Strategy has launched a $2.1 billion At-The-Market (ATM) fairness program for its Strife (STRF) most popular inventory, marking one other step within the agency’s long-term technique to construct a Bitcoin-backed monetary structure.

The announcement was made by CEO and President Phong Lee throughout an investor replace alongside Govt Chairman Michael Saylor. In line with Lee, robust year-to-date outcomes from the agency’s Bitcoin-linked securities Strike (STRK) and Strife (STRF) gave Technique the arrogance to increase its fundraising technique.

“We’re at the moment at 16.3% BTC yield for the yr, in opposition to a 25% goal,” Lee mentioned. “BTC greenback acquire is $7.7 billion to this point, on monitor towards our $15 billion goal.”

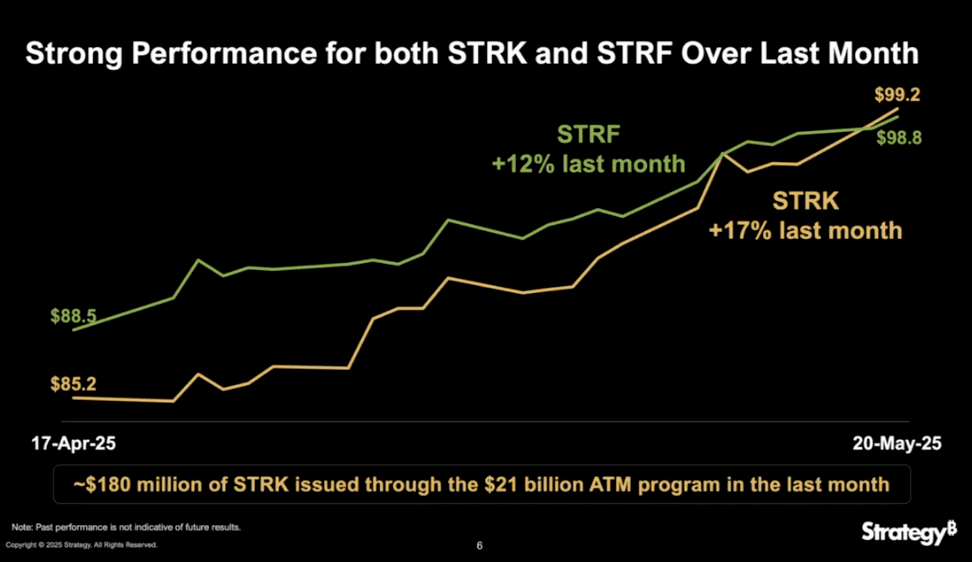

Each devices have outperformed expectations since launch. Strike is up 24% from its preliminary value of $80 to almost $100. Strife, which was priced at $85 simply two months in the past, now trades round $98.80, a 16% improve. By comparability, equally structured preferreds available in the market have declined by 3–5% over the identical interval.

Within the final 30 days alone, Strike rose 17% and Strife 12%, bringing each near par worth. Lee emphasised the liquidity profile of those devices, citing common day by day buying and selling volumes of $31 million for Strike and $23 million for Strife. “That’s 60x what we usually see in comparable preferreds,” he famous.

The corporate beforehand issued $212 million by way of Strike’s ATM, with no hostile pricing strain. Based mostly on the buying and selling quantity and investor demand, Lee mentioned the corporate believes the $2.1 billion Strife ATM could be executed similarly.

Strife is a perpetual most popular inventory with a ten% coupon and sits on the prime of Technique’s capital stack. Saylor described it as “the crown jewel” of the corporate’s most popular choices. “We’re going to be ten occasions as cautious with Strife,” he mentioned. “Our aim is for it to be seen as investment-grade fastened earnings — a high-quality instrument with strong protections.”

Strike, against this, is positioned for what Saylor known as “Bitcoin-curious” buyers. It carries an 8% coupon and consists of upside by way of Bitcoin conversion. “Consider it like a Bitcoin fellowship with a stipend,” Saylor mentioned.

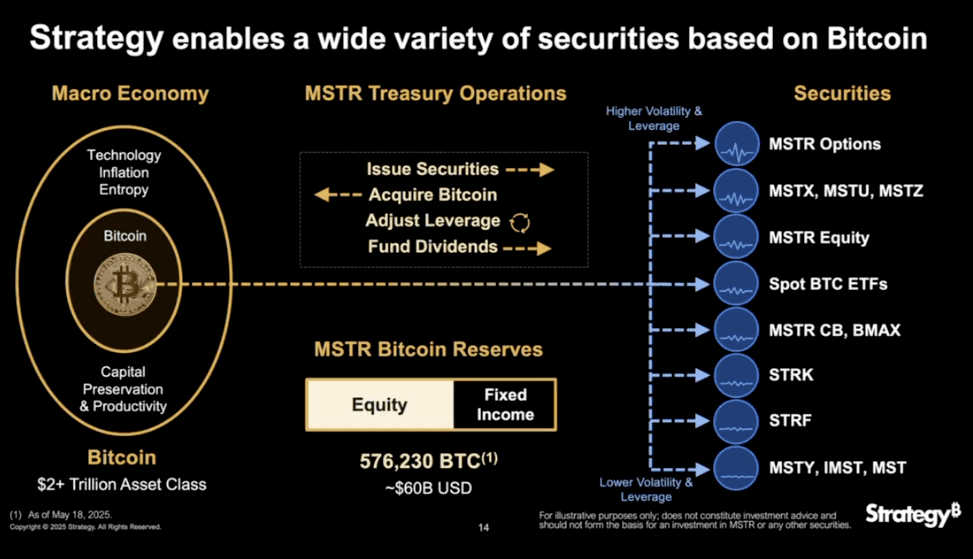

Technique now operates three ATM applications: $21 billion every for MSTR fairness and Strike, and $2.1 billion for Strife. These are rebalanced day by day, with issuance adjusted primarily based on market situations, volatility, and investor demand. In line with Saylor, this dynamic construction permits the corporate to optimize Bitcoin acquisition and capital deployment throughout altering market environments.

Behind this technique sits Technique’s Bitcoin treasury, now totaling 576,230 BTC — roughly $60 billion in worth. “That everlasting capital is the inspiration for the whole lot we’re constructing,” Saylor mentioned.

Whereas spot Bitcoin ETFs cater to buyers in search of direct value publicity, Technique continues to supply a extra nuanced set of devices — every focusing on completely different ranges of threat, return, and compliance. The Strife ATM is the most recent transfer in that broader technique.