A brand new report from CoinCorner reveals that the majority UK Bitcoin traders are taking part in the lengthy sport. In line with its 2024 UK Buyer Report primarily based on a pattern of two,000 customers, 51% of shoppers have by no means offered their Bitcoin. As a substitute, they’re constantly shopping for in small quantities, embracing the HODL strategy.

“The 2024 Bitcoin evaluation revealed that our pattern tended to purchase in small, frequent quantities and promote in bigger, extra important transactions, strategically reacting to Bitcoin’s value motion,” the report explains.

On common, customers purchased £412 price of Bitcoin per transaction, with some beginning as little as £5. In the meantime, the common promote was £5,513 (10x larger) indicating that clients are accumulating regularly and solely promoting throughout robust value surges. This habits aligned intently with Bitcoin’s market highs in 2024.

A staggering 86% of all transactions have been buys, reinforcing the buildup pattern. Much more telling: 88% of shoppers purchased greater than as soon as, and 51% have been shopping for Bitcoin for over three years.

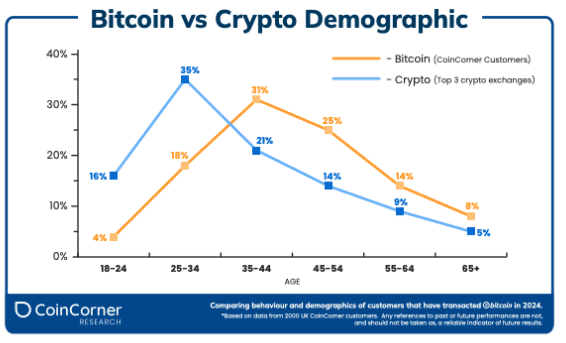

Demographics within the report additionally problem stereotypes. As a substitute of the standard younger, risk-driven picture of crypto merchants, 56% of CoinCorner customers fall inside the 35–54 age vary. The report notes, “This means CoinCorner… attracts a extra mature and financially established consumer base.”

Regionally, London led each in consumer depend and whole transaction quantity, probably on account of larger common financial savings within the capital. Male customers made up 86% of the pattern, and people working in IT held the most important portion of Bitcoin, whereas retirees recorded the very best total transactional quantity.

On the finish of 2024, 97% of customers who had solely purchased and offered Bitcoin by means of CoinCorner have been in revenue. This consequence underscores how long-term engagement and strategic shopping for patterns are paying off. Even amongst smaller traders (56% of whom held underneath £1,000) conviction stays robust. Within the chart under, you may see the outcomes over the past seven years.

As Bitcoin adoption grows within the UK, CoinCorner’s information exhibits that traders are treating it extra like digital gold than a get-rich-quick scheme. “These insights reinforce Bitcoin’s evolving position within the monetary panorama,” the report concludes, “balancing regular accumulation with energetic, strategic engagement.”