Cross-border funds was once a back-office drawback. Gradual rails, excessive charges, and too many middlemen. In 2026, consideration has shifted to one thing sensible: fixing how cash strikes throughout borders.

Whereas retail sentiment slid into “excessive worry”, with the Crypto Worry & Greed Index dropping to 17, bigger gamers quietly repositioned. Panic tends to be loud. Actual strikes often usually are not.

Supply: alternative.me

On platforms like Toobit, the place self-discipline issues greater than hype, the main focus in 2026 is obvious. It’s all about settlement, liquidity, and who controls the rails.

Can Bitcoin deal with the Fed?

If 2025 was all about halving hype, early 2026 has been formed by a coverage shock. The nomination of Kevin Warsh as the following Federal Reserve Chair rattled threat markets quick, and Bitcoin (BTC) didn’t escape the fallout. For anybody watching the present BTC worth tick by tick, the message was clear: Bitcoin nonetheless reacts to liquidity shifts set by the Fed.

By early February 2026, the worth of BTC settled across the $88,000 degree, effectively beneath the highs seen late final yr. Bitcoin worth has since been on a downward trajectory, with BTC price buying and selling at just under $78,000 on February 3, 2026, 02:58 (UTC +0).

The present Bitcoin worth is not only about hypothesis; it displays macro expectations, liquidity circumstances, and institutional urge for food.

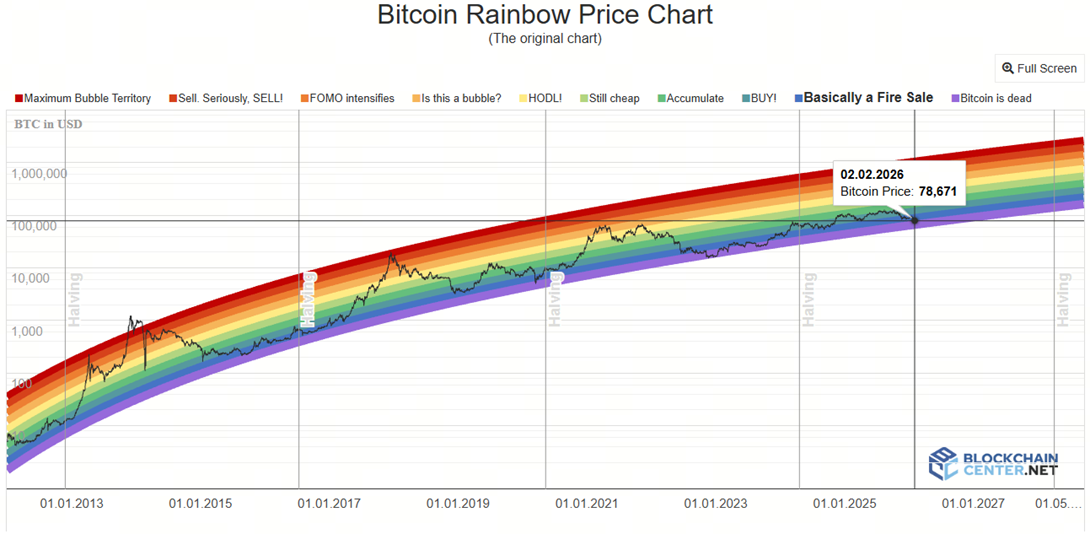

The BTC rainbow chart locations Bitcoin within the “Mainly a Hearth Sale” territory, whilst sentiment sits in “Excessive Worry.” Traditionally, these zones have marked intervals of consolidation fairly than collapse. The rainbow chart BTC doesn’t counsel a damaged asset, only a market digesting macro stress.

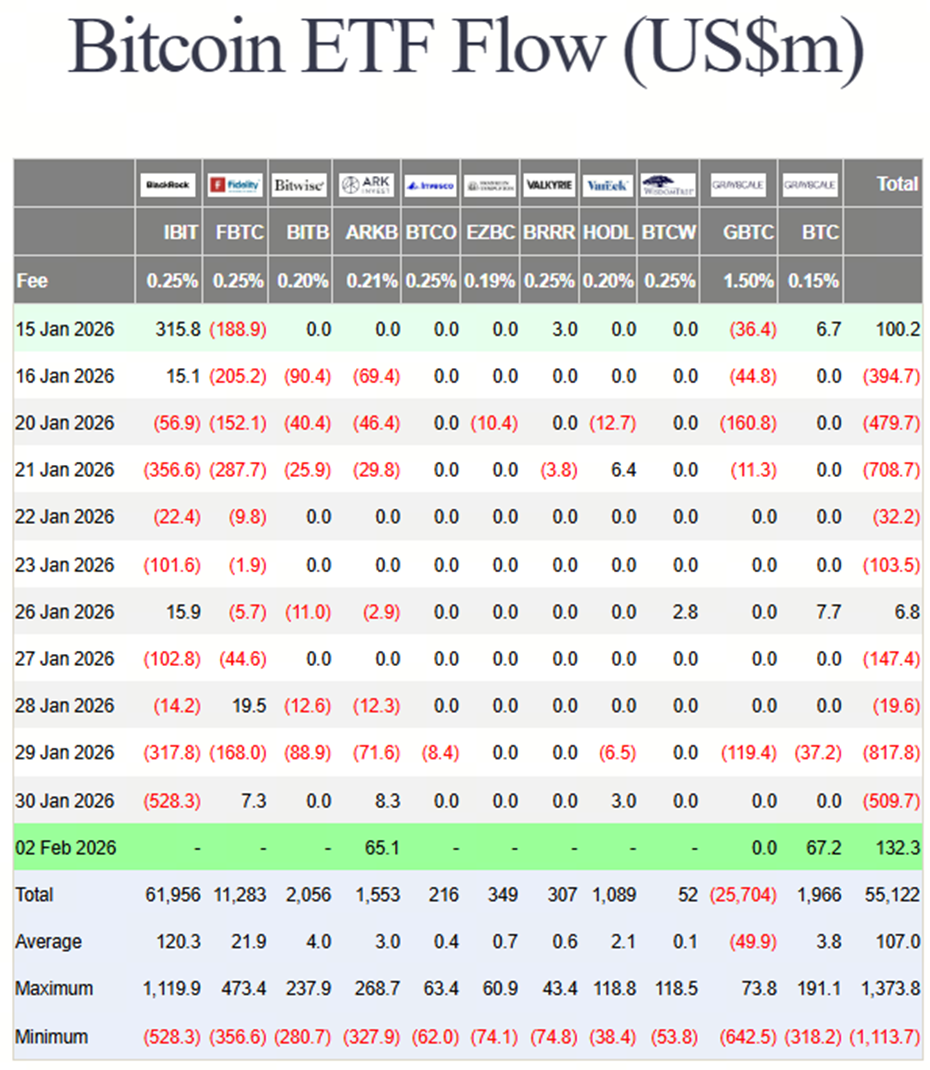

Based on CoinGlass and Farside Traders’ information, Bitcoin has slipped beneath the common entry worth of U.S. spot Bitcoin exchange-traded funds (ETFs), following two of the most important weekly outflows these merchandise have seen since launch.

Based on information mirrored as of February 2, there was a internet influx of $132.2 million although it has been overshadowed by the substantial outflows simply final month.

Supply: Farside Investors

Whole belongings underneath administration are hovering simply above $110 billion because the current worth motion factors to rising stress throughout the market.

Nevertheless, with U.S. spot Bitcoin ETFs and rising institutional custody, BTC is more and more handled as a impartial settlement asset fairly than only a speculative commerce. Massive transfers throughout borders are utilizing Bitcoin as a bridge asset when conventional rails are sluggish, costly, or restricted.

Then as financial coverage uncertainty and geopolitical threat persist, Bitcoin’s portability issues. It permits worth to maneuver throughout jurisdictions with out counting on correspondent banking networks, which retains BTC related in cross-border flows even when it isn’t used for on a regular basis funds.

That context shapes BTC worth prediction discussions. Analysts usually are not asking whether or not Bitcoin survives, they’re asking how central it turns into to settlement and collateral. For cross-border funds, BTC’s function is pushed by institutional use, macro hedging, higher infrastructure, and clearer regulation.

It’s much less about each day funds and extra about shifting giant quantities of worth throughout borders with out counting on conventional banking rails.

Is Stellar Lumens the quiet engine behind international funds?

Whereas Bitcoin wrestles with its function as a macro hedge, Stellar Lumens (XLM) has stayed centered on a less complicated job: shifting cash throughout borders. That focus has helped the XLM price maintain up in early 2026, pushed much less by hypothesis and extra by actual utilization.

Based on CoinMarketCap, on-chain exercise and institutional partnerships expanded steadily by means of 2025.

Current business analysis on cross-border funds factors to rising demand for quicker, cheaper settlement rails, particularly for business-to-business (B2B) transfers in rising markets. That explains why the XLM Stellar worth has proven relative energy whilst a lot of the altcoin market has struggled.

When individuals ask, “Is XLM a very good funding?”, they’re usually hoping for a quick breakout. That’s not actually the guess right here. In 2026, the XLM crypto worth is tied to infrastructure: transaction quantity, community utilization, and partnerships that don’t make flashy headlines.

XLM shouldn’t be making an attempt to be digital gold. It’s making an attempt to maneuver cash cheaply throughout borders. Our XLM information outlook suggests worth motion is more and more linked to fee stream fairly than hype cycles. As of February 3, 2026, 04:36 (UTC +0), worth of XLM is buying and selling round $0.17.

Current XLM information prediction protection has centered on stablecoin issuance, remittance corridors, and integrations with monetary establishments in rising markets. So in case you are asking how excessive will XLM go, the higher place to look shouldn’t be social media; it’s the scale of the worldwide cross-border funds market and the way a lot of it shifts on-chain.

Based on our analysis of XLM crypto worth habits, Toobit noticed a gentle rise in pockets exercise alongside modest worth appreciation; usually an indication of utilization main worth, not the opposite method round. The worth of XLM might not seize headlines, however it more and more displays actual transaction demand.

Is XRP the grownup within the room for cross-border funds?

The XRP price stays some of the watched indicators in cross-border funds, largely as a result of it sits on the intersection of regulation and institutional use. For the reason that decision of key authorized uncertainties within the U.S., XRP worth motion now displays adoption and integration fairly than courtroom headlines.

Ripple continues to place XRP for settlement use circumstances alongside stablecoin and liquidity merchandise designed for banks and fee suppliers, which has stored the XRP token worth tied to real-world flows as a substitute of short-term hype.

That’s the reason questions like is XRP a very good funding in the present day maintain resurfacing. The token worth of XRP doesn’t transfer in isolation; it strikes on expectations of integration.

On the charts, what’s XRP’s worth in the present day usually displays bursts of optimism adopted by consolidation. CoinGecko information exhibits XRP sustaining larger baseline volumes than many large-cap friends, even outdoors rally intervals. Worth of XRP is buying and selling at round $1.60 as of February 3, 2026, 05:01 (UTC +0).

As for XRP worth prediction in 2026, expectations hinge on one factor: continued adoption in cross-border settlement. If XRP retains taking share from legacy methods like SWIFT, worth stability might matter greater than dramatic spikes.

One narrative, 3 indicators

So what ties BTC, XLM, and XRP collectively?

Cross-border funds usually are not about one chain profitable all the things. They’re about layers and construction. The present BTC worth tells you ways a lot belief the market has within the system. The XLM worth exhibits whether or not the rails are getting used. The XRP worth displays how shut establishments are to going all in.

Based on information from our analysis, belongings tied to fee infrastructure confirmed a better chance of holding good points throughout market pullbacks in comparison with purely speculative tokens.

That’s the shift in 2026. Markets usually are not chasing pace alone. They’re pricing reliability.

So if you wish to perceive the place international funds are headed, you do not want a crystal ball. It is advisable to watch these 3 indicators and perceive why they transfer the best way they do.

This text is for informational functions solely and doesn’t represent monetary recommendation. At all times do your personal analysis (DYOR) earlier than making any selections.

The right way to purchase crypto on Toobit

Toobit is a fast-growing crypto change, constructed to make your buying and selling journey tremendous clean. It is safe and straightforward to make use of, whether or not you are new or skilled. Plus, you should purchase crypto, supplying you with immediate entry to tons of digital belongings.

First, you will must fund your Toobit Account, which begins by creating your account on Toobit. Registration is a 2-minute course of and might be performed with both e mail and even your Telegram account.

Navigate to the “Purchase Crypto” part. From there, you may choose the specified crypto and select a fee methodology. Toobit affords varied choices, together with bank card purchases by means of partnerships with third-party suppliers like Simplex and Advcash.

The platform will information you thru the remaining steps, which can contain getting into fee particulars, confirming the transaction, and probably finishing further verification steps.

As soon as the transaction is accomplished, return to Toobit and verify your “Spot Account” to view the newly credited belongings.

Congratulations, you now know easy methods to buy crypto on Toobit!

About Toobit

To remain up to date on the most recent crypto information and happenings, be certain to comply with Toobit. Toobit is a number one platform for crypto buying and selling, providing a seamless expertise for each novices and skilled merchants.

With a powerful deal with futures buying and selling and derivatives buying and selling, Toobit permits customers to maximise their potential income by means of leverage buying and selling.

Merchants can discover a variety of asset staking benefit of superior instruments and threat administration options. With dwell coin updates, the place you will get the most recent information on SHIB price, PEPE price, and even ETH price, Toobit does all of it!

Create an account with Toobit in the present day and learn how we provide A Bit Extra Than Crypto.