Crypto-linked fee playing cards have developed from a distinct segment product right into a mainstream fee methodology, with utilization now measurable on a big scale.

In Q3 2025, Easy Pockets analyzed anonymized transactional information from 1,000 randomly chosen European cardholders to measure precise spending habits. On the similar time, we at Changelly surveyed over 3,000 of our customers worldwide to seize self-reported adoption tendencies. Collectively, this information supplies one of the vital detailed seems at how crypto playing cards are utilized in observe to this point.

Changelly is a number one prompt cryptocurrency alternate platform and international blockchain API supplier.

Key Findings

- 60.6% of surveyed customers already use crypto playing cards.

- Prime use circumstances: on-line transactions (66%) and on a regular basis purchases (61%).

- Common transaction measurement in Europe: €40.

- Prime advantages: ease of use (65%), cashback (56%), flexibility (43%).

- Key boundaries: 58% don’t know what crypto playing cards are, and 43% cite restricted service provider acceptance (Changelly survey, 2025).

Adoption: 60% Already Use Crypto Playing cards

Survey information from over 3,000 Changelly customers exhibits that 60.6% are already utilizing a crypto card, whereas 39.3% are usually not. Transaction information from 1,000 Easy Pockets cardholders in Europe again this up, exhibiting 1000’s of real-world purchases every month with a mean ticket measurement of about €40. This mix of self-reported and noticed information factors to a transparent majority of lively crypto customers already spending by playing cards.

Consumer Motivations: Over 60% of All Transactions Are On a regular basis and On-line Purchases

Crypto spending has shifted from occasional cash-outs to on a regular basis use. Easy Pockets’s June 2025 evaluation of 1,000 European cardholders exhibits that between 60% and 70% of all transactions go to routine bills akin to groceries, subscriptions like Netflix and Spotify, transport, utilities, on-line buying, and cafés. One other 15% to twenty% covers journey and cross-border spending: accommodations, automotive leases, purchases outdoors the EU, and tolls. In the meantime, solely 10% to fifteen% pertains to topping up person accounts in neobanks like Revolut or high-ticket gadgets. The typical transaction measurement is about €40, and most funds are settled in USDC robotically transformed at checkout.

Changelly’s international survey tells the identical story: 66% say they use crypto playing cards for on-line transactions and 61% for on a regular basis purchases, in contrast with 45% for fiat conversion and 41% for journey.

Collectively, these findings point out that crypto playing cards are functioning as utility fee rails, not simply liquidation instruments. Suppliers trying to seize this market have to give attention to seamless, low-friction on a regular basis use circumstances and advantages that mirror conventional playing cards.

“When a Easy Pockets person pays for groceries, streaming, or transport with USDC, it exhibits the shift: crypto isn’t a future promise, it’s already a part of the on a regular basis economic system,” says Alex Emelian, CEO of Easy Pockets.

What Customers Worth Most: 65% Say Simplicity, 56% Say Rewards

Each survey and transaction information factors to the identical conclusion: crypto cardholders worth the identical issues as mainstream bank-card customers. In Changelly’s international survey, 65% cited ease of use as the highest profit of crypto playing cards, 56% highlighted cashback and different rewards, and 43% pointed to flexibility—the flexibility to carry crypto till fee and spend on demand.

Easy Pockets’s inner metrics and insights primarily based on years of expertise mirror these findings. Prospects use crypto playing cards as a result of they behave like bizarre financial institution playing cards: tap-to-pay by way of Apple Pay/Google Pay, computerized conversion in the meanwhile of buy with no pre-swaps, and no disclosure of pockets balances to retailers or banks. Funds keep in crypto till fee, letting holders stay invested proper as much as checkout.

Ache Factors: 58% Non-Customers Declare Lack of Data as Key Barrier

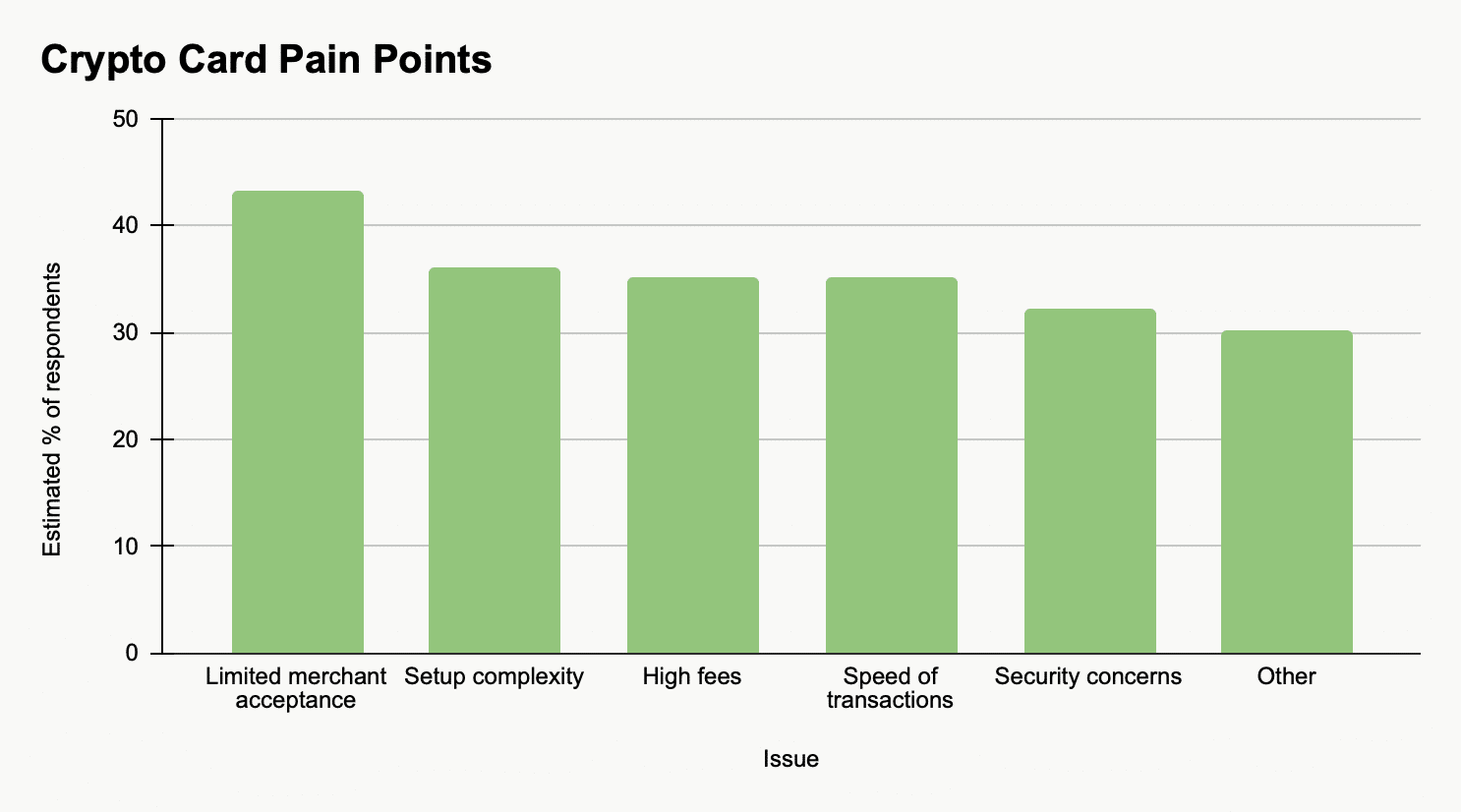

Changelly’s survey exhibits that crypto card customers report comparatively few issues. The truth is, 59% of respondents stated they skilled no challenges. Amongst those that do, the principle points are restricted service provider acceptance (43%), setup complexity (36%), excessive charges (35%), pace of transactions (35%), and safety issues (32%).

For non-users, the image is completely different. 58% cite lack of awareness as the first motive for not adopting crypto playing cards, adopted by “I don’t personal crypto” (24%) and smaller shares mentioning price or belief points.

These findings counsel that the principle bottlenecks are training, belief, and infrastructure, moderately than the expertise itself. Addressing these elements is prone to have extra impression on adoption than incremental characteristic adjustments.

8 key areas to assessment your WEB3 advertising!

Get the must-have guidelines now!

Why Crypto Playing cards Matter

Crypto playing cards are usually not nearly spending tokens—they shut the loop between Web3 property and the actual economic system. Easy’s expertise exhibits that their worth lies in 4 operational benefits:

- Comfort. Customers pay precisely like with a standard card or Apple Pay/Google Pay. No further steps, no pre-conversion.

- Privateness. For enhanced person privateness, the service provider solely sees an ordinary card transaction, with out entry to the person’s crypto pockets particulars.

- Flexibility. Property keep in crypto till the second of buy, permitting holders to stay invested and solely convert at checkout.

- Crypto-native design. Playing cards settle for direct crypto funding with a user-friendly compliance course of for funding your account.

This positions crypto playing cards as on a regular basis monetary instruments moderately than speculative devices. For companies, they unlock new alternatives:

- Pockets suppliers acquire larger stickiness and spend retention.

- Exchanges open income streams past spot buying and selling.

In brief, crypto playing cards make crypto simpler to make use of in every day life and lengthen its attain throughout the broader monetary ecosystem.

Strategic Implications

Survey information exhibits that 58% of non-users cite lack of awareness as the principle barrier to adoption, making training the first progress lever for issuers. Clear onboarding and in-app steerage can convert a big share of potential customers with out main product adjustments. For instance, Easy has decreased registration to a five-minute on-line passport/ID examine for EEA residents, turning what was as soon as a fancy course of into a fast commonplace step, changing a better proportion of their pockets customers into crypto card prospects in consequence.

Rewards and cashback are additionally decisive: Within the Changelly survey, 56% of respondents named rewards as a key profit. For max ease of adoption, UX should additionally mirror conventional playing cards. Easy has addressed this by adopting a banking-style interface with a built-in alternate and computerized number of low-fee networks, eradicating confusion about charges and settlement.

Final however not least, with stablecoins akin to USDC and EURC dominating card spending, suppliers ought to optimize liquidity swimming pools and FX routing to attenuate prices and enhance reliability.

Taken collectively, these measures—training, frictionless onboarding, rewards and stablecoin-optimized infrastructure—outline the roadmap for profitable a share within the crypto card market over the subsequent few years.

“This survey exhibits that training and value are the actual catalysts for wider crypto-card adoption,” says Zifa Mae, Head of Product at Changelly. “On the spot alternate API suppliers like Changelly may also help by making funding and conversion seamless, whereas crypto playing cards suppliers give attention to quick onboarding, clear rewards and stablecoin infrastructure to match the comfort of conventional playing cards.”

The Subsequent 5 Years in Crypto Playing cards

Card performance is prone to develop into an ordinary characteristic of main crypto wallets over the subsequent few years. Non-custodial, stablecoin-denominated playing cards will let customers spend instantly from their wallets and keep away from double conversions or tax-triggering swaps.

On-line banks akin to Revolut and N26 are already including crypto options, signaling that mainstream monetary apps are prone to begin accepting and routing crypto natively sooner or later. The mannequin will shift from “convert then spend” to “spend instantly,” with payroll, freelance earnings and passive revenue flowing straight to crypto playing cards.

This examine exhibits a transparent path ahead: shut the data hole with training, win customers over with seamless UX, and lock in loyalty by stablecoins and rewards. Suppliers who execute on these three levers will outline the subsequent technology of fee rails.

Changelly provides a complete suite of blockchain APIs for enterprise, with native crypto-to-crypto swaps, crypto-to-fiat purchases, and Changelly Pay—a singular resolution for retailers trying to settle for funds in crypto.

Disclaimer: Please observe that the contents of this text are usually not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.