Since 2019, Trezor—the primary open-source {hardware} pockets pioneering the idea of safe self-custody in crypto—has supplied its customers a seamless crypto swap expertise by integrating Changelly’s alternate API. This long-standing partnership has not solely stood agency by way of cycles of market volatility but additionally delivered sustained efficiency development, elevated person engagement, and deepened belief in self-custody.

Throughout 5+ years of collaboration:

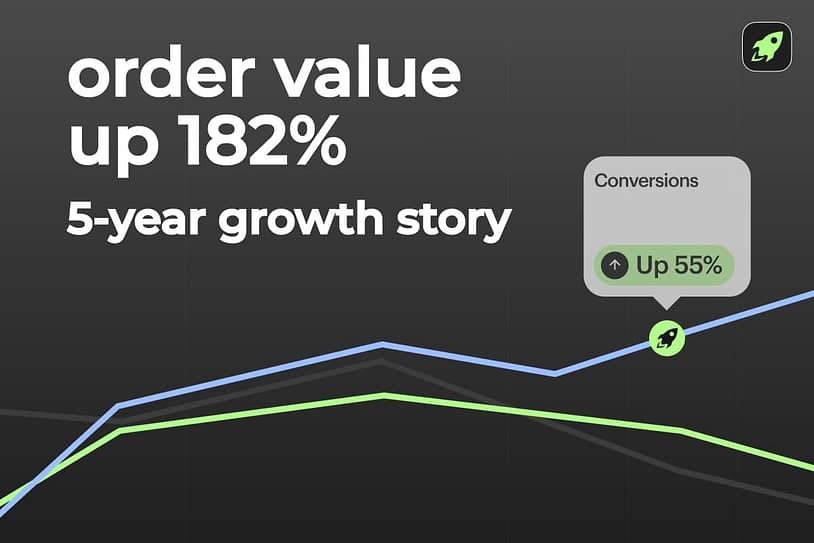

- Common Order Worth (AOV) elevated by 182%

- Conversion fee rose by 55%

- Changelly’s share of all swap quantity inside Trezor Pockets greater than doubled, as much as 48% in 2025 throughout 4+ companions

- Month-to-month swap exercise grew by 87.5% from Oct 2023 to Nov 2024

- Transaction funnel effectivity improved by 29% in simply 4 months

This collaboration demonstrates the long-term worth of strategic partnerships within the crypto {industry}. The alliance between Trezor and Changelly goes past technical integration—it has helped reshape how customers work together with their belongings in {hardware} wallets. By enabling safe, in-wallet swaps, the partnership eliminated the necessity to transfer funds to exterior platforms, setting a brand new person expertise customary. At this time, seamless swapping inside wallets is not a bonus characteristic—it’s a baseline expectation for crypto customers who prioritize comfort and management.

This case research was first printed in Finance Magnates’ report on Trezor and Changelly’s long-term API partnership, showcasing the expansion achieved from 2019 to 2025.

AOV Progress: +182% from 2020 to 2024

Over time, Trezor customers have more and more positioned higher-value swap orders. The 182% development in Common Order Worth (AOV) is an indication of maturing belief within the built-in swap performance and customers’ rising confidence in transacting bigger volumes immediately inside their {hardware} pockets interface.

This shift illustrates the core worth of embedding a dependable, long-term resolution: customers keep engaged, and their transaction conduct evolves in parallel with product familiarity.

Conversion Price: +55% from 2019 to 2023

The swap stream inside Trezor has grow to be considerably extra environment friendly. A 55% enhance in conversion fee because the starting of the partnership alerts an enchancment in each infrastructure and person belief.

Larger conversion means fewer drop-offs, better intent to transact, and a smoother decision-making course of for customers working in a safe, self-custodial surroundings. It additionally proves that constant UX and fee optimization pays off over time—one thing solely a long-term associate can ship.

Changelly’s Share Inside Trezor: From 22% to 48%

Between 2022 and 2025, Changelly’s share of all swaps initiated contained in the Trezor pockets greater than doubled, rising from 22% to 48%. Over the course of the partnership, Changelly has powered 33% of all swap quantity inside Trezor.

This development isn’t nearly visibility—it’s about satisfaction. Nothing displays service high quality higher than person retention and an rising share. As Trezor customers proceed selecting Changelly for his or her swaps, it’s a transparent sign of how properly the service performs. Backed by 10 years of market expertise, Changelly constantly delivers the reliability and effectivity customers anticipate from an in-wallet alternate.

Swap Exercise: +87.5% YoY in October 2024

In only one 12 months, the full variety of swap orders positioned by Trezor customers jumped by 87.5%. This development got here throughout a interval of industry-wide recalibration the place person engagement was tougher to keep up.

The uptick displays greater than market dynamics. It factors to person retention, elevated consolation with in-wallet swapping, and Trezor’s means to activate customers even in quieter market phases. This proves that when the expertise works—and belief is sustained—customers come again constantly.

Funnel Completion Price: +29% in 4 Months

Between November 2024 and March 2025, the speed of confirmed swap transactions rose by 29%, even because the market entered one other high-demand interval.

“A few of our strongest development occurred in bear markets—not due to hype, however as a result of customers trusted the stream. Belief compounds quietly, and over time, this partnership turned quiet reliability into lasting efficiency.”

—Zifa Mae, Head of Product at Changelly

Intervals of rising exercise—usually pushed by market hype—can stress infrastructure, decelerate responses, and scale back transaction success. However throughout this spike, the Changelly x Trezor swap stream carried out higher than ever. In as we speak’s market, it’s not sufficient to draw swap intent—customers anticipate clean, end-to-end execution.

That is the results of a secure backend, refined pricing logic, and a constant person expertise developed over time. A dependable stream isn’t constructed for durations of calm—it’s examined when volumes surge. This 29% enhance proves that when demand rises, long-term integrations constructed on belief can ship with out compromise.

Strategic Partnerships Create Strategic Outcomes

Greater than 5 years of collaboration between Trezor and Changelly have demonstrated one important reality: dependable partnerships between {industry} leaders don’t simply survive crypto’s ups and downs—they drive sustainable development by way of them.

“We worth our collaboration with Changelly and admire the chance to convey extra flexibility and utility to our customers. This partnership has proven tangible outcomes over time and continues to help our shared objective of constructing crypto safer, accessible, and sensible—with out compromising on the rules of self-custody and person management.”

—Matěj Žák, CEO at Trezor

Every year, Trezor customers have transacted extra, transformed extra effectively, and relied more and more on Changelly-powered swaps. And every metric exhibits that as the combination matured, so did customers’ belief and transaction conduct.

This case proves that when a pockets supplier chooses the appropriate long-term alternate associate, the result’s greater than uptime or API help. It’s about fostering loyalty, constructing belief, and supporting real-world use instances that stand the check of market cycles.

8 key areas to assessment your WEB3 advertising!

Get the must-have guidelines now!

Key Outcomes & Future Plans

The partnership between Trezor and Changelly stands as a benchmark for embedded fintech collaboration, proving that long-term alignment creates extra worth than short-lived promotions. With almost half of all in-wallet swap quantity now powered by Changelly and all core metrics on an upward trajectory, this integration has grow to be a foundational element of the Trezor person expertise.

Wanting forward, each corporations are positioned to strengthen this partnership additional—increasing swap entry to new belongings and refining the stream to satisfy evolving person wants. Greater than 5 years in, this collaboration continues to reveal how belief, shared values, and consistency can drive long-term success in a fast-moving {industry}.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native rules earlier than committing to an funding.