Bitcoin artwork and Bitcoin firms don’t appear to combine. However for many years — certainly centuries — firms have collected artwork to precise their position in society. As early because the fifteenth century, the Banca Monte dei Paschi di Siena (1472) established one of many first company artwork collections. What started merely as ornamental embellishment shortly developed into a standing image and an indication of wealth, success and cultural accountability. Can Bitcoin-native firms acquire strategic benefits via digital artwork? And what position does Bitcoin artwork play as a brand new asset class and cultural anchor?

Why Do Corporations Accumulate Artwork?

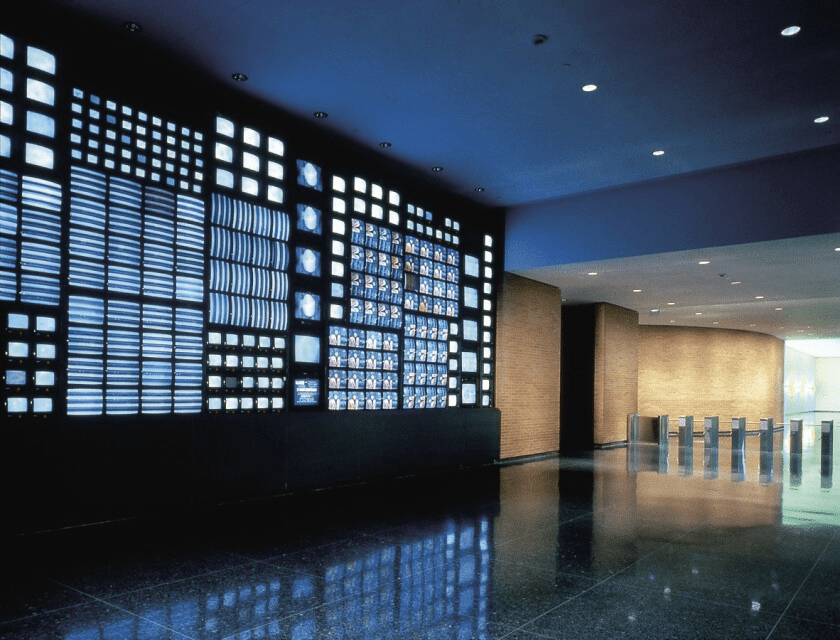

Work, sculptures and installations now cling in company headquarters worldwide, not simply to beautify partitions however as statements: Artwork indicators cultural capital and underscores a agency’s id and values. With the rise of the digital economic system, particularly Bitcoin, the query arises how this custom can proceed within the twenty first century.

Company artwork collections are actually a hard and fast a part of company tradition. By the mid-2010s there have been already greater than 2,000 main company collections in North America and past, collectively value billions. The motivations are various: Surprisingly, quick financial gain isn’t the primary driver; the tax deduction isn’t what’s motivating companies. Reasonably, artwork engagement helps companies advance strategic targets, attain new consumer teams, strengthen worker loyalty and enrich the standard of life across the firm. In different phrases, artwork in enterprise creates cultural capital — the worth that French sociologist Pierre Bourdieu outlined because the sum of cultural information and status.

Corporations that accumulate artwork subsequently pursue picture constructing and cultural promotion concurrently. Traditionally, a transparent sample emerges: Within the affluent Nineteen Fifties, many U.S. firms started amassing artwork to make cultural statements on their newly constructed campuses and to assist the neighborhood. The motion peaked within the Nineteen Eighties, then cooled when different types of company philanthropy (schooling, social causes) got here to the fore. But firms that stored shopping for artwork did so beneath stricter standards and with a transparent function.

Strategic Leveraging of Artwork: Cultural Capital and Model Identification

Company artwork collections fulfill a number of roles without delay. Internally, they create inspiring environments that foster creativity and identification; externally, they function reputational instruments: Artwork indicators schooling, stability and neighborhood spirit, and artwork collections have lengthy since turn out to be a part of model id.

The most effective examples present that the objective isn’t ostentation however social worth: Deutsche Financial institution, as an illustration, based its assortment in 1980 expressly to assist rising German artists. At the moment, it holds tens of hundreds of works of worldwide artwork and even operates its personal museum in Berlin (the PalaisPopulaire) to stage public exhibitions. Right here, artwork builds bridges between the corporate and society. JPMorgan Chase has pursued the same idea for many years: Its “Artwork at Work” program, initiated in 1959 by David Rockefeller, targeted intentionally on rising and missed artists worldwide — an uncommon strategy however one that really fosters artwork. Such collections are proactively constructed and make artwork central to company DNA moderately than utilizing it merely as ornament.

A strategically managed assortment turns into a lever for cultural capital. By selecting artwork (together with Bitcoin artwork) that matches the corporate’s philosophy, a agency can subtly talk its values: innovation, internationality or reverence for custom. UBS started constructing its company assortment within the early Seventies as a part of a dedication to cultural engagement, focusing from the outset on each established and rising artists from throughout the globe. The UBS assortment, for instance, displays the financial institution’s international attain by buying artwork from each area the place it operates, together with new markets resembling Thailand or Korea. Guided by unbiased curators and a global advisory board, UBS has created a group that represents the variety of its communities whereas spotlighting younger, rising artists.

Economists see such investments as akin to different intangible belongings: They increase model worth via cultural legitimacy and recognition. Corporations are the brand new patrons: Financial institution collections, as an illustration, have gone past their authentic advertising and marketing perform and now act as “new Medici”-patrons, on par with Renaissance households who as soon as supported the humanities. Particularly as public cultural budgets shrink, this personal patronage is extra essential than ever. Correctly managed, company collections thus serve not solely the agency however society at massive, filling gaps left by underfunded public museums. They’re, appropriately used, a cultural asset for the general public.

Change within the Final Ten Years: From Up to date Artwork to Bitcoin Artwork

Just lately, company collections have developed primarily in content material. Up to date works — portray, sculpture, images — nonetheless dominate, however digital artwork varieties are more and more gaining floor. Digital artwork has existed for the reason that Sixties (from early computer-plotter drawings to video artwork), and collections like JPMorgan’s built-in video and media artwork many years in the past. Within the 2010s, nevertheless, blockchain know-how sparked a revolution: NFTs (non-fungible tokens) made it doable to connect proof of possession to digital artworks and commerce them. Progressive firms, particularly in tech, started to incorporate digital works of their collections and even construct their very own NFT portfolios to underscore an revolutionary picture.

The event, nevertheless, was not linear. The NFT growth of 2021 — fueled by spectacular auctions resembling Beeple’s “Everydays” for USD 69 million — led to exuberance; many collectors, together with firms, purchased digital artwork at peak hype. Disillusion quickly adopted: Since its 2021 peak, the NFT artwork market has collapsed by over 90 %, from USD 2.9 billion annual turnover in 2021 to roughly USD 24 million within the first quarter of 2025. This drastic correction is mirrored within the warning of established collectors. In line with an Art Basel/UBS survey, the share of digital artwork in high-net-worth collections fell in parallel. In brief, after the hype got here the fact test, and firms that jumped too shortly onto the NFT bandwagon hit the brakes because the speculative bubbles burst.

This needs to be seen not as an finish, however as maturation. What stays is a core of significant actors and establishments that imagine within the long-term potential of digital artwork and now accumulate extra selectively. For company collections, this implies digital artwork can now be built-in with higher prudence — not as a short-term PR stunt however as a substantive addition. Corporations ought to give attention to digital artwork of clear creative high quality and historic context moderately than chasing each fashionable NFT. New presentation codecs, resembling firm galleries or on-line platforms, are being examined. The previous decade has thus seen artwork and tech converge, with company collections step by step studying to view digital artwork as a part of their ideas.

Digital Artwork From a Bitcoin Perspective: Standing Quo and Future in Collections

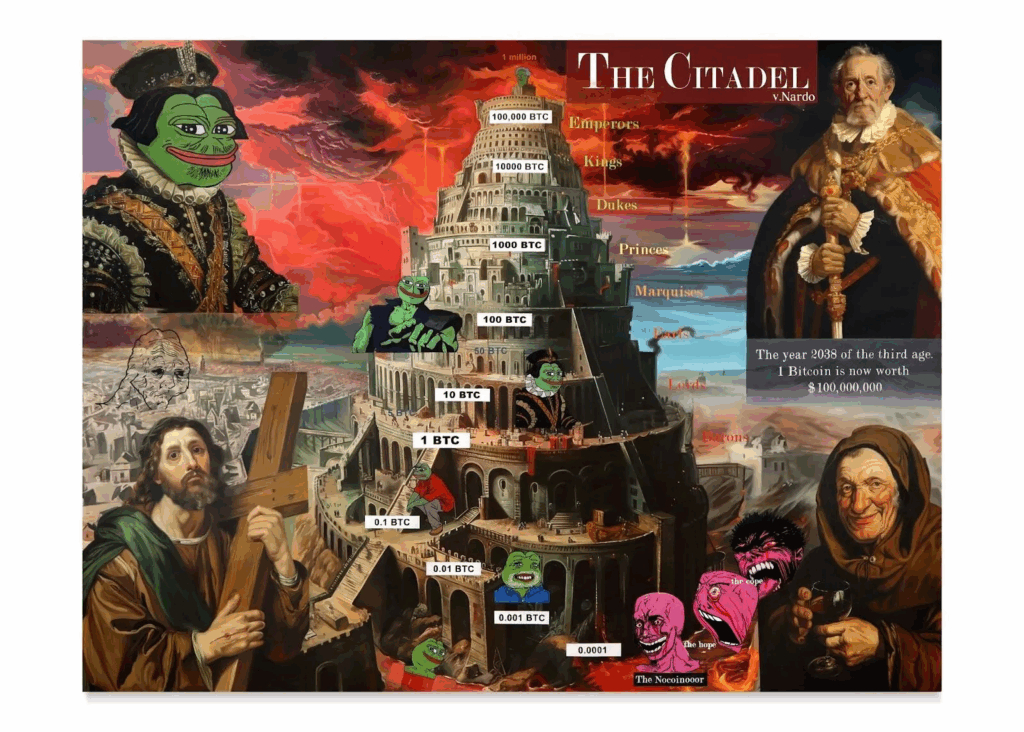

Inside Bitcoin, digital artwork opens a particular chapter. For years, the NFT market performed out primarily on Ethereum and different smart-contract platforms, whereas Bitcoin — conceived mainly as a financial system — was culturally represented extra by bodily objects (Casascius cash, sculptures or work with Bitcoin themes) and meme tradition (e.g., Pepe). But Bitcoin-centric artwork tasks truly predate the NFT hype: Experimental works started showing on the Bitcoin-fork Namecoin as early as 2012, and the Colored Coins initiative in 2013 supplied one other approach to encode and switch digital belongings on-chain. The launch of the Counterparty protocol (2014) accelerated issues, with the primary Counterparty-minted artworks rising; most well-known are the Uncommon Pepe buying and selling playing cards (2016), now considered pioneers of crypto-art. Native experiments instantly on Bitcoin Layer 1 additionally surfaced round 2015, however Bitcoin solely captured broad public consideration as a medium for digital artwork after the 2023 Ordinals growth. For company collections, this indicators that Bitcoin-based digital artwork has deep historic roots, is clearly on the rise, and might hardly be ignored by anybody wishing to remain present.

From a Bitcoin-only perspective, digital artwork is seen not merely as an asset however as a cultural expression of the ecosystem. Typically described as a socioeconomic motion, Bitcoin carries its personal aesthetics and beliefs (decentralization, censorship resistance, HODL mentality, and so on.). These values are mirrored in artworks — from blockchain information visualisations to portraits of Satoshi Nakamoto to meme-infused creations. Such Bitcoin-native works may turn out to be iconic cultural items, similar to company artwork of earlier eras — suppose industrial work of the nineteenth century or propaganda artwork of the early fashionable age that accompanied financial upheavals. For present collections this implies adopting Bitcoin artwork now is not only buying any digital artwork however a chunk of monetary and tech historical past. The 2020s are writing the creative narrative of cryptocurrency firms. By amassing rising and historic Bitcoin artwork, they’ll turn out to be a part of that narrative and assist form it.

Why Bitcoin-Native Corporations Ought to Accumulate Artwork and Bitcoin Artwork

Given these developments, why ought to Bitcoin firms accumulate artwork now? The reply mixes status, id and accountability. A group can definitely burnish the picture of Bitcoin companies, exhibiting openness to tradition and decreasing perceptions that they’re mere tech or finance nerds. Extra essential is their energetic contribution to cultural formation inside the Bitcoin ecosystem. Bitcoin is greater than a protocol; it’s a social motion with its personal conferences, memes and a world neighborhood. Tradition is the glue that holds such actions collectively. If firms like Nakamoto, Technique or Metaplanet construct collections, they create id anchors for the Bitcoin neighborhood. A curated Bitcoin artwork assortment can visualise the motion’s values and tales — performing like a visible manifesto.

On the similar time, the businesses turn out to be protagonists of this tradition. Simply as main banks turned “new Medici” via their collections, Bitcoin companies may set up themselves as digital patrons who nurture and form an rising artwork scene. This goes past sponsorship: It means taking long-term accountability for cultural heritage. Within the competitors for prime expertise and prospects, that may be decisive. I imply, who wouldn’t want to work for or spend money on an organization that helps form tradition and historical past moderately than merely chase revenue? A well-communicated artwork initiative can spark loyalty and pleasure that no finances may purchase, each contained in the agency.

There may be additionally an financial community impact: A vibrant cultural setting round Bitcoin will increase all the ecosystem’s attraction. The extra artwork, music, literature and discourse exist about Bitcoin, the extra firmly it turns into anchored in society. That may not directly increase demand (folks encounter Bitcoin via artwork), foster innovation (artists experiment with the know-how) and enhance public acceptance (it isn’t simply “quantity go up” however a world cultural phenomenon), in the end elevating community worth. Corporations amassing and supporting artwork now spend money on Bitcoin’s future viability, yielding long-term industrial advantages. Technique, as the most important bitcoin treasury company, has an inherent curiosity in strengthening Bitcoin culturally in addition to financially to safeguard the longevity of its holdings. Artwork can turn out to be a soft-power instrument, creating narrative legitimacy for Bitcoin within the broader public.

Measures: Constructing Museums, Scholarships, Prizes and Archives

What concrete artwork initiatives may Bitcoin firms pursue? Historic precedents abound.

Some banks and firms have based their very own museums or artwork halls (Deutsche Financial institution’s PalaisPopulaire, Samsung’s Leeum Museum in Seoul). A Bitcoin firm may equally set up a Bitcoin Artwork Museum to exhibit excellent works: digital projections, interactive items, classical work or sculptures with Bitcoin themes. First initiatives already level on this route. The Bitcoin Museum in Nashville, for instance, is a noteworthy early try to inform the story of Bitcoin via a mixture of artefacts, memorabilia and artworks, to showcase the journey from Cypherpunk beginnings via the Mt. Gox period to the current. Such a museum serves as a cultural assembly level for the neighborhood and the general public.

My concept for firms builds on this: to assemble collections that transcend modern Bitcoin artists, tracing the mental historical past of Bitcoin in artwork for the reason that 1910s. Professionally managed, these collections can be rooted in historic context, adaptable for thematic exhibitions and accessible for loans to strengthen each the educational recognition and the cultural presence of Bitcoin-related artwork.

Scholarships and prizes are highly effective levers. A agency may supply an annual “Bitcoin Artwork Scholarship” to assist proficient younger artists participating with Bitcoin, or a prize for Bitcoin-based digital artwork (e.g., for essentially the most revolutionary Ordinals mission of the 12 months). Such awards would create on the spot resonance within the artwork and crypto scenes, granting recipients higher visibility — consider the Arab Financial institution Switzerland Digital Artwork Prize.

Like main collections of the previous that intentionally purchased works from then unknown artists, Bitcoin firms ought to now search tomorrow’s hidden champions moderately than merely chasing quantity with out cultural worth. Supporting the avant-garde of Bitcoin artwork right this moment may later show each culturally and financially rewarding: Analysts have remarked that blockchain-based digital artwork may turn out to be the following trillion-dollar asset class, interesting to international collectors and new investor teams.

A continuously missed however important element is constructing archives and documentation constructions. Artwork is barely as worthwhile as its historical past is traceable — particularly within the digital realm. Corporations may subsequently spend money on archival infrastructure, for instance, a database of all identified Bitcoin-related artworks, with particulars on artists, descriptions, on-chain transaction histories and extra.

Skilled Assist: Artwork Historians, Curators and Museum Follow

Formidable and worthwhile as these plans are, firms want experience. Amassing artwork and particularly digital artwork, isn’t one thing to be dealt with casually by a number of economists or IT specialists. Bitcoin companies wishing to spend money on tradition ought to contain artworld professionals from the beginning. This has custom: the UBS assortment, as an illustration, has been managed by curatorial specialists for many years and suggested by a global board. These specialists know how you can construct a group with a coherent narrative, assess high quality and guarantee correct conservation and presentation.

Digital artwork brings extra challenges, from questions of digital stock to modes of show. Right here, tapping museum expertise pays off: An organization may collaborate with media-art specialists who’ve already curated digital exhibitions. Artwork historians can bridge “new Bitcoin artwork” and artwork historical past, inserting the gathering in context. Whether or not avant-garde artwork, protest artwork or digital artwork for the reason that Sixties, such perspective deepens understanding and helps establish artists more likely to stay related. Steady documentation and analysis additional improve cultural worth.

Moral and authorized recommendation is one other side. On this area, the place sources of wealth are scrutinized, transparency and accountable conduct are important. Artwork historians and curators guarantee collections aren’t staged merely as PR however stay credible and respectful towards the artwork neighborhood. Classical company collections often commit to purchasing artwork on the first market instantly from artists or galleries, thereby supporting dwelling artists as a substitute of chasing public sale trophies. This angle, away from fast flipping towards sustainable patronage, is advisable for Bitcoin firms. Hiring or consulting curators to design and look after the gathering mirrors finest apply in firms that systematically keep their collections.

Lastly, artwork and tradition as investments require long-term pondering. Classical artwork investments have traditionally yielded reasonable returns of about 6% per 12 months, and specialists advise shopping for artwork primarily from ardour, not for returns alone. The identical probably holds for Bitcoin artwork: Its intangible positive factors (social affect and cultural heritage) are paramount, although monetary appreciation could observe. Skilled recommendation helps stability creative and monetary worth. When each align, artwork collections turn out to be exactly the strategic asset that doesn’t seem as a quantity on the stability sheet but exerts huge impression inside and past the corporate.

Conclusion: A Vivid Future for the Arts

In an period the place the excellence between the digital and bodily worlds is turning into more and more blurred, company artwork collections are on the verge of getting into a brand new period. Bitcoin represents not solely an financial but in addition a cultural paradigm shift. Company artwork collections within the age of Bitcoin are greater than a continuation of an previous custom with new instruments; they’re a possibility to form an rising cultural cosmos. Traditionally, firms collected artwork to current their face to society, encourage workers and make their values tangible.

At the moment, Bitcoin firms can undertake these motives and infuse them with new life: By amassing digital artworks on-chain, they create cultural capital in a language that matches their enterprise DNA. They’ll leverage this capital strategically to generate community results. Every supported artist and every donated art work strengthens the narrative of Bitcoin as not merely know-how or funding however a cultural motion.

The subsequent steps for me are clear: artwork scholarships for rising Bitcoin artists; devoted exhibition areas on-line and offline; partnerships with museums and artwork academies; maybe even a company museum. Corporations ought to strategy the duty with humility and search skilled experience. Simply as a CFO is consulted for funding technique, a curator needs to be consulted for artwork technique. Outfitted on this means, Bitcoin-focused companies may turn out to be real cultural actors, incomes future recognition akin to right this moment’s collections of UBS, Deutsche Financial institution, or JPMorgan.

The younger Bitcoin artwork scene at the moment presents a historic alternative: Its tradition remains to be malleable, the “canvas” largely unpainted. Corporations that act now can write cultural historical past. They are going to personal not solely digital masterpieces but in addition contribute to the id of a decentralized future. Bitcoin is poised to open a brand new chapter; artwork offers the language to inform it. Company collections will help form the canon. That is strategic leveraging in its noblest sense: uniting capital and tradition to create one thing of lasting worth for the corporate, for the neighborhood and for the longer term.