“Nothing stops this practice,” Lyn Alden initially said at Bitcoin 2025, strolling the viewers by a data-rich presentation that made one factor clear: the U.S. fiscal system is uncontrolled—and Bitcoin is extra vital than ever.

Her first chart, sourced from the Federal Reserve’s FRED database, displayed a stark decoupling: the unemployment fee is down, but the fiscal deficit has surged previous 7% of GDP. “This began round 2017, went into overdrive throughout the pandemic, and hasn’t corrected,” Alden stated. “That’s not regular. We’re in a brand new period.”

She didn’t mince phrases. “Nothing stops this practice as a result of there are not any brakes hooked up to it anymore. The brakes are closely impaired.

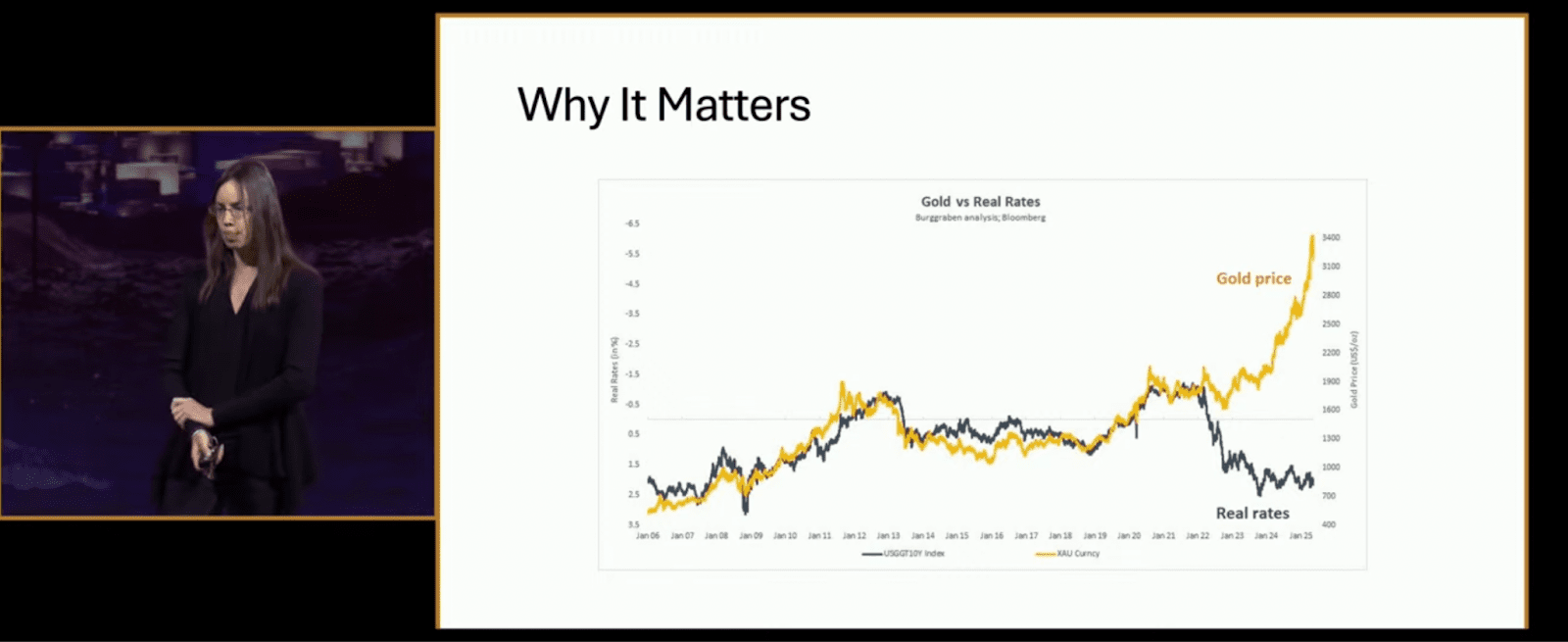

Why ought to Bitcoiners care? As a result of, as Alden defined, “it issues for asset costs—particularly something scarce.” She displayed a gold vs. actual charges chart that confirmed gold hovering as actual rates of interest plunged. “5 years in the past, most would have stated Bitcoin couldn’t thrive in a high-rate atmosphere. But right here we’re—Bitcoin over $100K, gold at new highs, and banks breaking beneath stress.”

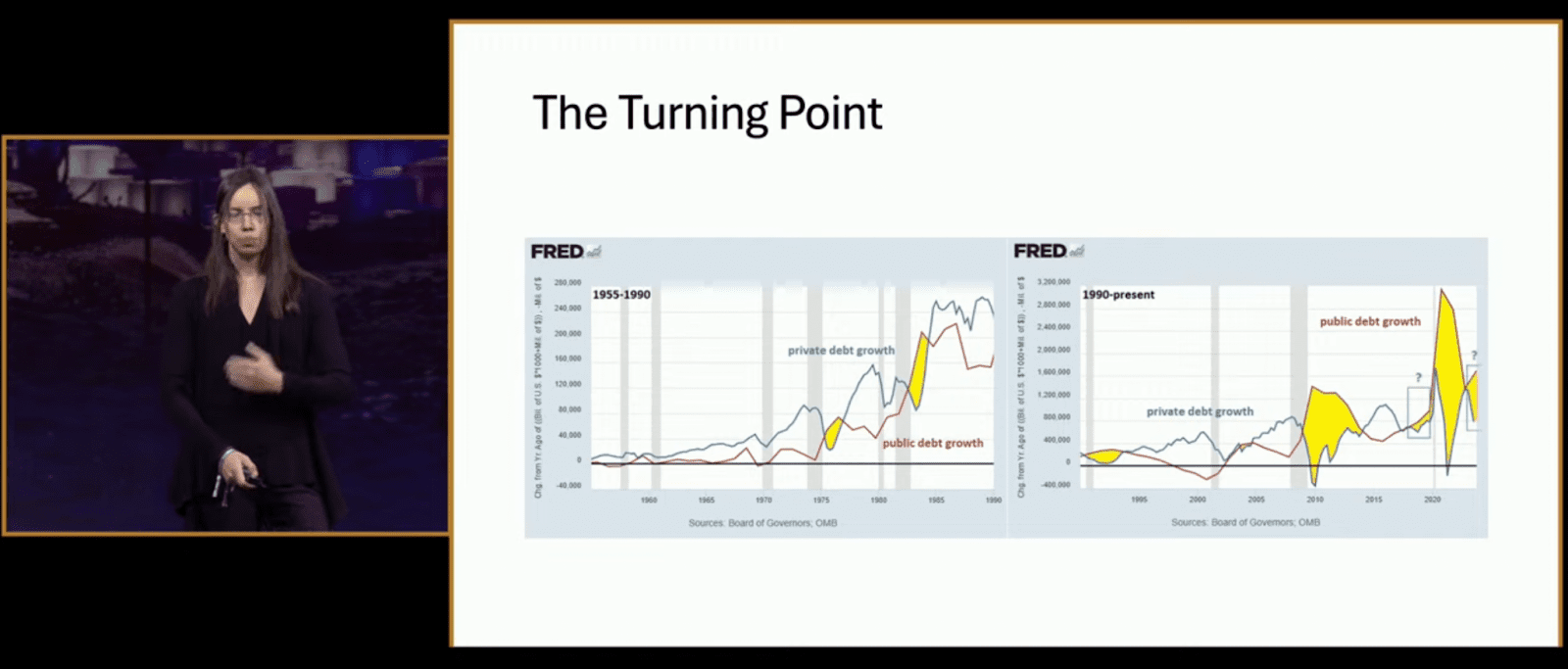

Subsequent got here what she known as “The Turning Level”—a side-by-side exhibiting how public debt development overtook personal sector debt post-2008, flipping a decades-long norm. “That is inflationary, persistent, and it means the Fed can’t sluggish issues down anymore.”

One other chart revealed why rising rates of interest at the moment are accelerating the deficit. “They’ve misplaced their brakes. Elevating charges simply makes the federal curiosity invoice explode quicker than it slows financial institution lending.”

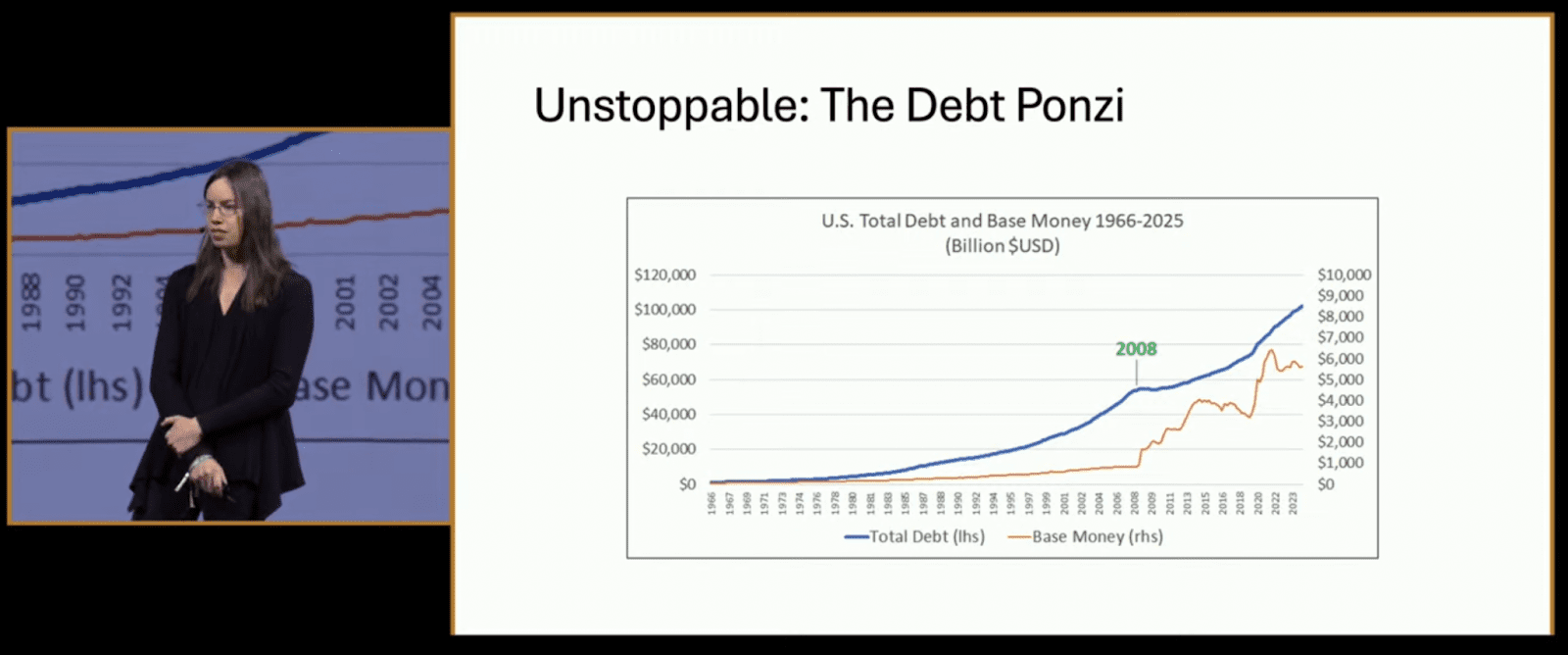

Alden known as it a ponzi: “The system is constructed on fixed development. Like a shark, it dies if it stops swimming.”

Her slide confirmed a relentless rise in whole debt versus base cash—aside from a jolt in 2008, and once more after 2020. “This isn’t going backward. Ever.”

So why Bitcoin? “As a result of it’s the other. Scarce, decentralized, and mathematically capped,” Alden concluded. “There are two causes nothing stops this practice: math and human nature. Bitcoin is the mirror of this technique—and the very best safety from it.”

You possibly can watch the total panel dialogue and the remainder of the Bitcoin 2025 Convention Day 3 beneath: