Heightened volatility available in the market continues to maintain the price of Ethereum under the $2,000 mark, capping each try in direction of the upside. Through the persistent downward worth motion, a divergence has emerged amongst ETH traders, with massive holders promoting whereas smaller holders are shopping for.

Ethereum Whale Promoting Meets Retail Accumulation In Market Break up

Ethereum’s ongoing waning price action is taking its toll on traders, as evidenced by their present exercise and sentiment. Following the downward pattern, a notable divergence in traders’ habits is growing, inflicting massive and small holders to maneuver in separate instructions.

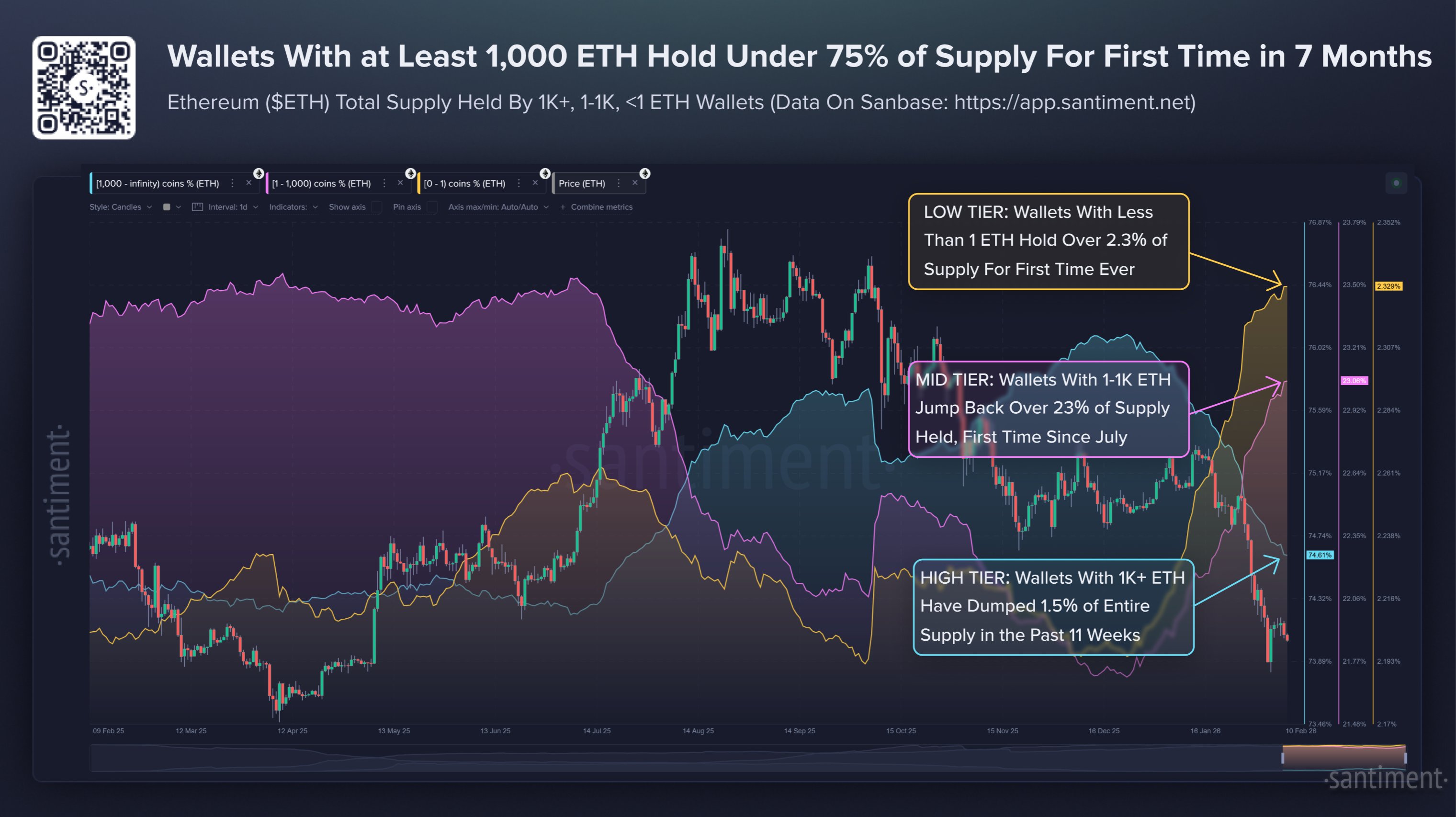

the report from Santiment, a number one market intelligence and on-chain information analytics platform, large investors are pushing toward the sell side, whereas small traders are leaning in direction of the purchase facet. At the same time as retail and grassroots traders enter the market to buy, this divergence raises the likelihood that main holders typically considered whales or institutional-grade contributors could also be locking in income or repositioning.

The present promoting exercise is noticed amongst pockets addresses holding no less than 1,000 ETH, which on this case are thought-about high-tier holders. In the meantime, buying activity is going down amongst pockets addresses holding lower than 1 ETH, flagged as low-tier traders.

Prior to now, these high-tier holders had been collectively holding greater than 75% of Ethereum’s whole provide. Nevertheless, after the dumping of about 1.5% of the provision since Christmas, their holdings are actually under the extent. Such redistribution phases have the potential to change the market construction by shifting supply from concentrated fingers to a wider base.

In response to information from Santiment, mid-tier traders (these holding between 1 and 1,000 ETH) have additionally been steadily shopping for the altcoin. This persistent shopping for has pushed their collective holdings again to over 23% of the whole provide for the primary time since July 2025.

For smaller holders and low-tier traders, ETH accumulation has been rising, bringing their collective stash to 2.3% of the general provide, marking the very best stage ever. Santiment highlighted that these pockets addresses are seemingly rising as a result of ETH staking.

Staking ETH Now Takes Extra Time

As Ethereum staking grows, the method is now taking extra time than ever. Milk Street shared on X that traders are anticipated to attend for 71 days and 11 hours to stake ETH. Lately, Ethereum staking reached 30% of the whole provide, locking up 36.8 million ETH valued at a whopping $72 billion.

The 4.1 million ETH queue means that demand to stake is at an all-time excessive whereas the altcoin’s worth sits under $2,000. In the meantime, the exit queue is actually nonexistent by comparability, with simply 75,872 ETH leaving. Such a pattern is a sign of conviction, not yield farming habits. When folks lock up $74B throughout a worth dip, it means they’re settling in, as a substitute of speculating. “Watch that queue, it’s a sentiment indicator,” Milk Street added.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.