People wish to make analogies to know new issues higher. It makes full sense why we might search for one within the case of Bitcoin.

Bitcoin is a novel idea to most individuals listening to about it for the primary time, and may require nice effort to understand totally. Utilizing the phrase “digital gold” to explain Bitcoin is extremely palatable, and even in the event you don’t perceive the performance of the community, you’ll be able to know sure issues to be true: Bitcoin is scarce, international, and a retailer of worth.

This narrative has labored effectively, ushering in institutional and nation-state adoption. The primary part of President Donald Trump’s government order establishing the Strategic Bitcoin Reserve states, “Because of its shortage and safety, Bitcoin is also known as ‘digital gold’.”

On one finish, we must be celebrating these unbelievable achievements for Bitcoin. We have now made huge strides in adoption by propelling the “digital gold” narrative that shouldn’t be understated. Nevertheless, for Bitcoin to achieve its true potential, the narrative must shift.

Bitcoin is NOT “digital gold”.

Labeling Bitcoin as “digital gold” is a misrepresentation that reduces the world’s most revolutionary type of cash to a mere retailer of worth. Bitcoin’s fundamentals make even essentially the most fascinating attributes of gold utterly out of date whereas concurrently being a quicker, safer, extra decentralized different to fiat currencies.

Let’s dive into what separates Bitcoin from gold.

Shortage vs Finicity

Seemingly the most important promoting level for gold, and why it’s survived as a retailer of worth for 1000’s of years, is its shortage.

It’s estimated that over the previous 100 years, gold’s provide has solely elevated by round 1-2% every year. It is because there is no such thing as a actual financial incentive to extend the provision of gold by mining. Along with how tough new gold is to search out, labor, tools, and environmental compliance prices make the method extraordinarily tough to justify financing.

Because of this, gold has held its worth effectively all through historical past, with its financial standing courting again to 3000 BC. Within the 1st century AD in Historic Rome, you might purchase a high-quality toga for a similar worth in gold as a luxurious tailor-made go well with immediately!

Gold’s shortage and the influence that it has had on society for 1000’s of years can’t be understated. Nevertheless, within the age of Bitcoin, persevering with to measure financial worth by way of an asset with a fluctuating provide appears arbitrary.

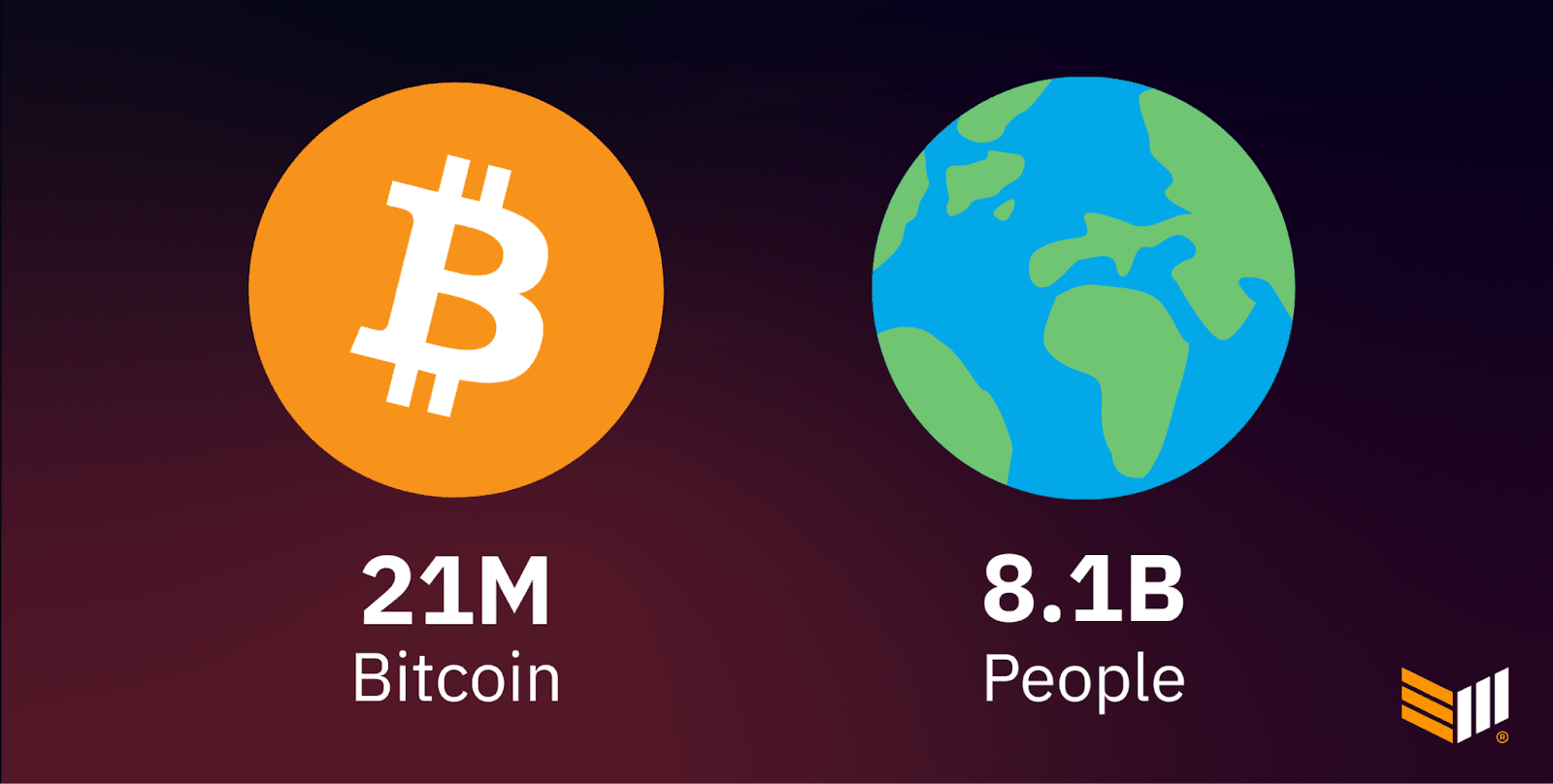

Bitcoin isn’t scarce, however finite, with a set provide of 21 million cash getting into circulation. There isn’t any “gold rush” for Bitcoin, and, as know-how advances, we received’t discover Bitcoin on an asteroid.

By technological and mathematical developments, we now have the capabilities to purchase and alternate money with a fastened provide. The importance of this improvement can’t be understated as “digital gold”.

Microdivisability

I’ll concur that gold is technically “divisible” – that’s, in case you have a handsaw or laser helpful together with a scale. Nevertheless, “microdivisible” isn’t a phrase that describes gold.

Gold thrives in giant transactions the place costly items and providers are being transferred. However once you begin shifting to smaller transactions, issues begin to come up.

Beneath is a picture of 1 gram of gold, which, on the time of my scripting this, is price ~ $108. Think about a world the place you get a sandwich from Subway, and, in alternate, you shave off the nook on a gram of gold…

That’s not taking place.

Older societies all through historical past understood this limitation of gold and acted swiftly to fight this by issuing cash that represented a selected focus of the valuable steel.

Though it may be tough to pin down, it’s potential that the primary gold-backed foreign money was the Lydian stater in 600 BC. Issued in Lydia (modern-day Turkey), the coin was initially minted with electrum (an alloy of gold and silver), with a gold composition of round 55%.

In 546 BC, the Persian Empire conquered Lydia and inherited the Lydian stater. Though the Persian Croeseids initially retained a excessive proportion of gold within the cash, they ultimately debased the foreign money by including base metals like copper. By the top of the fifth century BC, the Lydian stater solely contained 30-40% gold.

Gold’s incapacity to be a microdivisible asset is a devastating flaw, and the rationale societies have by no means been in a position to really put it to use for a big time period. To make small transactions, residents select at hand their gold to the federal government in alternate for 1:1 cash, which, over time, are inevitably diluted and debased by the elite class, inflicting the society to break down.

There may be not a single instance in historical past the place a rustic working on a gold normal hasn’t ultimately debased its foreign money in alternate for microdivisibility by cash and paper notes. This, once more, is essentially on account of folks’s final want for small items of account to buy cheap items.

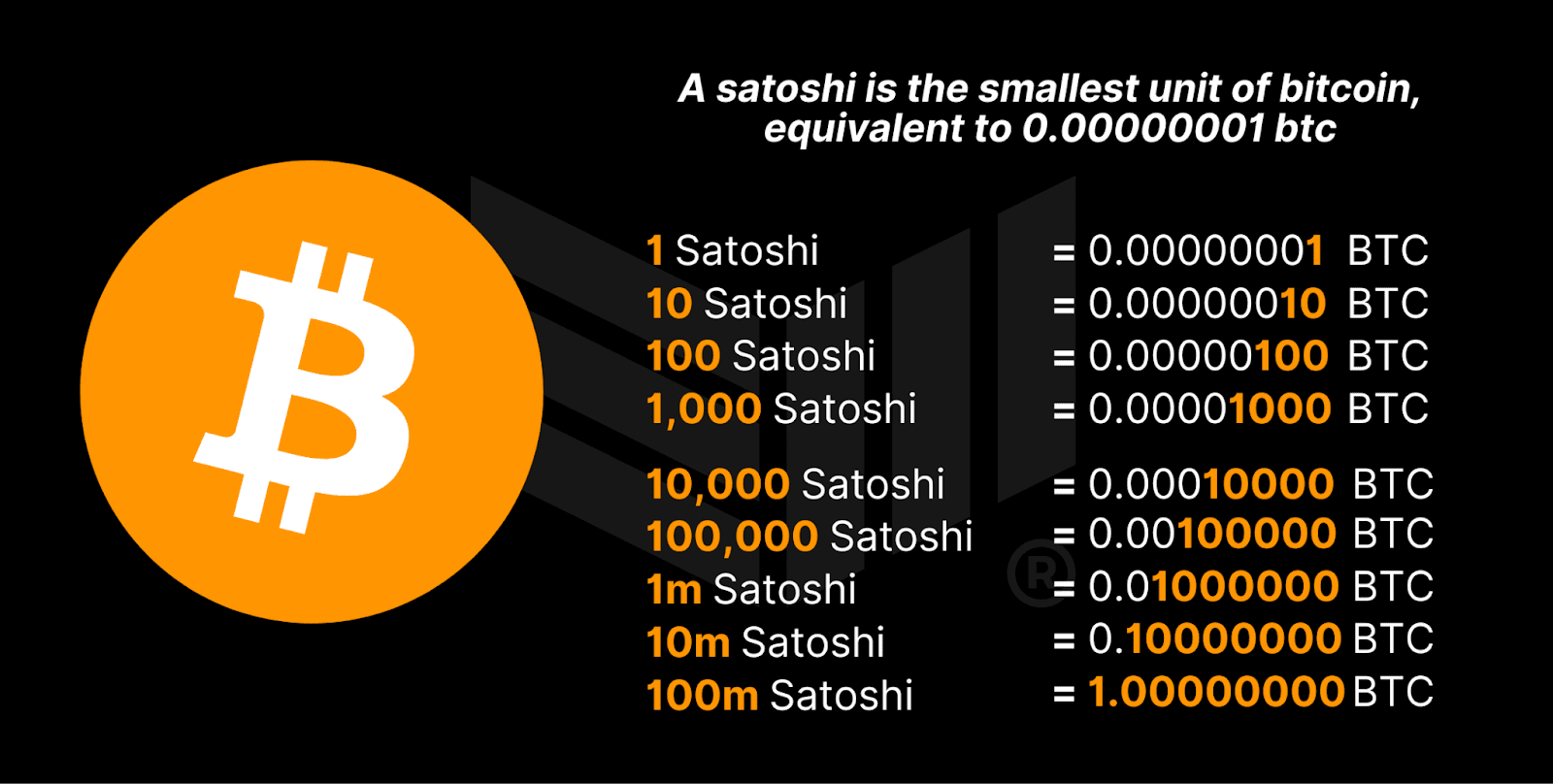

This deadly blow to gold is finally solved by Bitcoin. Bitcoin’s smallest unit of account is known as a “satoshi” and represents 1/100,000,000th of a bitcoin. As we speak, one satoshi is the same as roughly $0.001, which makes it extra microdivisible than the US greenback!

There may be by no means a cause to contain governments in Bitcoin transactions as a result of there is no such thing as a want for a smaller unit of account. For that cause (amongst many others), Bitcoin works completely as cash with out the involvement of any intermediaries.

When contemplating bitcoin’s divisibility and units-of-account, it’s comical to even examine it to gold in any kind or trend.

Auditability

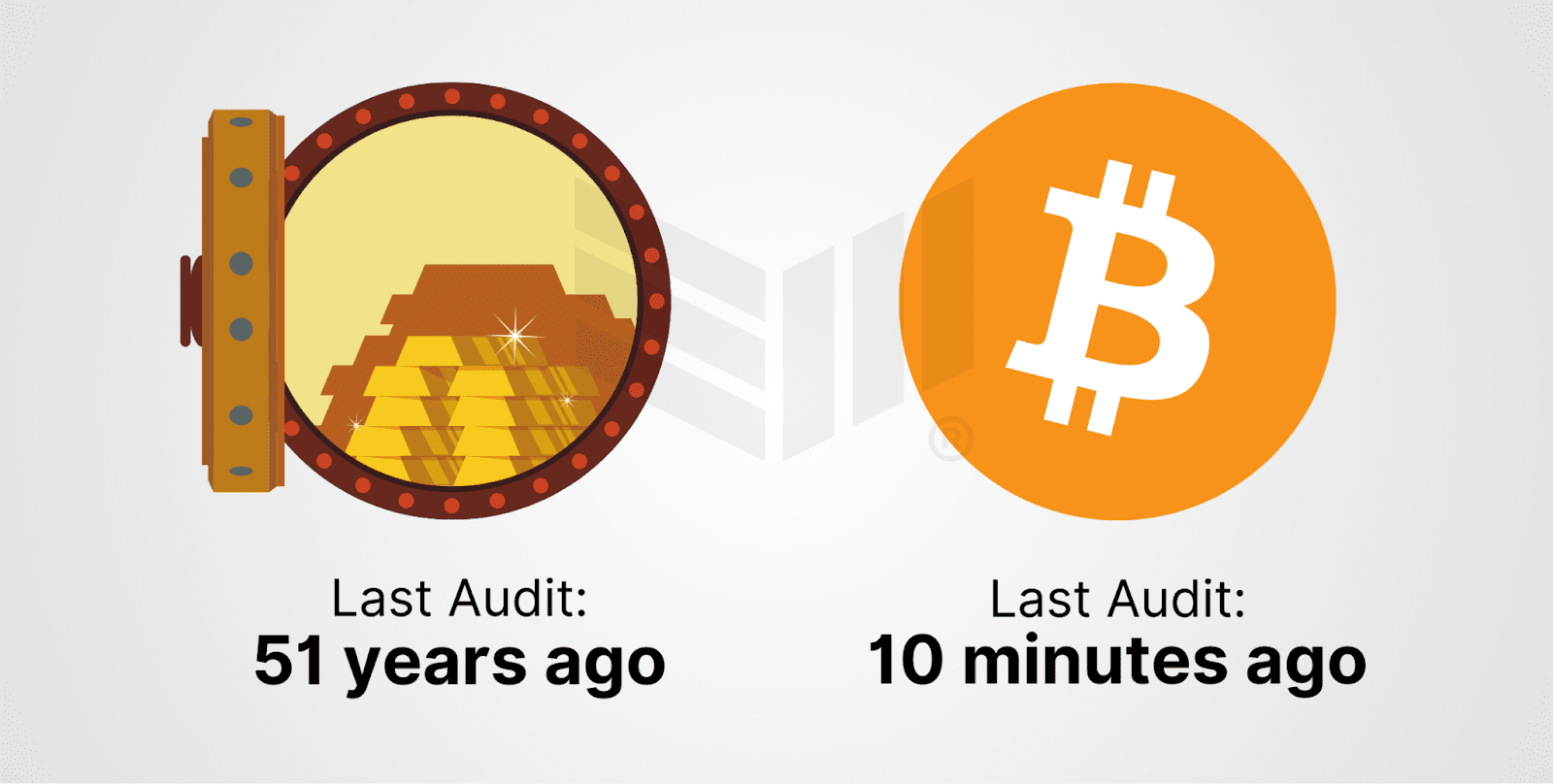

I consider it’s a good assumption that on the time of this text’s launch, the “Fort Knox Audit” nonetheless hasn’t occurred. As rapidly because it turned the highest headline, the concept disappeared into irrelevance.

America’ gold holdings have been final audited in 1974. After a number of a long time of conspiracy theories and public hypothesis, President Gerald Ford determined to permit journalists inside Fort Knox. Their findings have been unremarkable, with no noticeable lacking gold on the premises.

Nevertheless, that was 51 years in the past. As we speak, we’re in an analogous place, with public curiosity piqued concerning the gold in Fort Knox.

Simply a few months in the past, the “Fort Knox Audit” appeared like it could occur any day. In actual fact, Elon Musk was going to livestream it! Although now, it’s starting to appear just like the elephant within the room that we’re not supposed to speak about.

Not like gold audits, that are rare and handbook, Bitcoin’s validation occurs routinely by its proof-of-work consensus mechanism.

Roughly each 10 minutes, miners add a brand new block to the blockchain, verifying the legitimacy of transactions, the overall Bitcoin provide, and adherence to consensus guidelines.

In distinction to conventional audits, which depend on trusted third-party intermediaries, Bitcoin’s decentralized course of is trustless and clear, permitting anybody to independently confirm the blockchain’s integrity in real-time.

Don’t belief, confirm.

Portability

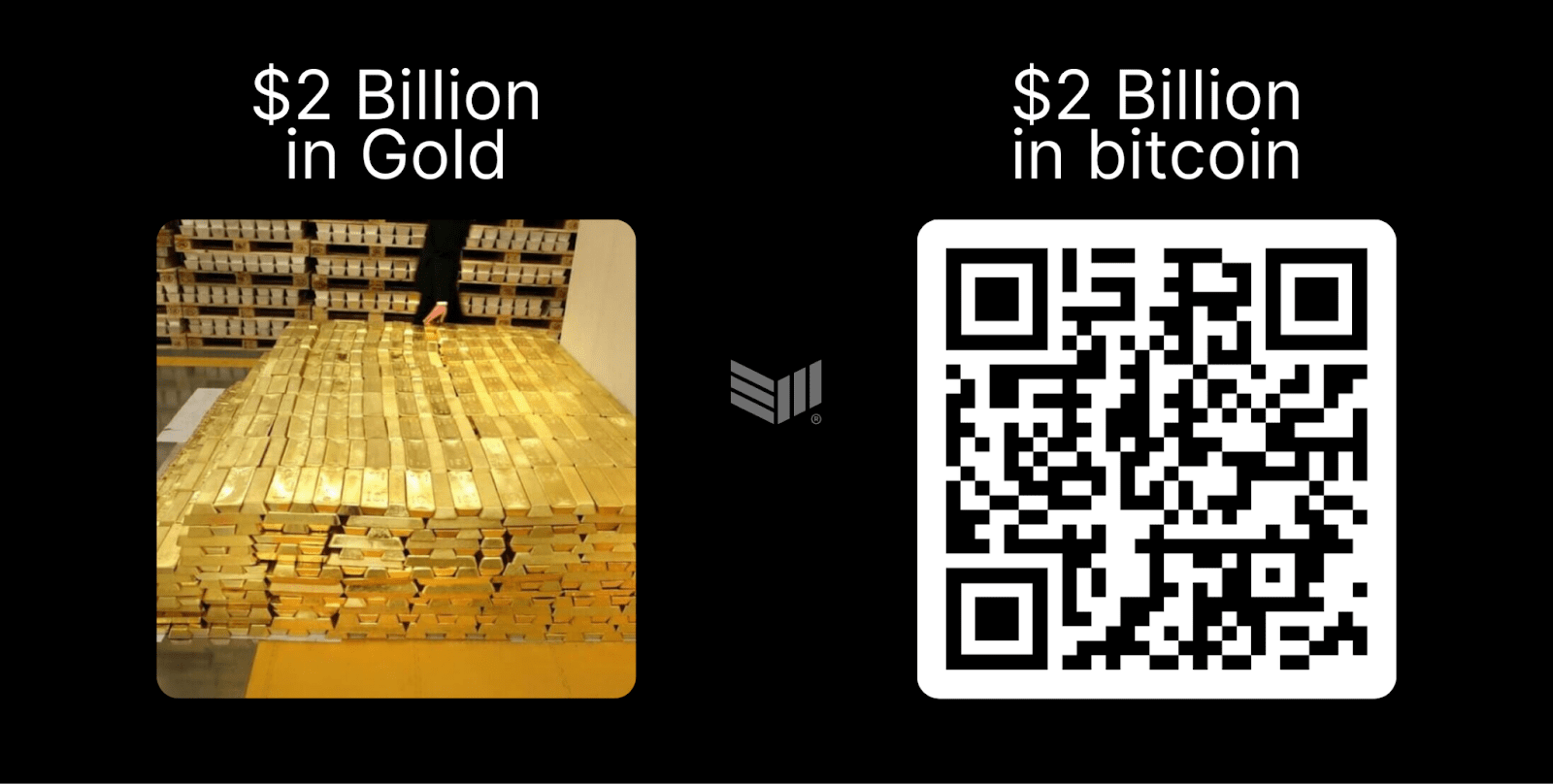

It requires little persuasion to make the case that bitcoin is extra “movable” than gold. Stored merely, gold in giant portions might be extraordinarily heavy and require specialised ships and planes for cross-border transportation. Conversely, Bitcoin is held in a pockets that retains the identical bodily weight whatever the quantity.

Nevertheless, there’s a higher distinction right here that can’t go unaddressed; Bitcoin doesn’t must bodily “transfer” anyplace.

The commonest critique of Bitcoin is that it’s “not actual” and “can’t be held”. Nevertheless, I argue that it is likely one of the biggest flaws of gold. To obtain a big cost in gold, you will need to put up the prices vital to move the heavy and extremely invaluable supplies throughout fields, oceans, or jungles.

As well as, you will need to even have a excessive stage of belief for the third events concerned. Throughout cross-border gold transactions, you’re trusting your gold with:

- The third social gathering that brokered the transaction

- The supply crew that took your gold to the export station

- The crew on the airplane or ship that’s transporting the gold

- The supply crew that took your gold to you

- Whoever you place in control of guarding and sustaining the gold

Then again, Bitcoin permits you to make transactions while not having to journey or contain intermediaries. As mentioned earlier than, the Bitcoin blockchain’s consensus protocol permits customers to ship cash throughout borders while not having a 3rd social gathering.

This not solely removes the prices related to cross-border journey and the varied people who could also be concerned, but in addition eliminates the opportunity of fraud, as all transactions are public and on-chain for customers to see and confirm.

For the primary time in human historical past, we have now “digital money”. Bitcoin Journal’s Conor Mulcahy defines “digital money” as “a broad class of cash that exists solely in digital kind and can be utilized to facilitate peer-to-peer transactions electronically. Not like e-money, which usually entails intermediaries like banks and cost processors, digital money is designed to imitate the traits of bodily money, resembling anonymity and direct alternate between customers.”

The concept that a peer-to-peer transaction with out an middleman might happen with out being collectively in particular person was solely a principle earlier than the creation of Bitcoin. Detractors who dismiss this development in our species’ capabilities as “not actual as a result of I can’t contact it” will quickly understand that they’re combating a shedding battle in a world that turns into extra digital by the second.

Not All Bitcoin “Adoption” is Equal

If our sole goal is to drive Bitcoin’s worth to the moon, the “digital gold” label will suffice. Actually, governments, sovereigns, companies, and people will proceed to pour in quickly, and the quantity will maintain going up.

However…

If Bitcoin is the transformative freedom know-how we consider it to be, we should essentially rethink how we educate and share it with the world. To grab this chance, we should prioritize educating pre-coiners on the novelty of Bitcoin and keep away from oversimplified analogies. This strategy will finally cement Bitcoin’s function because the cornerstone of worldwide monetary freedom.

This can be a visitor publish by Isaiah Austin. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.