In Q1 FY2025, Metaplanet posted the strongest monetary leads to its 20-year company historical past—pushed by a Bitcoin treasury technique that’s now working at scale.

Metaplanet isn’t simply aligning with Bitcoin. It’s compounding shareholder worth by means of it—by utilizing capital markets infrastructure, BTC-native KPIs, and recurring earnings methods to systematically enhance Bitcoin per share.

With 6,976 BTC on its stability sheet, a 170% BTC Yield year-to-date, and a rising world footprint, Metaplanet is now not a sign — It’s a system.

A Breakout Quarter for Japan’s Bitcoin Treasury Chief

Metaplanet’s Q1 FY2025 outcomes marked a turning level—not solely when it comes to scale, however in consistency. For the primary time, each core working metrics and Bitcoin treasury KPIs broke firm information.

Quarterly Financials:

- Income: ¥877M (+8% QoQ)

- Working Revenue: ¥593M (+11% QoQ)

- Whole Property: ¥55.0B (+81%)

- Internet Property: ¥50.4B (+197%)

- Unrealized BTC Positive factors (as of Could 12): ¥13.5B

Whereas the corporate reported a ¥7.4B valuation loss on its Bitcoin place as of the March quarter-end on account of market costs, it famous that these losses had totally reversed—after which some—by mid-Could.

This context issues: valuation volatility is predicted in a BTC-denominated capital model. What issues extra is BTC per share progress, operational profitability, and capital effectivity—all of which trended strongly upward.

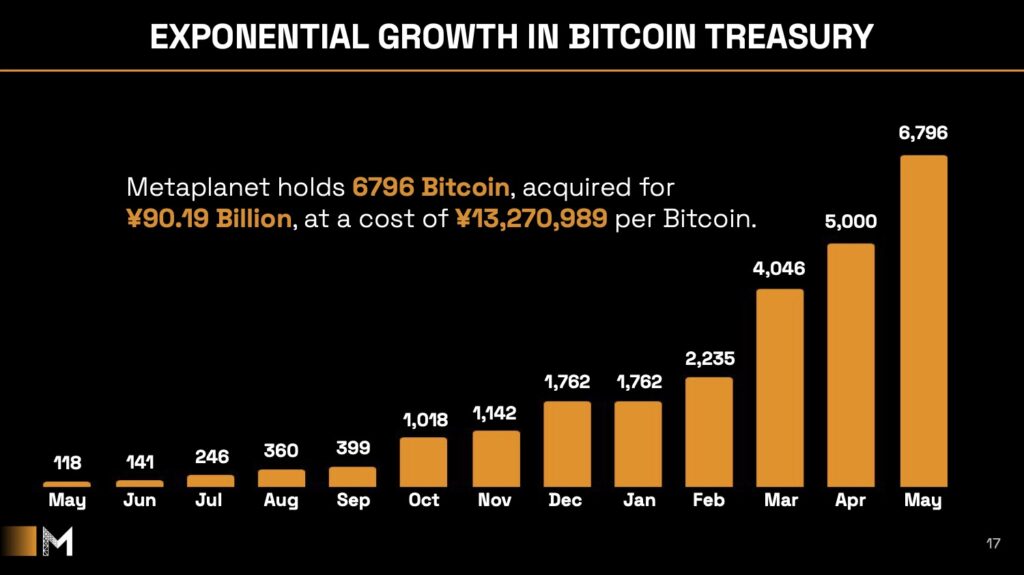

BTC Holdings Surge to six,976—Up 3.9x 12 months-to-Date

Metaplanet added 5,034 BTC in Q1 alone, rising its Bitcoin holdings to 6,976 BTC—a 3.9x enhance since January 1.

It now holds:

- ~68% of its near-term 10,000 BTC goal

- A price foundation of ¥13.27M per BTC

- A prime 11 place globally and #1 in Asia amongst public firms by Bitcoin held

This accumulation was funded by way of Japan’s largest moving-strike warrant program, which permits the corporate to concern fairness into market energy with out setting a set low cost or strike. As of Could 10:

- 87% of the 210M-share program has been executed

- ¥76.6B has been raised

- This system enabled steady BTC purchases with out disrupting share worth stability

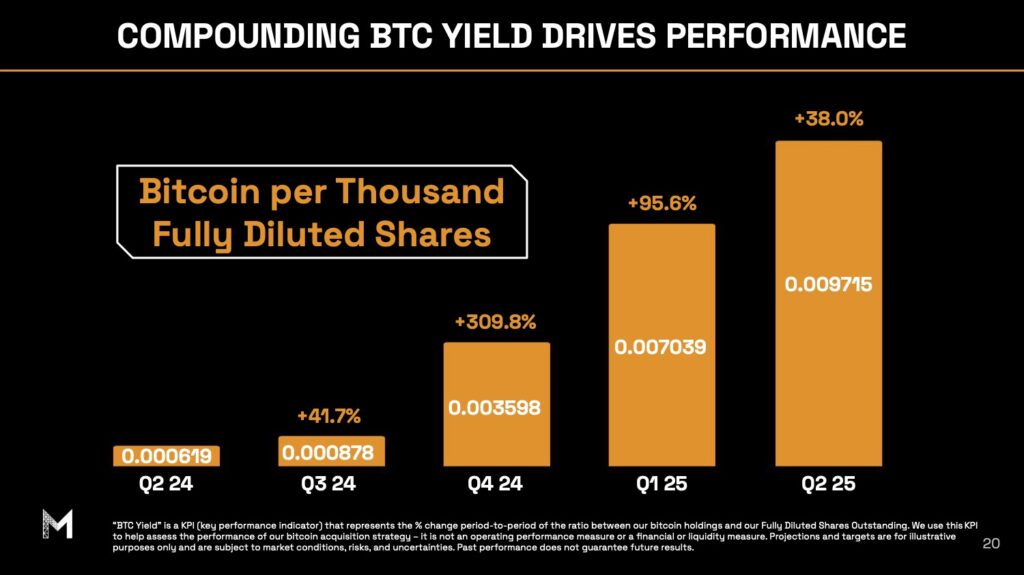

BTC Yield Hits 170%—A Defining KPI

Metaplanet tracks a novel Bitcoin-native KPI: BTC Yield, which measures the expansion in Bitcoin per diluted share. In Q1:

- BTC Yield: 170.0%

- BTC Acquire: 2,996 BTC

- BTC ¥ Acquire: ¥45.4B

This metric is central to how Metaplanet evaluates treasury efficiency—not in fiat returns, however in how successfully it grows BTC per shareholder unit.

BTC Yield displays not simply accumulation, however capital technique. Fairness raised should end in BTC that outpaces dilution. If that occurs, BTC Yield goes up. If not, it drops. It’s a precision software for treasury self-discipline.

This mirrors the improvements pioneered by Technique (previously MicroStrategy), however with a distinctly Asia-Pacific capital markets mannequin.

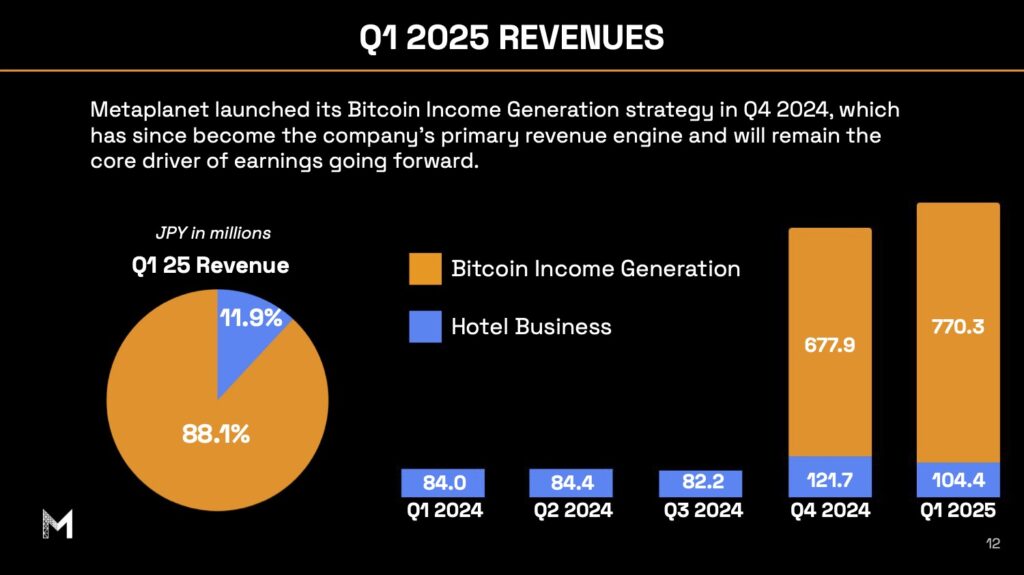

Working Revenue Hits New File—Pushed by Bitcoin Revenue

In contrast to many Bitcoin-focused corporations, Metaplanet isn’t simply elevating capital and shopping for Bitcoin—it’s additionally producing recurring revenue.

Q1 working earnings was ¥592M, a brand new firm file.

Breakdown:

- ¥770M from Bitcoin Revenue Era (primarily from writing BTC cash-secured places)

- ¥104M from its legacy lodge enterprise

- Working margin: 67.6%

Why it issues: this earnings mannequin reduces dependence on fairness issuance and improves capital flexibility. It additionally means new capital can go immediately into BTC—to not fund operations. This reinforces Metaplanet’s capacity to develop each BTC and BTC per share.

The corporate has now monetized 30 out of 58 days in 2025 by way of its BTC volatility methods, whereas sustaining strict draw back safety. This turns stability sheet volatility right into a income supply.

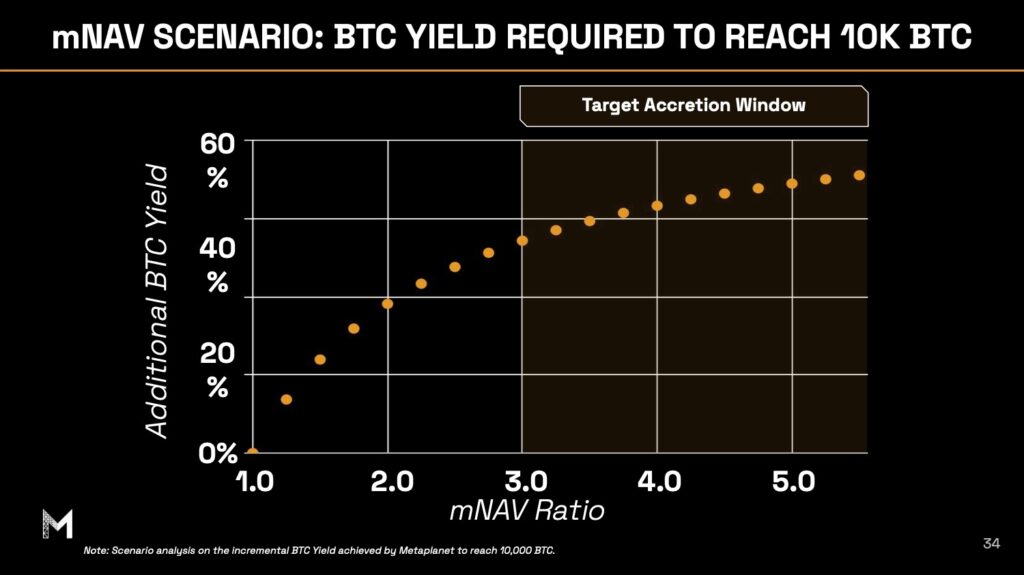

Metaplanet’s Premium to NAV and International Liquidity Edge

One of many defining options of Metaplanet’s public market presence is its capacity to take care of a premium to NAV—a uncommon feat amongst Bitcoin treasury firms.

At present ranges, its fairness trades nicely above the mark-to-market worth of its BTC holdings, adjusted for dilution. This premium isn’t a speculative fluke—it’s a mirrored image of how the corporate is structurally positioned to outperform Bitcoin per share, and the way world buyers are starting to grasp and worth in that functionality.

Drivers of this premium embody:

- Constant BTC Yield progress that reinforces long-term per-share worth

- A clear cap desk with no most popular fairness and no debt

- Deep home liquidity on the Tokyo Inventory Alternate, the place Metaplanet has develop into one of many prime 3 most actively traded shares by quantity in 2025

- Broad ETF inclusion and algorithmic index participation, on account of its excessive volatility, sector neutrality, and tradability

- International publicity by means of MTPLF (U.S. OTC itemizing) and DN3 (Germany), offering accessibility to retail and institutional capital throughout time zones

- Clear, BTC-native treasury reporting that aligns with fashionable investor expectations

Metaplanet has additionally attracted cross-border capital flows from Bitcoin-aligned buyers in search of jurisdictional diversification and treasury progress, not simply uncooked BTC publicity. The agency’s constantly optimistic BTC Yield and working margin has helped reinforce this shareholder base, resulting in natural demand-driven fairness issuance at accretive costs.

A Scalable Bitcoin Treasury Mannequin for Asia

As a Premiere Member of Bitcoin For Corporations, Metaplanet is enjoying an important function in shaping the worldwide Bitcoin treasury motion—significantly throughout the Asia-Pacific area.

Whereas most Bitcoin treasury firms up to now have emerged from the U.S., Metaplanet’s mannequin proves that Bitcoin-native capital technique can scale inside completely different regulatory frameworks, capital markets, and investor cultures.

The corporate’s design is purpose-built to maximise Bitcoin per share with out counting on mounted debt devices or opportunistic “buy-the-dip” moments. As a substitute, it leverages:

- Shifting-strike fairness applications that enable it to concern shares solely when market demand helps it

- A programmable treasury acquisition framework, enabling day by day BTC purchases with out timing discretion or guide buying and selling

- BTC Revenue Era methods that flip volatility into working revenue

- Built-in liquidity infrastructure spanning three areas and currencies (JPY, USD, EUR)

As a Premiere Member of BFC, Metaplanet actively shares learnings, metrics, and execution insights with different public firms exploring Bitcoin treasury adoption. Its construction will not be solely repeatable—it’s exportable.

For corporates in Japan, Korea, Taiwan, Hong Kong, and Southeast Asia, Metaplanet presents greater than proof of idea. It presents a blueprint.

And as BFC continues to broaden its worldwide footprint, Metaplanet’s function will likely be central to how the playbook for Bitcoin-native capital design evolves throughout world markets.

Conclusion: Metaplanet Strikes From Sign to System

Metaplanet is now not simply Japan’s first public Bitcoin treasury firm. It’s turning into the primary in Asia to construct an operational mannequin that proves Bitcoin treasury technique can ship:

- Excessive working margins

- Capital-efficient BTC accumulation

- Scalable, clear shareholder efficiency metrics

- Public market outperformance

With 6,976 BTC on the stability sheet, 170% BTC Yield, and a premium valuation supported by execution—not hype—Metaplanet is setting a brand new customary.

It’s not simply holding Bitcoin. It’s exhibiting what a Bitcoin-first capital construction can actually do.