With Bitcoin breaking into new all-time highs, the inevitable query emerges for each investor: how excessive can this bull market truly go? On this evaluation, we’ll take a data-driven and mathematical strategy to attempt to estimate potential worth targets for each Bitcoin and (Micro)Technique all through the present cycle.

Reevaluating The Pi

The Pi Cycle Top Prediction chart depends on two key transferring averages: the 350-day transferring common multiplied by two (inexperienced line) and the 111-day transferring common (orange line). Traditionally, when the 111-day MA crosses above the 350-day MA x 2, a cycle peak has occurred inside just some days. Regardless of its previous accuracy, together with flawless calls throughout prior cycles, it’s necessary to stay cautious.

At present trajectories, the indicator forecasts a cycle peak round January 17, 2027. Nonetheless, for any crossover to happen, BTC would want to maintain costs nicely above the 350DMA*2 for months, probably at costs considerably larger than $200,000. That stage of sustained worth appreciation appears unlikely this cycle, though I’d like to be confirmed flawed! Whereas the instrument stays a useful danger administration indicator, we shouldn’t rely solely on it for timing macro tops simply due to its historic accuracy.

MVRV Ratio

A extra grounded methodology includes the Market Value to Realized Value (MVRV) ratio. By analyzing the connection between market worth and the realized worth (the typical value foundation of all BTC in circulation), we are able to set practical expectations. If we extrapolate a conservative cycle peak MVRV rating of two.8 utilizing prior diminishing returns, peaks we’ve already set on this cycle within the MVRV, and the present realized worth of $50,000, we arrive at a present projected Bitcoin high of round $140,000.

Nonetheless, for the reason that realized worth continues to extend as capital flows into Bitcoin, a $70,000 realized worth later within the cycle would counsel a possible peak nearer to $200,000. This methodology displays a extra dynamic strategy to understanding Bitcoin’s market habits primarily based on on-chain knowledge and investor psychology.

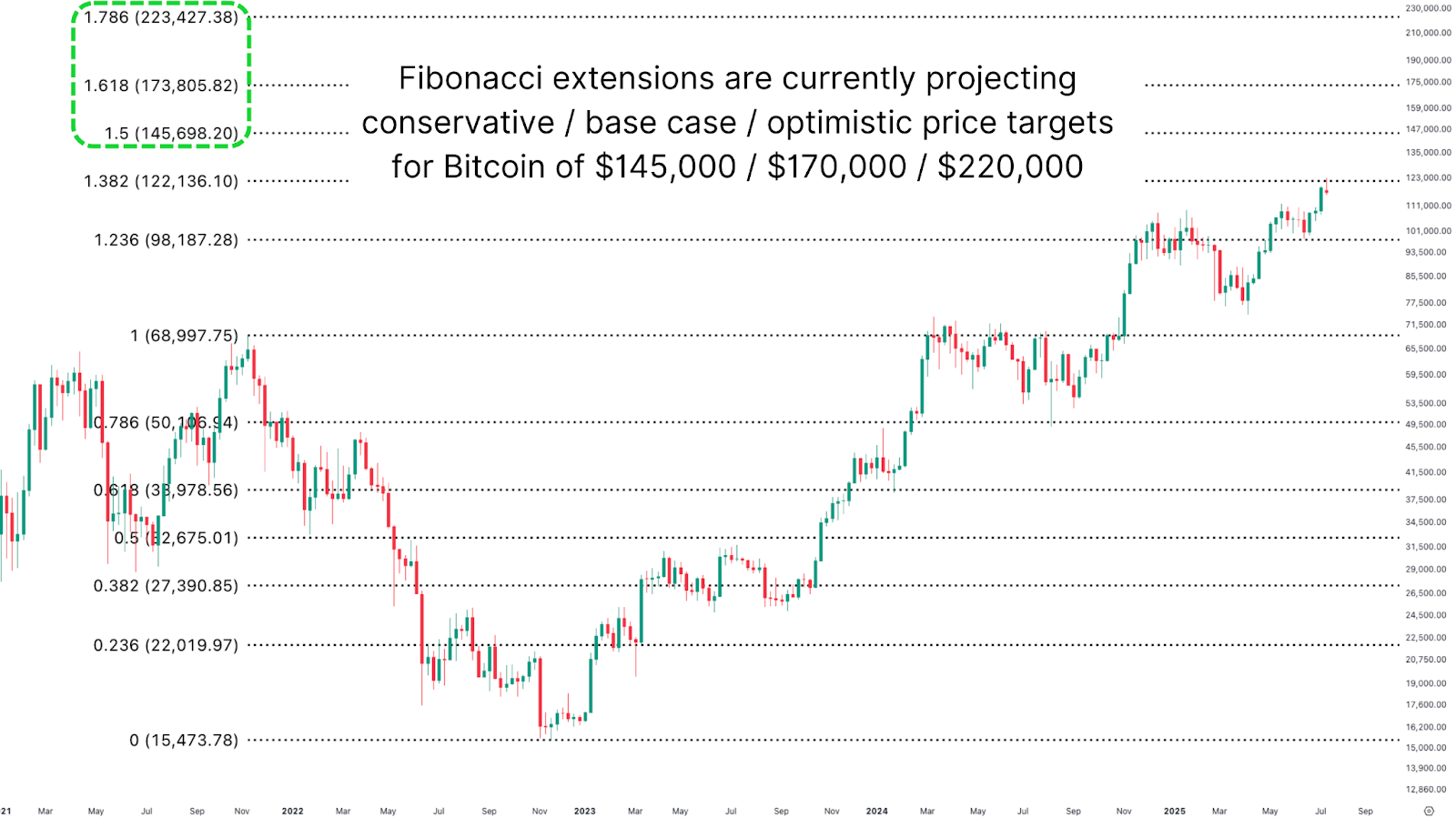

Fibonacci Extensions

For extra technically inclined merchants, Fibonacci extensions can supply insights when coming into worth discovery. Utilizing TradingView’s Fib extension instrument on earlier cycle lows and highs, we’ve recognized vital ranges which have acted as resistance and help traditionally with an extremely excessive diploma of accuracy. Together with that, the current excessive corresponded extremely intently to the 1.382 Fib stage at ~$122,000.

Trying forward, the 1.618 extension suggests ~$170,000 as a probable cycle high, with a extra aggressive upside goal of ~$220,000. Curiously, this aligns intently with the $140k to $200k projections derived from MVRV evaluation, offering stable cross-model validation.

Technique’s Peaks

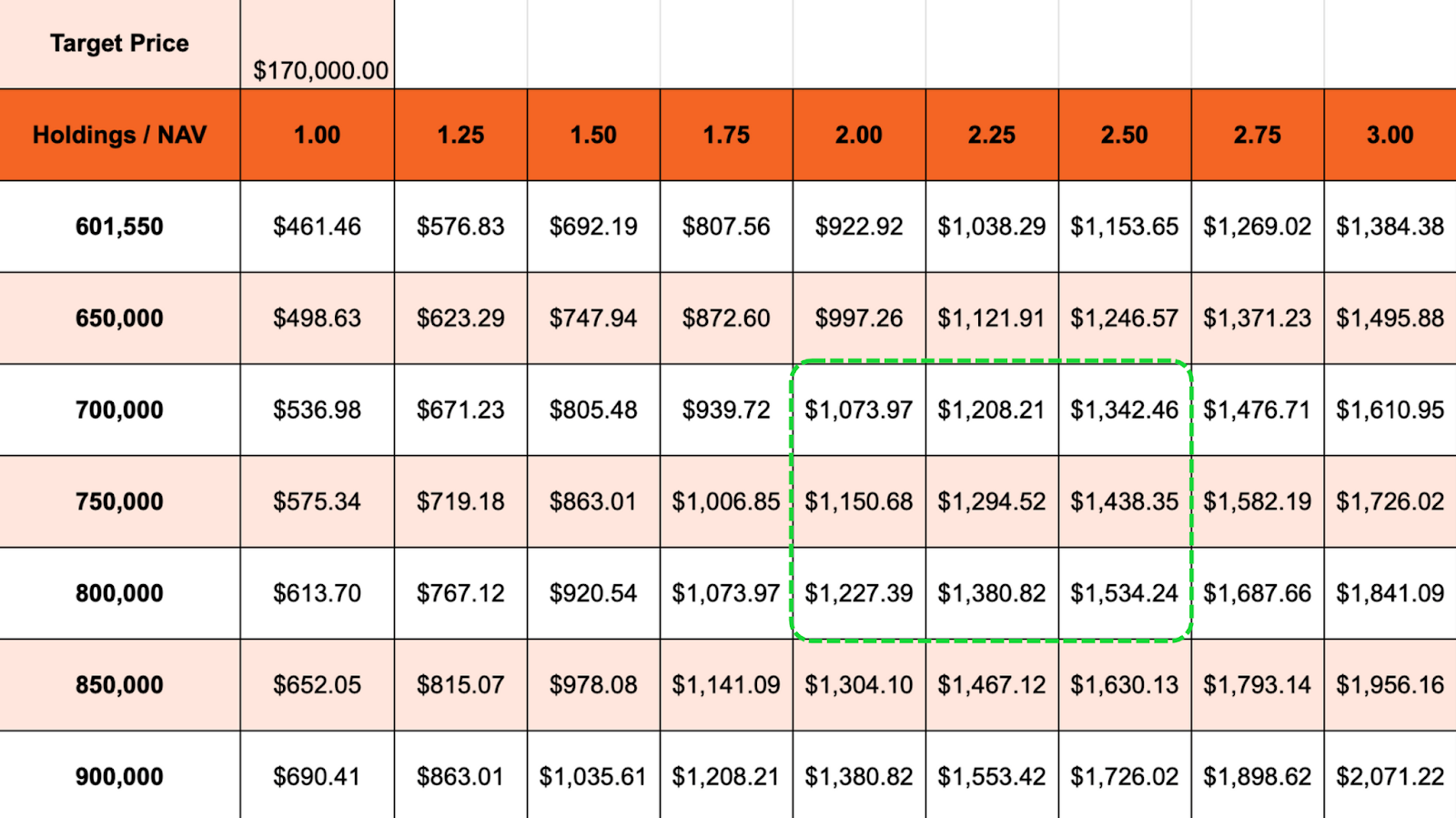

(Micro)Technique’s share worth is closely influenced by its rising BTC reserves. The corporate at present holds over 600,000 BTC and is predicted to extend this to between 700k and 800k because the cycle continues. Making use of the identical Fibonacci framework to MSTR reveals a possible resistance round $543, additionally the present all-time excessive, and upcoming targets of ~$800 and ~$1,300.

To validate this, we analyzed MSTR’s premium to its Bitcoin Web Asset Worth (NAV), which has fluctuated between 2x and almost 3x a number of instances this cycle. Assuming a future Bitcoin worth of $170K and continued accumulation, a 2–2.5x premium means that MSTR reaching $1,300 is a reputable higher certain.

Conclusion

Bitcoin’s price potential this cycle ranges from $140,000 on the conservative finish, to $170,000 within the base case, and as much as $220,000 in a bullish state of affairs. For Technique, this interprets into a probable higher certain of round $1,300, providing uneven upside for traders betting on oblique Bitcoin publicity.

Finally, whereas modeling future worth motion is informative, knowledge ought to information your choices, not dictate them. Don’t cling to spherical numbers or fashions alone. Be ready to behave when danger alerts emerge, even when your favourite mannequin hasn’t hit its magic quantity.

💡 Cherished this deep dive into bitcoin worth dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for extra skilled market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to skilled evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.