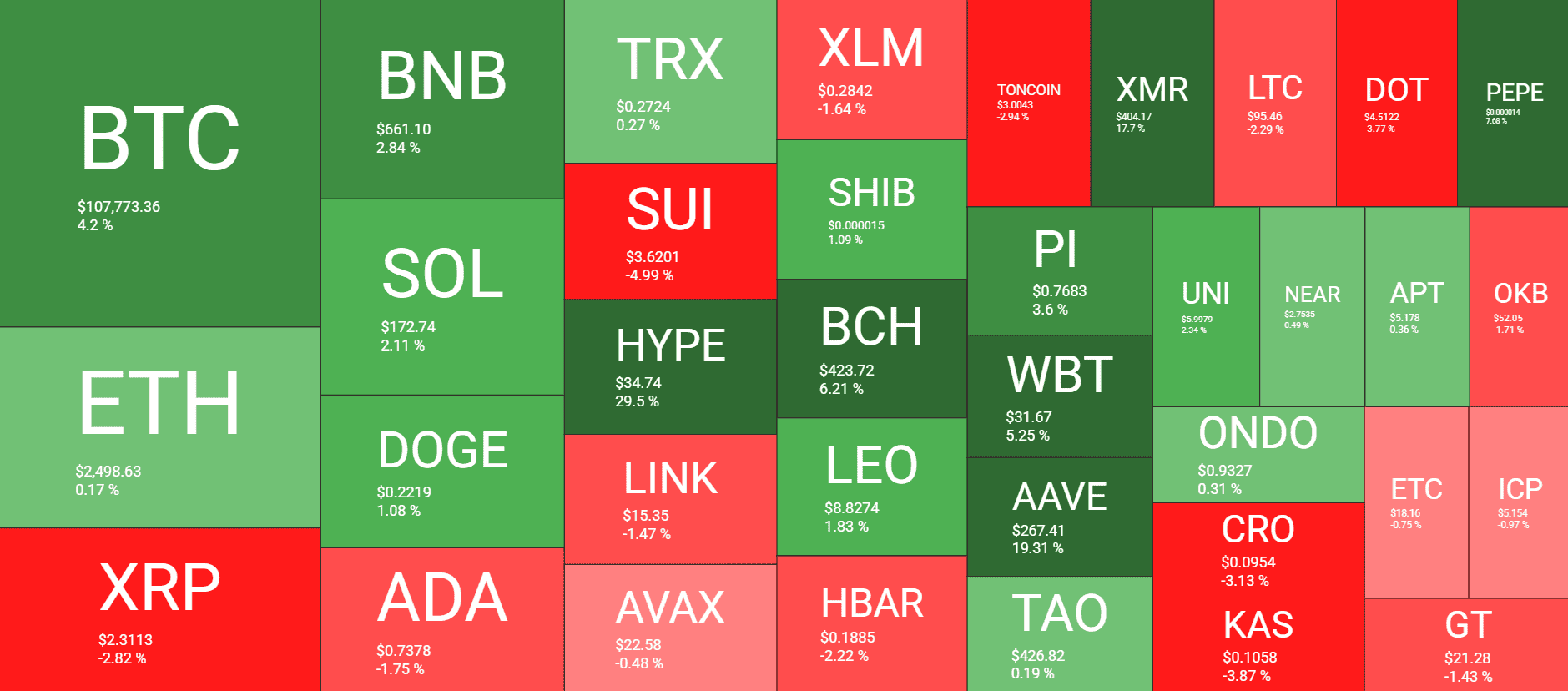

Many altcoins have posted notable features on a weekly scale, led by HYPE, whereas SUI and XRP have retraced probably the most from the bigger caps.

BTC to $108K

All of it started final Sunday night when BTC broke out of its weekend calmness and shot up from $103,000 to virtually $107,000. It confronted instant resistance there and was pushed south on Monday. The state of affairs repeated as soon as once more because the enterprise week progressed, however the bulls took full management of the market on Wednesday.

After a minor pullback, the cryptocurrency went onerous on the offensive within the afternoon and jumped previous $109,100 to market a brand new all-time excessive. The bears had been fast to intercept and drove bitcoin again all the way down to $106,500, however that was one other short-lived correction.

By Thursday morning, BTC had resumed its run and skyrocketed to virtually $112,000 (on Pizza Day) to register a brand new all-time excessive.

Extra volatility ensued on Friday when US President Trump recommended new tariffs towards the EU, and bitcoin slipped by a number of grand virtually instantly. It now trades at round $108,000 after a quiet weekend, but it surely’s nonetheless 4% up weekly.

Its market cap stays near $2.150 trillion on CG, whereas its dominance over the alts is above 61%.

Unstable Alts

The altcoins appear to be led by a brand new megastar: HYPE. Its value charted a brand new all-time excessive on Friday, and even a compromised Hyperliquid X account couldn’t halt its momentum. It’s up by 30% on a weekly scale and has turn into the highest performer.

AAVE follows go well with with a 19% weekly soar, whereas XMR is third with a 17.7% such improve. PEPE and BCH are subsequent in line.

In distinction, SUI has dropped by 5% since this time final Sunday, and XRP has slipped to $2.3 after a 2.8% weekly decline.

The full crypto market cap has shed round $30 billion since yesterday and is all the way down to $3.5 trillion on CG.

The submit These Are This Week’s Biggest Altcoin Gainers and Losers as BTC Slides to $108K (Weekend Watch) appeared first on CryptoPotato.