The worth of Ethereum continues to struggle within the month of April, because it barely holds above the $1,600 degree over this weekend. Regardless of its underwhelming efficiency, a number of buyers are nonetheless retaining a watch out for the second-largest cryptocurrency by market cap. As such, a preferred crypto dealer on the social media platform X postulated that it may be time to purchase the Ethereum token once more.

Has ETH Value Reached A Backside?

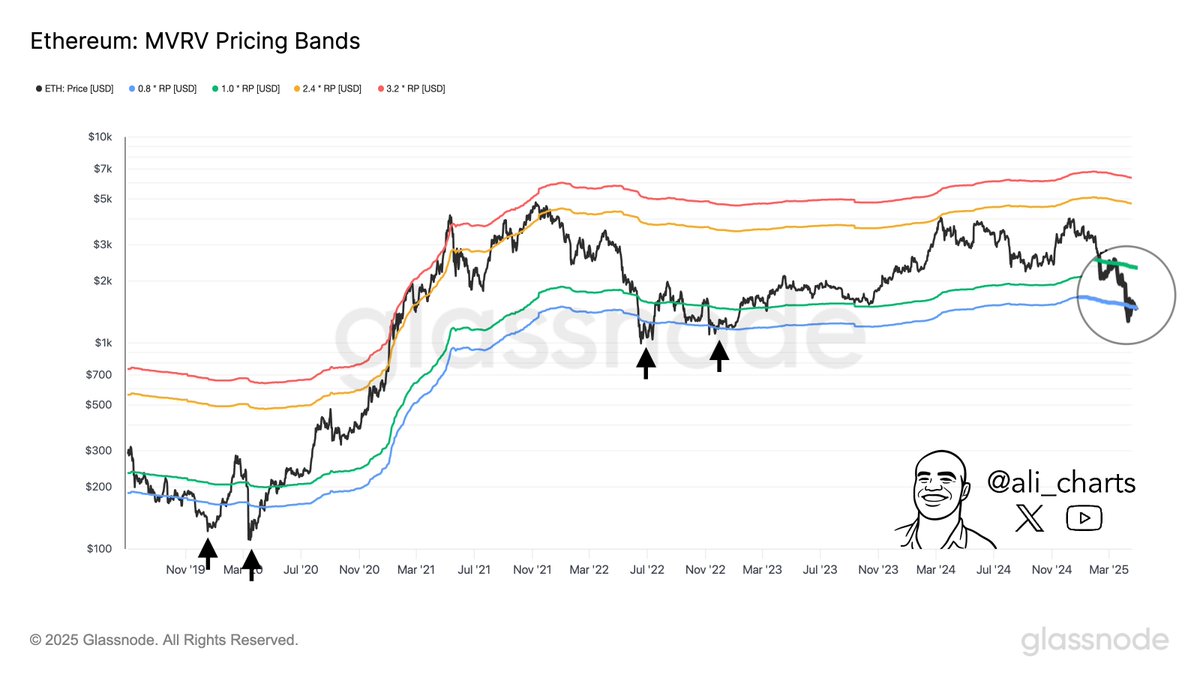

In an April 19 submit on X, distinguished crypto analyst Ali Martinez revealed that Ethereum has hit an important on-chain degree, which may very well be bullish for the worth. This on-chain remark revolves across the Market Worth to Realized Worth (MVRV) Pricing Bands, which are primarily based on a set of MVRV values that usually describe the extremes of the market cycles.

The MVRV (Market Worth to Realized Worth) ratio is an indicator that tracks the ratio between a coin’s market cap and its realized cap. When the worth of this ratio is bigger than 1, it implies that extra buyers are thought-about to be in revenue in the meanwhile.

Usually, the MVRV ratio presents perception into how the worth the buyers maintain (the market cap) measures in opposition to the worth they put in (the realized cap). In the meantime, the pricing bands assist to estimate the extremes of a coin’s market cycle, the place excessive ranges point out excessive unrealized revenue and low ranges sign excessive unrealized loss.

For context, a excessive MVRV worth is taken into account a value prime sign, as merchants are normally extra more likely to offload their belongings when they’re within the inexperienced. In the meantime, when the MVRV ratio is low, it implies that the market cycle has reached a backside.

Supply: @ali_charts on X

The blue pricing band represents extraordinarily low ranges, the place the MVRV has been below 0.8 for round 5% of buying and selling days. In the meantime, the purple pricing band marks extraordinarily excessive ranges, with the MVRV worth trending above the two.4 mark for round 6% of the buying and selling days.

As proven within the chart above, the worth of Ethereum has dropped beneath the blue pricing band previously few days. Traditionally, every time the worth of ETH falls to this extraordinarily low degree, it signifies that the altcoin has bottomed out and may be gearing up for a development reversal.

Ethereum Value At A Look

As of this writing, the worth of ETH sits simply above $1,610, reflecting 1.4% improve previously 24 hours. In line with information from CoinGecko, the altcoin is down by 2% previously seven days.

The worth of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.