Ethereum continues to wrestle to reclaim the $2,000 stage as persistent promoting stress and elevated volatility weigh on market sentiment. Repeated makes an attempt to push greater have met resistance, reflecting cautious positioning amongst merchants and broader uncertainty throughout the crypto market. Whereas fluctuations round key psychological ranges are widespread throughout corrective phases, the present atmosphere suggests ongoing fragility, with liquidity situations and derivatives positioning taking part in a rising function in short-term value dynamics.

Associated Studying

Including to the stress, latest on-chain information from Arkham signifies {that a} main market participant — generally known as the Hyperunit whale — has reportedly bought roughly half a billion {dollars} value of ETH. Massive transactions of this magnitude have a tendency to draw important market consideration, as they will affect liquidity situations, sentiment, and short-term volatility, even when indirectly triggering sustained value declines.

Such actions don’t mechanically sign a broader market reversal, however they typically mirror strategic repositioning by massive holders amid unsure situations. Traditionally, comparable episodes have coincided with transitional phases, the place markets reassess path following intervals of robust tendencies.

Hyperunit Whale Rotation Provides Context To Ethereum Market Strain

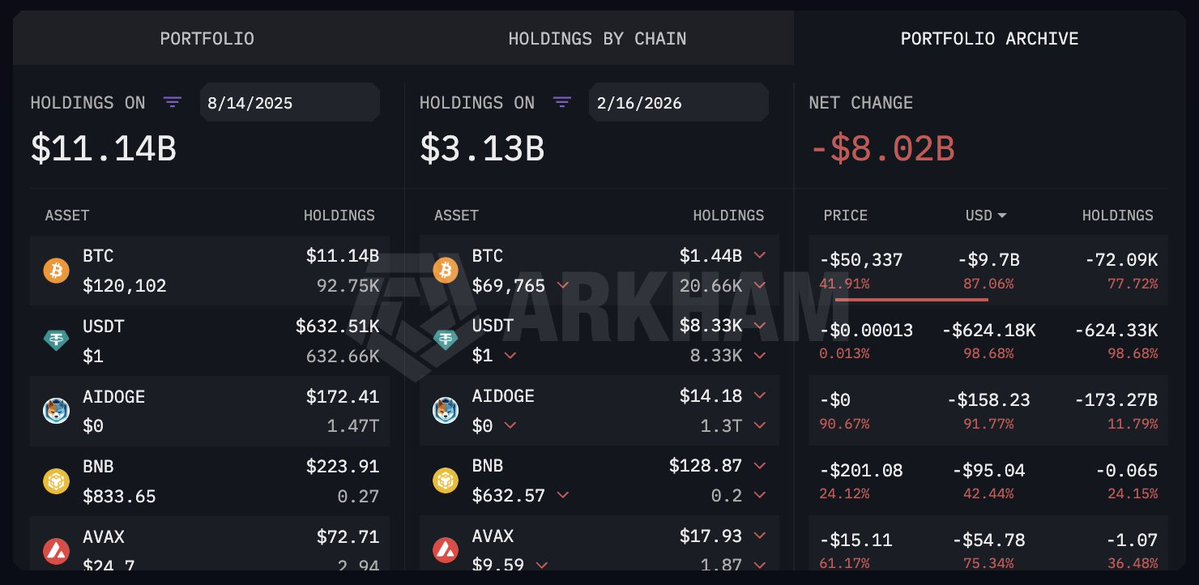

Further data from Arkham gives additional context on the massive ETH transaction just lately noticed on-chain. The entity sometimes called the “Hyperunit whale” is believed to be a significant Bitcoin holder, seemingly of Chinese language origin, whose wallets collected greater than 100,000 BTC throughout early 2018, when these holdings have been valued close to $650 million. For a number of years, the technique appeared easy: accumulate Bitcoin and keep a long-term holding place, with over 90% of these cash reportedly untouched for roughly seven years.

On the peak of its on-chain publicity, Arkham estimates the whale managed roughly $11.14 billion value of BTC. Nonetheless, in August 2025, round 39,738 BTC — valued close to $4.49 billion on the time — have been reportedly transferred in a transfer interpreted as a rotation into Ethereum. Subsequent accumulation introduced complete ETH holdings to roughly 886,000 cash, valued at over $4 billion throughout that interval.

Since that shift, efficiency seems to have weakened. Estimates counsel roughly $3.7 billion in losses tied to leveraged ETH publicity and mixed BTC/ETH spot holdings, alongside roughly $1.2 billion in unrealized losses on staked ETH. In combination, Arkham information point out a drawdown approaching $5 billion from peak portfolio ranges.

Associated Studying

Ethereum Worth Holds As Downtrend Strain Persists

Ethereum value motion continues to mirror sustained weak spot, with the chart displaying a transparent sequence of decrease highs because the late-2025 peak above the $4,000 area. The latest decline towards the $2,000 psychological stage highlights persistent promoting stress, whereas the lack to generate a robust rebound suggests patrons stay cautious regardless of oversold situations.

Technically, ETH is buying and selling beneath its key shifting averages, which at the moment are trending downward — a configuration sometimes related to bearish momentum slightly than a brief correction. The breakdown beneath the mid-range consolidation seen late final 12 months accelerated draw back volatility, accompanied by a noticeable spike in buying and selling quantity. Such quantity expansions typically sign capitulation or compelled deleveraging, slightly than routine profit-taking.

Associated Studying

The present stabilization across the $1,900–$2,000 zone could characterize an early try and kind a short-term base, however affirmation would require sustained closes above close by resistance ranges, notably the $2,200–$2,400 vary, the place prior help has become resistance. Till that happens, upside makes an attempt threat being corrective bounces inside a broader downtrend.

From a structural perspective, sustaining the $2,000 space is essential for sentiment, whereas a decisive break decrease may open the door to deeper retracement towards historic help zones.

Featured picture from ChatGPT, chart from TradingView.com