Gold shone brightly as we speak, racing to a brand new excessive whereas crypto took the again seat, and the hole between the 2 belongings opened vast.

Associated Studying

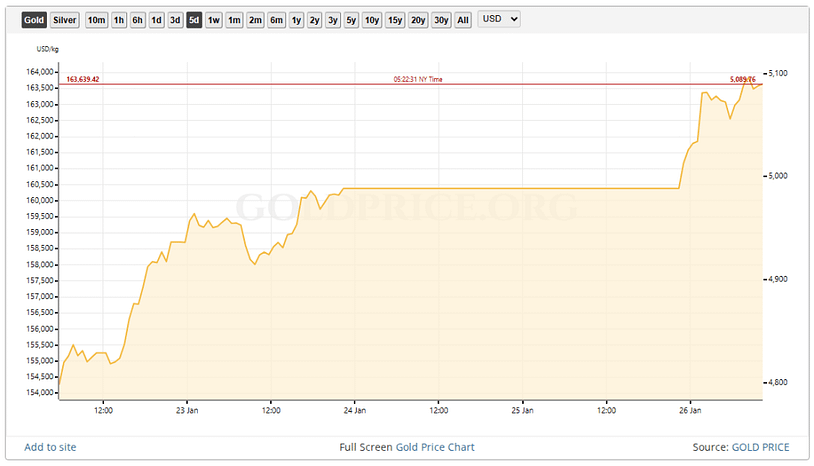

On Monday, the valuable steel moved past the $5,000 mark, registering a value level market sentinels had not witnessed earlier than. Bitcoin, against this, didn’t maintain tempo and traded effectively beneath its latest highs.

Gold Hits Report Ranges

Protected-haven demand pushed gold sharply larger. Costs have been up above $5k an oz and inked roughly $5,110 on the peak. Silver, for its half, didn’t go unnoticed, leaping to contemporary peaks close to $107/ounce.

Supply: Gold Price

Merchants pointed to simmering geopolitical friction and discuss of harder commerce strikes led by US President Donald Trump as gas for the rally.

A weaker dollar made metals extra enticing to prospects abroad, and central financial institution shopping for supplied regular backing. Liquidity in some corners have been skinny as buyers rushed to shift money into issues that really feel secure when danger elevates.

Bitcoin Falls Behind

Market numbers present Bitcoin hovering within the mid-$80,000s vary, retreating from peaks seen late final yr. Stories notice the alpha crypto is roughly 30% beneath the very best stage it hit reached in October 2025, leaving some holders fairly jittery.

Volatility was one other issue. The place bullion is being hunted for security, Bitcoin is considered extra as a progress or speculative play, and that distinction in investor utility turns into clear when markets tighten. Some funds slashed their crypto publicity, signaling a brief reroute away from high-risk gambits.

Why Traders Are Shifting

Analysts and merchants described a easy selection: shelter or swing for features. When headlines push fear, cash flows into belongings which might be broadly trusted throughout markets and governments.

Metals match that ticket. Primarily based on market chatter, fears of a US authorities funding conflict and contemporary tariff bulletins stacked stress on shares and added a way of urgency to safe-haven acquisition.

Choices and futures buying and selling hinted at a extra cautious perpective, with volatility indexes rising and bond yields behaving in ways in which made the yellow steel look extra interesting by comparability.

Associated Studying

What Merchants Are Watching

Market watchers stated eyes shall be glued on a number of key metrics: The greenback’s path, strikes by main central banks, and any signal that US politics escalates may maintain metals elevated.

For Bitcoin, community exercise, giant pockets flows, and regulatory headlines will possible set the tone. Some merchants count on swings each methods. Others warning that when danger urge for food is again, crypto might bounce laborious, however that end result just isn’t a positive factor and shall be depending on a string of coverage and macro strikes.

Featured picture from Unsplash, chart from TradingView