TL;DR

- XLM holds agency at $0.35, organising for a possible triangle breakout to $0.50.

- MACD and RSI present weakening momentum, with bears nonetheless controlling the each day pattern.

- Open curiosity on XLM futures has decreased after a pointy spike final month.

XLM Holds Close to Key $0.35 Degree

Stellar (XLM) is buying and selling at $0.36 after falling 7% up to now 24 hours. During the last week, the asset has declined by 5%. The present value sits simply above a key help zone at $0.35, a degree that has beforehand proven sturdy shopping for curiosity.

In line with crypto analyst Ali Martinez, the current dip was not sudden. He stated,

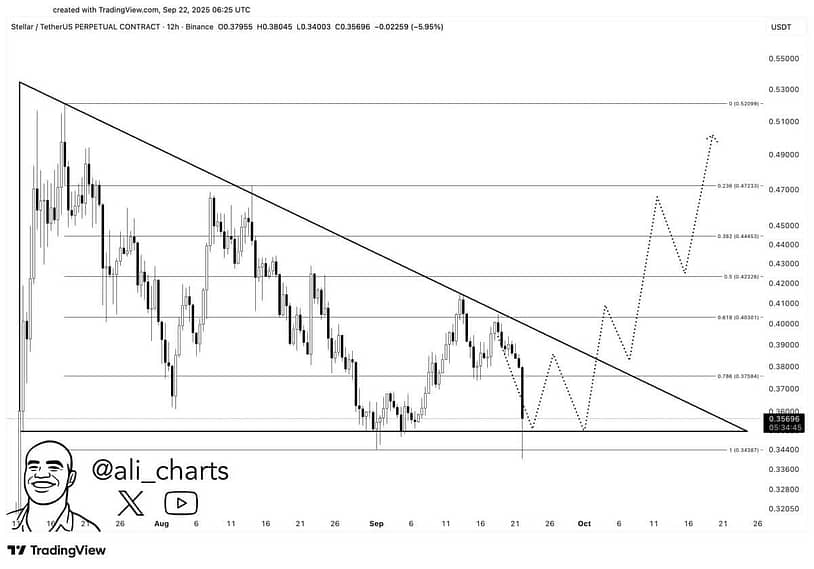

“Stellar $XLM dipped to $0.35 as anticipated. If this degree holds, consolidation towards the triangle’s apex might arrange a breakout to $0.50.”

The $0.35 space stays an vital zone for merchants waiting for a shift in pattern.

Notably, the 12-hour chart reveals a descending triangle formation, which has been growing over the past a number of weeks. XLM is now close to the decrease help boundary of this sample. The value has revered this vary earlier than, making the present degree a key level to look at.

If the help holds, the sample means that the worth might start to coil inside the triangle. This setup could result in a breakout above the descending trendline. Based mostly on Fibonacci retracement ranges, the following resistance areas are close to $0.4, $0.42, and $0.44.

If the breakout performs out absolutely, XLM might attain $0.50. A break under $0.35, nonetheless, could push the asset decrease to the $0.34–$0.33 vary.

Indicators Present Weak Momentum

On the each day chart, the MACD reveals bearish indicators. The MACD line is under the sign line, and each stay in adverse territory. The histogram bars are crimson and widening, which displays rising promoting strain.

The RSI is now at 39, under the mid-point of fifty. This studying confirms that present momentum favors sellers. Whereas not in oversold territory but, the RSI is approaching ranges the place consumers have stepped in earlier than.

Information from Coinglass reveals that XLM futures open curiosity surged in late October and early November, peaking above $500 million throughout a robust value transfer towards $0.60. Since then, open curiosity has declined together with value, returning to extra reasonable ranges.

In the meantime, the drop in open curiosity could mirror decreased exercise from leveraged positions. This kind of cooling off typically follows intervals of heightened hypothesis and could be a signal that merchants are ready for a clearer course.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome provide on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!