Bitcoin Bulls Shocked after Sellers Take Value All of the Manner All the way down to $80K

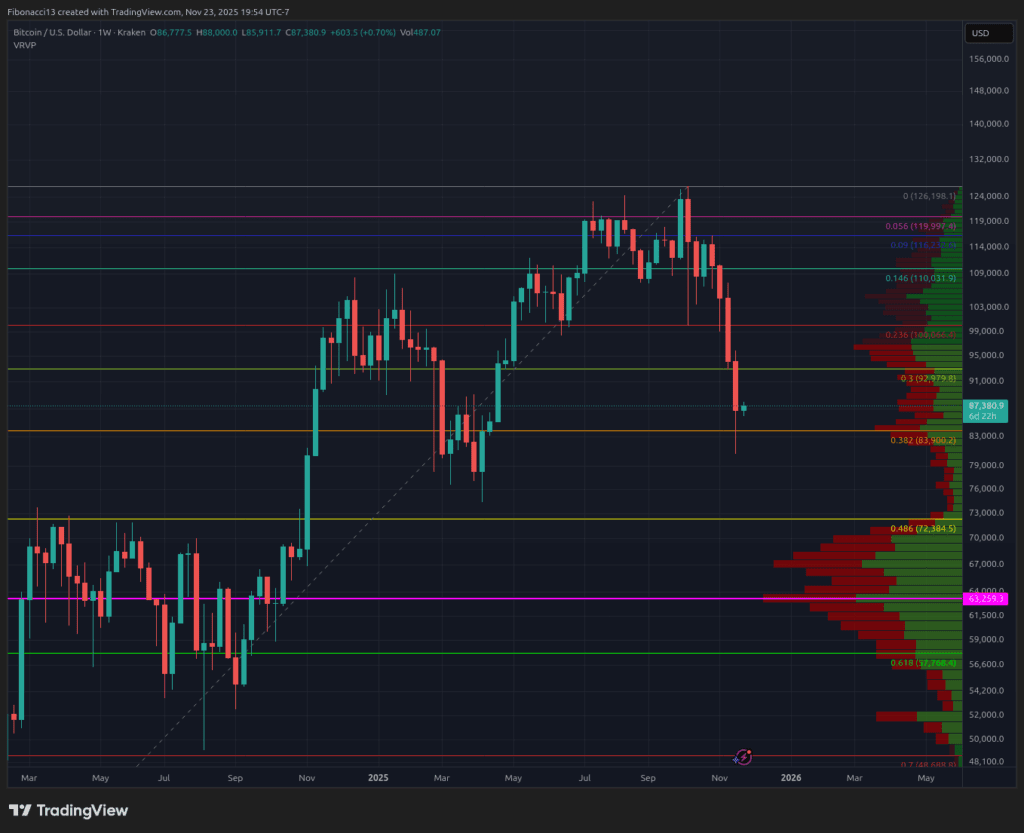

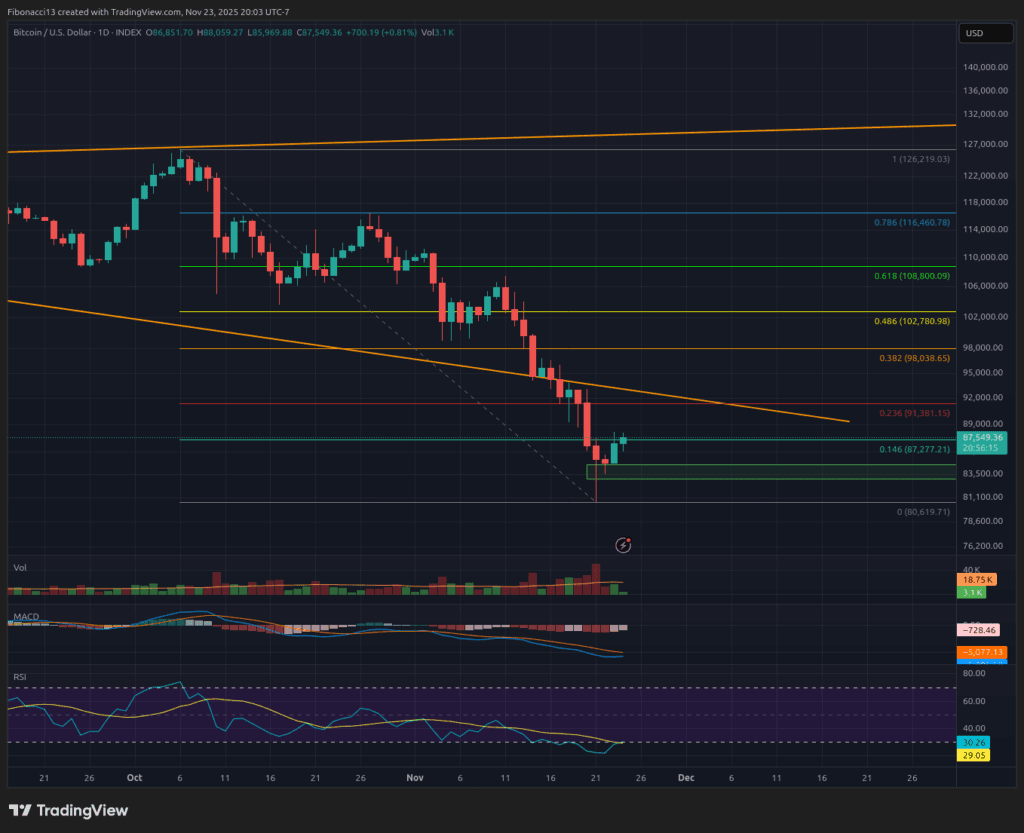

Final week, we recognized the $84,000 space as the subsequent main assist for bitcoin, and that’s precisely the place the worth went. Bitcoin dropped to just about $80,000 however managed to climb again above $84,000 assist to shut the week out at $86,850. Heading into this week, search for bears to let off the fuel pedal somewhat bit as they sit comfortably in charge of the worth motion. Every day oscillators had been closely oversold heading into this previous weekend, so a bounce is so as not less than into Monday, presumably somewhat additional out.

Key Help and Resistance Ranges Now

$84,000 Help held on the weekly shut, so that is the extent bulls will wish to stay above into this week’s shut. If $84,000 is misplaced, bulls look to $75,000, which possible received’t be too sturdy of a assist stage, and under there we’ve bought a excessive quantity assist zone between $72,000 and $69,000. It’s troublesome to see the worth pushing under $70,000 too rapidly, so anticipate some bounces from this space, even when it will definitely fails to carry. Beneath right here, we’ve the $58k gang assist and 0.618 Fibonacci retracement at $57,700.

With final week’s worth breakdown, resistance ranges have now modified heading into this week. Bulls will look to tackle the $91,400 resistance stage on the 0.236 Fibonacci retracement initially. Above right here, we should always see sturdy resistance at $94,000 now on the excessive quantity node. If worth can handle to grind by this zone, $98,000 sits above it as a closing barrier to determine this high-volume node as assist. If this happens, there are nonetheless resistance ranges at $103,000 and one other at $109,000 on the 0.618 Fibonacci retracement. Lastly, $116,500 stays because the final layer of resistance stopping the worth from reaching new highs.

Outlook For This Week

Every day RSI hit very oversold ranges on Friday final week, so it’s not stunning that the worth made a transfer up into the weekend from these lows. This week, search for the worth to attempt to problem the $91,400 resistance stage and doubtlessly $94,000 if it could climb above there. So long as the worth can maintain above $84,000, it ought to attempt to head for these goal ranges. With all of the promoting main into final Friday, one other large selloff shouldn’t be anticipated, but when the $80,000 low is misplaced, the worth might drop to $75,000 this week.

Market temper: Extraordinarily Bearish – The bulls are down on the canvas. Little hope stays for any significant rally or new highs after dropping main assist ranges.

The subsequent few weeks

The broadening wedge sample we had been watching for thus many weeks lastly and definitively broke to the draw back final week. The goal for this sample is true round $70,000, so even when we see a rally this week and into the subsequent, the worth ought to ultimately roll again over and head down to check $70,000. The US authorities, getting again to work final week, did nothing to help the markets. Within the coming weeks, it might be troublesome to foretell when financial information could or will not be obtainable since a lot of it was delayed as a result of shutdown. The market is combined on whether or not or not the Federal Reserve will scale back rates of interest on the subsequent assembly, and so they themselves appear to be conflicted between balancing inflation issues with labor market points.

Terminology Information:

Bulls/Bullish: Patrons or buyers anticipating the worth to go larger.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Help or assist stage: A stage at which the worth ought to maintain for the asset, not less than initially. The extra touches on assist, the weaker it will get and the extra possible it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of assist. The extent that’s more likely to reject the worth, not less than initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the worth.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).

Quantity Profile: An indicator that shows the overall quantity of buys and sells at particular worth ranges. The purpose of management (or POC) is a horizontal line on this indicator that exhibits us the worth stage at which the very best quantity of transactions occurred.

Excessive Quantity Node: An space within the worth the place a considerable amount of shopping for and promoting occurred. These are worth areas which have had a excessive quantity of transactions and we might anticipate them to behave as assist when worth is above and resistance when worth is under.

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the velocity of the worth and modifications within the velocity of the worth actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is under 30, it’s thought-about to be oversold.

Broadening Wedge: A chart sample consisting of an higher pattern line appearing as resistance and a decrease pattern line appearing as assist. These pattern traces should diverge away from one another so as to validate the sample. This sample is a results of increasing worth volatility, sometimes leading to larger highs and decrease lows.