Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Capital poured into US-listed Bitcoin exchange-traded funds this week, with Tuesday alone witnessing practically $1 billion in contemporary money.

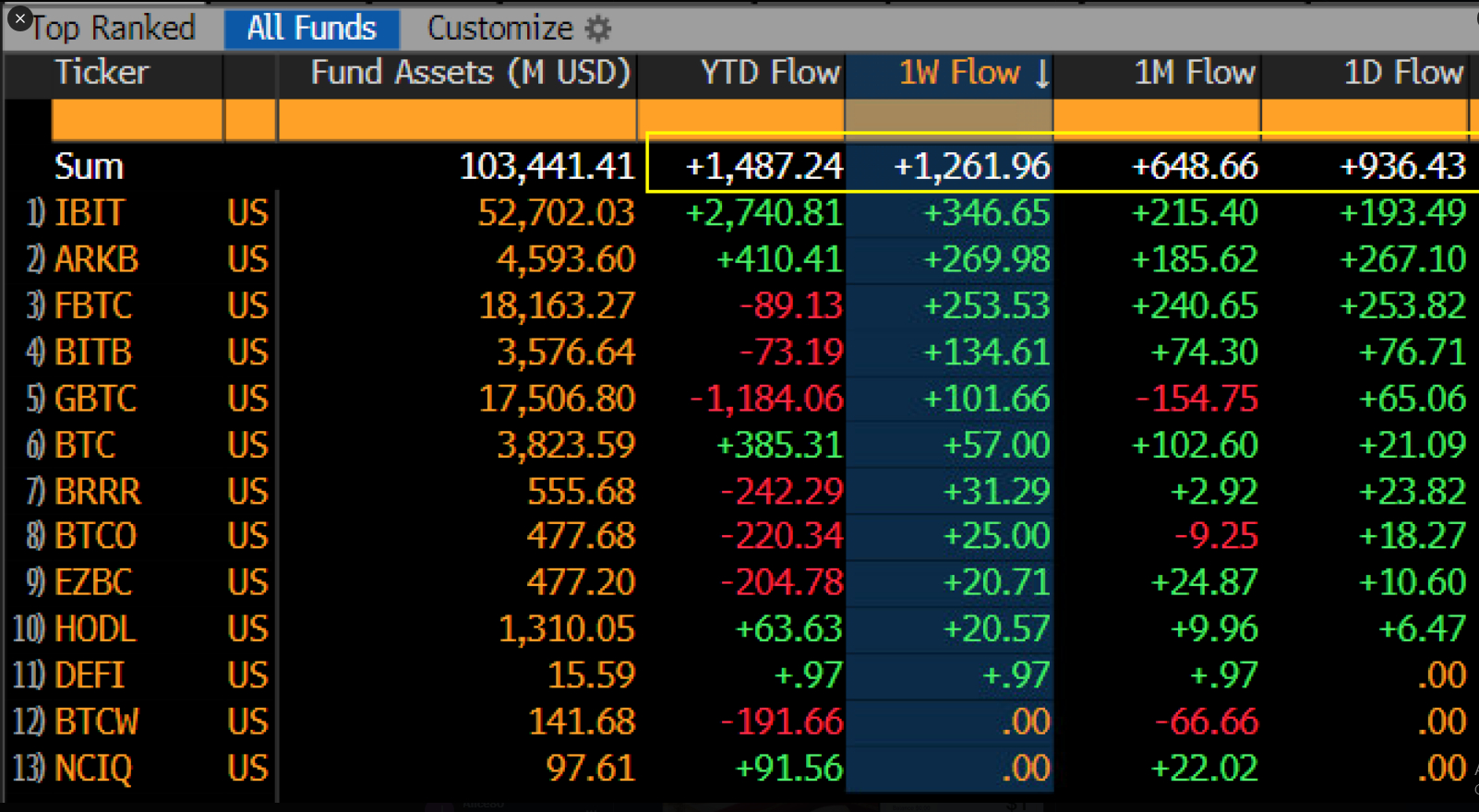

The frenzy propelled weekly inflows to $1.2 billion and complete property below administration (AUM) to $103 billion, primarily based on Bloomberg knowledge. The funding deluge occurred whereas Bitcoin’s worth rose above $93,000, reaching $93,700 – its highest since early March.

Associated Studying

BlackRock Fund Stays High Canine Amongst Rivals

BlackRock’s iShares Bitcoin Belief (IBIT) stays on the forefront with year-to-date inflows of $2.7 billion. The fund took in one other $346 million final week alone.

Ark Make investments’s ARKB and Grayscale’s Bitcoin funds lag behind with considerably smaller year-to-date inflows of $410.41 million and $385.31 million.

Not every thing is arising roses, nonetheless. Grayscale’s GBTC has seen $1.18 billion of outflows since January, going towards the general constructive tide.

The spot bitcoin ETFs went Pac-Man mode yesterday, +$936m, $1.2b for week. Additionally notable is 10 of 11 of the originals all took in money too. Good signal to see movement depth vs say $IBIT doing 90% of the lifting. Worth up $93.5k. Fairly sturdy all issues thought-about IMO. pic.twitter.com/HeLwffgT8F

— Eric Balchunas (@EricBalchunas) April 23, 2025

Growing Institutional Confidence Mirrored In Broad Participation

Ten of 11 spot Bitcoin ETFs noticed inflows of contemporary funds this week, Bloomberg senior ETF analyst Eric Balchunas reported. They’re going “Pac-Man mode”, the analyst mentioned on X. That broad-based involvement signifies institutional gamers are diversifying their bets into a number of funds somewhat than specializing in one or two.

The worth traded throughout all Bitcoin spot ETFs totaled $496 million, whereas internet property in them now characterize practically $57 billion – equal to round 2.80% of Ethereum’s market cap.

Ethereum Merchandise Preserve Shedding Streak Whereas XRP Shocks

As Bitcoin-linked investments thrive, Ethereum merchandise merely can’t appear to get a break. In keeping with stories from CoinShares, funding merchandise centered round Ethereum misplaced yet one more $26.7 million final week.

This takes their eight-week outflow quantity to a mind-boggling $772 million. Even within the face of this continued outflow, Ethereum stays in second place for year-to-date inflows at $215 million.

Quick Bitcoin Merchandise Beneath Ongoing Strain

Quick Bitcoin merchandise are experiencing the squeeze. Quick BTC merchandise had their seventh consecutive week of outflows, with $1.2 million exiting these funds.

CoinShares knowledge present that these quick bets have now misplaced $36 million over seven weeks – 40% of their property below administration. The continued outflows from quick positions are in line with Bitcoin’s latest worth power.

Associated Studying

XRP is the one exception amongst various cash, and its funding merchandise attracted over $37 million final week, the third highest for year-to-date inflows on $214 million. This defies the pattern noticed in many of the different altcoins, which nonetheless face promoting strain.

Actually, all of this new cash being poured into Bitcoin ETF investments is probably the clearest signal but that conventional monetary establishments are coming round to cryptocurrency as an asset class.

We’re speaking nearly $1 billion coming into the market in simply in the future: this seems just like the daybreak of a brand new period wherein acceptance of the asset class by the mainstream is even better.

Featured picture from Wallpapers.com, chart from TradingView