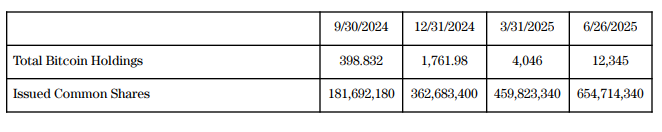

Metaplanet Inc., well known as Japan’s main Bitcoin treasury firm, has announced right now the acquisition of a further 1,234 Bitcoin, bringing its whole holdings to 12,345 BTC. The acquisition was valued at ¥19.27 billion at a median value of ¥15.6 million per Bitcoin.

This acquisition is a part of the corporate’s newly launched “555 Million Plan,” a method focusing on the buildup of 210,000 BTC by the tip of 2027, equal to 1% of Bitcoin’s whole provide. The initiative replaces the sooner “21 Million Plan,” which had aimed for 21,000 BTC by 2026.

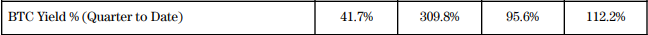

BTC Yield, the corporate’s proprietary key efficiency indicator (KPI) monitoring Bitcoin per totally diluted share, has continued to rise. It jumped from 41.7% in Q3 2024 to 112.2% quarter-to-date. This enhance displays a BTC Achieve of 4,538 and a corresponding hypothetical BTC ¥ Achieve of ¥71.2 billion, highlighting the effectiveness of the corporate’s capital allocation technique.

Capital markets exercise has performed a central position in funding these purchases. Since January 2025, Metaplanet has executed a sequence of zero-coupon, non-interest-bearing bond issuances, elevating greater than ¥90 billion and USD 121 million. All issuances have been redeemed early, utilizing proceeds from inventory acquisition rights exercised underneath the now totally accomplished “210 Million Plan.”

“On June 25, 2025, the Firm accomplished the early redemption and full compensation of the sixteenth, seventeenth, and 18th Sequence of zero-coupon, non-interest-bearing Peculiar Bonds issued to EVO FUND,” the corporate acknowledged within the press launch.

As of June 26, 2025, Metaplanet has expanded its issued frequent shares to over 654.7 million. This rising share base displays the corporate’s technique of utilizing fairness financing to transform capital instantly into Bitcoin, reinforcing its dedication to turning into a long-term institutional holder of Bitcoin.