What’s the Lightning Community? It’s typically spoken about in analogies, metaphors or direct explanations of goal.

- “It’s the checking account, versus on-chain because the financial savings account.”

- “It’s a collection of tubes just like the web, with bitcoin flowing by them.”

- “It’s a fast, instant-settlement layer of bitcoin.”

What it truly is is a community of cost channels, the place folks lock bitcoin right into a multisignature handle, and replace the state of stability distributions off-chain. It’s how we’re going to scale Bitcoin — or a minimum of a part of how we’re going to scale Bitcoin.

Within the brief “Explainer” collection on this magazine, I clarify the mechanics of how Lightning works: how the pre-signed transactions that make up a Lightning channel work, how funds are routed throughout the community, ways in which liquidity is managed, and so on. Learn these, and you must have a stable understanding of the underlying mechanisms that make the Lightning Network work.

The issue is, with regards to asking what the Lightning Community is, all of these particular person items are modular and replaceable. What if we structured the pre-signed transactions otherwise? Or what if we used a special mechanism to route funds throughout the community? What about completely rethinking the way in which we even choose routes for funds within the first place?

What if we changed all of them over time, in order that not one of the particular person items of the protocol or community are the identical? Is that also the Lightning Community? Just like the Ship of Theseus, is the ship still Theseus’ ship after each plank and screw has been changed?

Is the Lightning Community nonetheless the Lightning Community if we modify how all the person items work?

Channel Designs

Lightning channels are units of pre-signed transactions. The aim of those transactions is to decide to, and provides customers a mechanism to implement, a stability distribution of a shared UTXO that neither get together has unilateral management over.

These channels, or transactions, at present take the type of a Poon-Dryja channel. These transactions use the revocation key mechanism invented by Tadge Dryja within the original Lightning Network white paper. This can be a very particular transaction construction for a cost channel, however it’s not at all the one one.

Let’s have a look at an idea known as “timeout timber” to have a look at one thing with minimal variations from the way in which channels at present work.

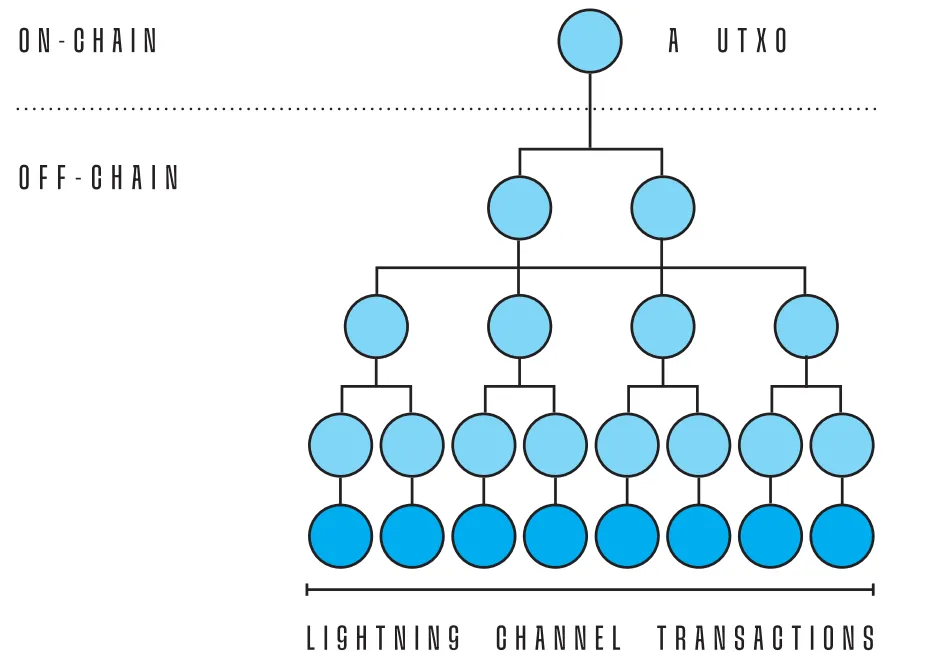

A timeout tree is without doubt one of the most simple potential types of multiparty channels (a channel with greater than two members in it). A Lightning service provider (LSP) creates a tree of transactions branching out from a single on-chain UTXO, and ending alongside every department with a Lightning channel between the LSP and a few person. Every tree has an expiry time, after which the on-chain UTXO (or any of the middleman ones between it and the Lightning channels) will be spent unilaterally by the LSP. The thought is that customers can merely swap their funds from channels within the expiring tree to a brand new one earlier than that time, and let the LSP reclaim the liquidity it locked up with its customers after expiry.

This was proposed as a use case for CHECKTEMPLATEVERIFY (CTV), an opcode that stops a UTXO from being spent any approach apart from the transaction that matches a predefined hash; in precept, it may very well be carried out with out it utilizing pre-signed transactions with the trade-off of introducing extra coordination complexity and danger of failure to initialize a tree.

The Lightning channels would primarily work simply the identical as Poon-Dryja channels, but in addition want to incorporate all the additional pre-signed transactions concerned in unfurling the tree, and topic to the expiry time of the tree as a complete.

Is that this Lightning? Or is that this one thing else?

What about LN-Symmetry? That may be a proposal utilizing CTV and CHECKSIGFROMSTACK (CSFS), an opcode that allows you to examine a signature in opposition to arbitrary knowledge in a transaction to utterly change the revocation key and revocation mechanism.

As an alternative of the revocation system, LN-Symmetry creates the idea of a floating signature or floating transaction. The LN-Symmetry script has two methods to spend it, both a CTV department locking the spend to the transaction representing the stability distribution for that channel state, or a CTV + CSFS department that lets any transaction matching a CTV template signed by a particular key set within the script spend it. This, together with the usage of completely different timelock values, permits any dedication transaction to spend the output of any prior dedication transaction, i.e., to exchange older states with newer ones.

Quite than penalizing a celebration who used an previous transaction, LN-Symmetry “corrects” the previous transaction to distribute balances primarily based on the present state as an alternative. Is that this nonetheless Lightning? Or is that this too completely different?

Fee Forwarding Protocols

Hash-time lock contracts (HTLCs) are used to route funds throughout the Lightning Community. Every HTLC both finalizes the cost shifting ahead with the revealing of a preimage to a hash, or permits it to be refunded backward if that preimage shouldn’t be revealed in time. That is the mechanism safely imposing that each hop of a cost both strikes ahead to the receiver, or backward to the sender (if it couldn’t be accomplished).

This isn’t the one method to accomplish that purpose.

Level timelock contracts (PTLCs) are one other mechanism that may very well be used rather than HTLCs. PTLCs make use of adapter signatures versus preimages and hashes to supply atomic ensures between all of the hops in a cost. Adapter signatures are cryptographic signatures which have had a knowledge worth added to them — or faraway from them — with a purpose to render them invalid. The signature can now solely be made legitimate once more by including (or eradicating) the “adapter worth” that was used within the first place.

Funds alongside a route are signed with adapter signatures, with the recipient of the cost releasing the knowledge wanted to render them legitimate once more. However this isn’t that radically completely different from an HTLC; it simply makes use of a special mechanism for facilitation.

Let’s have a look at one thing wildly completely different: packetized funds. That is an previous proposal to utterly dispose of HTLCs with a purpose to ahead funds. The thought is to interrupt up a single cost into quite a few funds of very small worth, say 100 satoshis, after which simply blindly ahead them to a peer with routing directions.

The recipient can inform the sender each time a “cost packet” arrives efficiently, and if one doesn’t arrive, the sender is aware of that one hop alongside the route shouldn’t be truthfully forwarding the cash. They will cease utilizing that route and check out one other one, solely dropping 100 satoshis within the course of.

Is that this nonetheless Lightning, or one thing utterly completely different? The channel transactions would work the identical approach and the routing protocol can be equivalent, however is it nonetheless Lightning?

Routing Protocols

What if we utterly change the routing protocol? Lightning at present makes use of the gossip protocol with a purpose to make sure that all Lightning nodes on the community have a comparatively good map of the completely different channels throughout the community, how a lot bitcoin is in them, and the charges they cost — all the knowledge mandatory for every node to completely choose the routing path for its funds by itself.

Ant Routing is a proposal to dispose of all of that fully: to route funds throughout the community with none gossip protocol, with none map of the community, and with out the sender choosing the trail that their cost takes.

The design to perform that’s constructed round “pheromone trails” and “pheromone seeds,” particular messages which are broadcast out throughout your complete community with a purpose to facilitate funds. Collectively, the sender and receiver generate a big random quantity, and create a partial hash of that (the pheromone seed). Each events then broadcast the seed to all of their speedy friends with a counter that will increase by +1 each time the seed is handed alongside.

Finally, one node within the community will obtain each seeds, and know that they’re the connecting level for a whole path between sender and receiver. At this level, that node will ship a response message again in each instructions, and when the sender and receiver each affirm the response they will coordinate the cost.

It is going to be handed again alongside the path to the connection level, and from there to the receiver, all with out anybody alongside the trail, together with the sender and receiver, having to assemble the route themselves or having any concept what the entire route is.

Is that this nonetheless the Lightning Community? Or is that this too radically completely different?

What Is It?!

The Lightning Community is a collection of pre-signed transactions to implement a stability distribution between customers, plus the opposite mechanisms concerned in updating that distribution and synchronizing these updates between customers all throughout the community.

However doesn’t that additionally describe Ark? Or statechains? Sure. That’s my level.

The core concept of Lightning is simply updating agreements about find out how to distribute funds off-chain, whereas making certain that the newest model of that settlement will be enforced on-chain if wanted, with out room for an concerned get together to “cheat the system” and implement a extra favorable previous settlement.

There are numerous other ways to realize that purpose. The way in which used at present is just the primary concrete approach that was specified. There are, and will be, extra and other ways to try this. Over time the strategies and instruments for conducting that purpose will change.

Possibly some new approach will utterly out of date an older approach. Possibly some new approach works higher in a sure state of affairs or scenario. However new methods will certainly come, and that’s okay.

Some issues will utterly change, others will solely be slight variations of what got here earlier than, however Lightning will shapeshift over time. It must with a purpose to proceed scaling in the long run, to unravel its personal issues, to assist bitcoin function as a money.

Lightning will evolve.

Don’t miss your chance to own The Lightning Issue — that includes an unique interview with Lightning co-creator Tadge Dryja. It dives deep into Bitcoin’s strongest scaling layer. Restricted run. Solely out there whereas provides final.

This piece is an article featured within the newest Print version of Bitcoin Journal, The Lightning Problem. We’re sharing it right here to point out the concepts explored all through the total situation.