Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The NASDAQ has been bringing crypto and conventional investing collectively since 2025.

With the June 7 filing of a standard K-8 fund, the Nasdaq famous that its normal Nasdaq Crypto US Settlement Worth Index (NCIUS) would add 4 new cryptos – Cardano, Solana, Stellar Lumens, and XRP Ledger – to its present roster of Bitcoin and Ethereum.

The transfer units up the potential for the first-ever multi-asset crypto ETF, and indicators crypto’s continued ascension to the higher ranks of the monetary world.

The information comes on the again of stories that BlackRock’s Bitcoin ETF simply turned the fastest-ever ETF to reach $70B in complete property.

Add all of it collectively, and it’s clear that the finance world has expanded past recognizing simply $BTC and $ETH.

And any progress may skyrocket when crucial upgrades like Solaxy, Solana’s first-ever Layer-2, present a much-needed increase to Solana scalability and reliability.

ETFs: Sort Of A Massive Deal

Change-Traded Funds (ETFs) are swimming pools of property listed on exchanges, letting peculiar traders acquire publicity to the underlying property with out buying them instantly.

That makes them nice for retail traders who might not need the battle of organising a crypto pockets – even a easy pockets like Best Wallet app. Nevertheless, ETFs are additionally interesting to institutional traders, who use ETFs to diversify their portfolios.

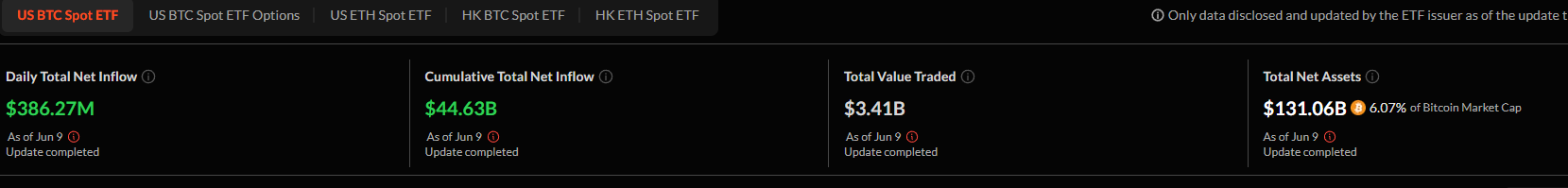

$BTC and $ETH ETFs each induced a spike within the worth of their respective cryptos once they launched final yr, and have been extensively credited with fueling a gentle enhance in demand.

At present, $BTC ETFs account for six% of the overall Bitcoin market cap; $ETH ETFs maintain 3.13%.

In each instances, that’s a major proportion of the overall market cap and provides shopping for strain.

A possible multi-asset ETF, from Nasdaq, no much less, would do the identical for any included cryptos, together with Solana.

Solana’s Ecosystem Set to Increase

Solana has traditionally relied on a single Rust-based validator shopper. That was Agave, maintained by Anza, with over 90% of stake weight operating on Jito-Solana, a fork constructed round MEV infrastructure.

The Jito-Solana consolidation boosted efficiency and staking returns, however raised issues {that a} failure at a single level may severely disrupt the community.

In a constructive signal, a number of competing purchasers are rising:

- Jito‑Solana: the unique MEV resolution, which jump-started the pattern of validator innovation

- Firedancer: developed by Leap Crypto, aimed toward blazing-fast, modular efficiency

- Sig: Syndica’s rewrite in Zig, optimized for read-heavy workloads widespread in dApps

- Paladin: a light-weight MEV-focused fork of Jito that includes a protected ‘P3’ transaction lane to mitigate sandwich assaults and improve equity

- TinyDancer: an open-source mild shopper designed for cellular environments, with SPV verification, information sampling, and fraud proofing

Taken collectively, these purchasers symbolize a maturing Solana ecosystem: every addresses particular limitations and contributes to better resilience, specialization, and decentralization.

They lay the groundwork for additional improvement on a Solana community that has seen a few of the best meme coins and new crypto presales launched in recent times.

And now there’s one other enchancment on the best way, simply in time for any potential ETF: the first-ever Solana Layer-2 resolution, Solaxy.

Solaxy ($SOLX): First-Ever Solana Layer-2 for Zero Down-Time

Why have traders poured $46M into the Solaxy ($SOLX) presale thus far?

As a result of the potential for a Layer 2 resolution that solves a few of Solana’s nagging issues – like failed transactions and community congestion – is just too nice to overlook.

The Solaxy challenge brings collectively features of Ethereum’s scalability and reliability, mixing them with Solana’s sooner community speeds and decrease transaction prices.

The $SOLX token shall be multi-chain, launching on Ethereum and bridging to the Solaxy Layer-2 when absolutely deployed.

Within the meantime, the challenge is already effectively underway.

Any traders desperate to get in early on what could possibly be the following technology of Solana improvement can try our information on how to buy Solaxy.

Tokens at present price $0.00175, however our price prediction reveals the potential for the token to hit $0.025 by the top of 2025, a 1300% enhance.

Visit the Solaxy presale page today.

Nasdaq Itemizing Positions Solana – and Solaxy – As Monetary Cornerstones

With Nasdaq itemizing Solana in its crypto index and a possible ETF on the horizon, institutional demand may surge.

Paired with the emergence of Solaxy, Solana is now not simply quick – it’s turning into foundational, and a core a part of crypto finance.

Do your personal analysis earlier than investing; this isn’t monetary recommendation. However remember – time’s operating out to get in on the bottom ground, with below every week left within the Solaxy presale.