On-chain knowledge reveals the Ethereum community has seen a pointy uptick in weekly whale quantity, an indication that big-money curiosity is again within the asset.

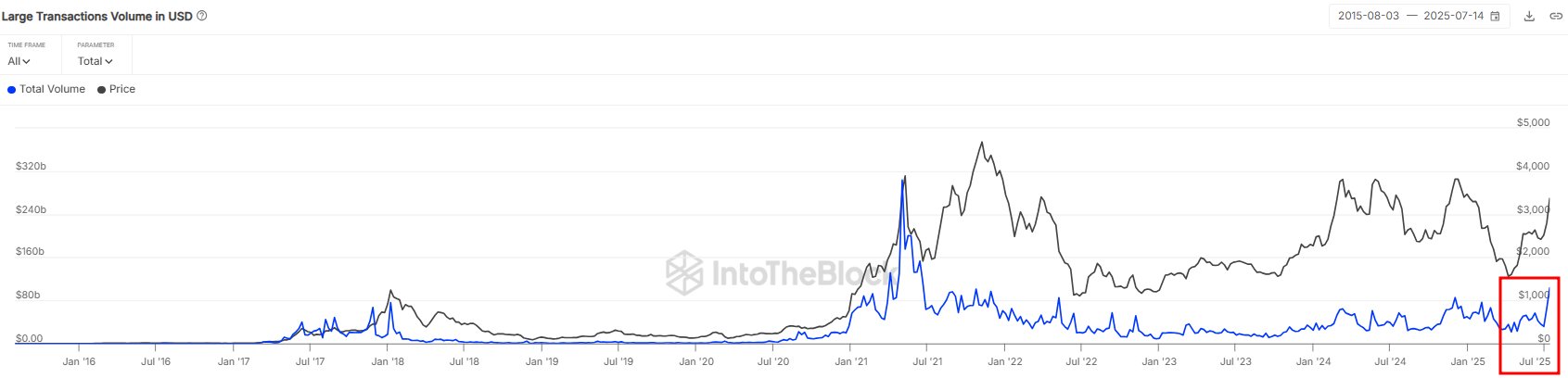

Ethereum Giant Transactions Quantity Has Hit Highest Since 2021

In a brand new post on X, institutional DeFi options supplier Sentora (previously IntoTheBlock) has talked in regards to the newest development within the Giant Transactions Quantity of Ethereum.

The “Large Transactions Volume” right here refers to an indicator that retains monitor of the full quantity of quantity that’s being moved on the ETH community by transactions valued at greater than $100,000.

Usually, solely the whale-sized traders are able to shifting quantities of this scale with a single switch, so the quantity related to these strikes may be assumed to be a illustration of the exercise being finished by big-money traders.

When the worth of the metric rises, it means the whales are rising their transaction exercise. Such a development generally is a signal that their curiosity within the asset goes up. Then again, the indicator happening implies the massive holders could also be dropping curiosity within the cryptocurrency.

Now, here’s a chart that reveals the development within the Ethereum Giant Transactions Quantity over the historical past of the coin:

The worth of the metric seems to have been rising in current days | Supply: Sentora on X

As displayed within the above graph, the Ethereum Giant Transactions Quantity has noticed some fast development not too long ago, suggesting the whales have considerably upped their transaction exercise.

Final week, the metric’s worth totaled to greater than $100 billion, which is the very best weekly degree because the 2021 bull run. This newest wave of exercise from the whales has come alongside ETH’s breakout that has now introduced its worth into the excessive $3,000 ranges.

Whereas that is actually an indication of elevated curiosity from the humongous entities, it’s exhausting to say whether or not it’s a optimistic. The Giant Transactions Quantity incorporates no details about the cut up between shopping for and promoting strikes, so its spike says nothing about which habits is extra dominant, simply that these holders are making some type of strikes.

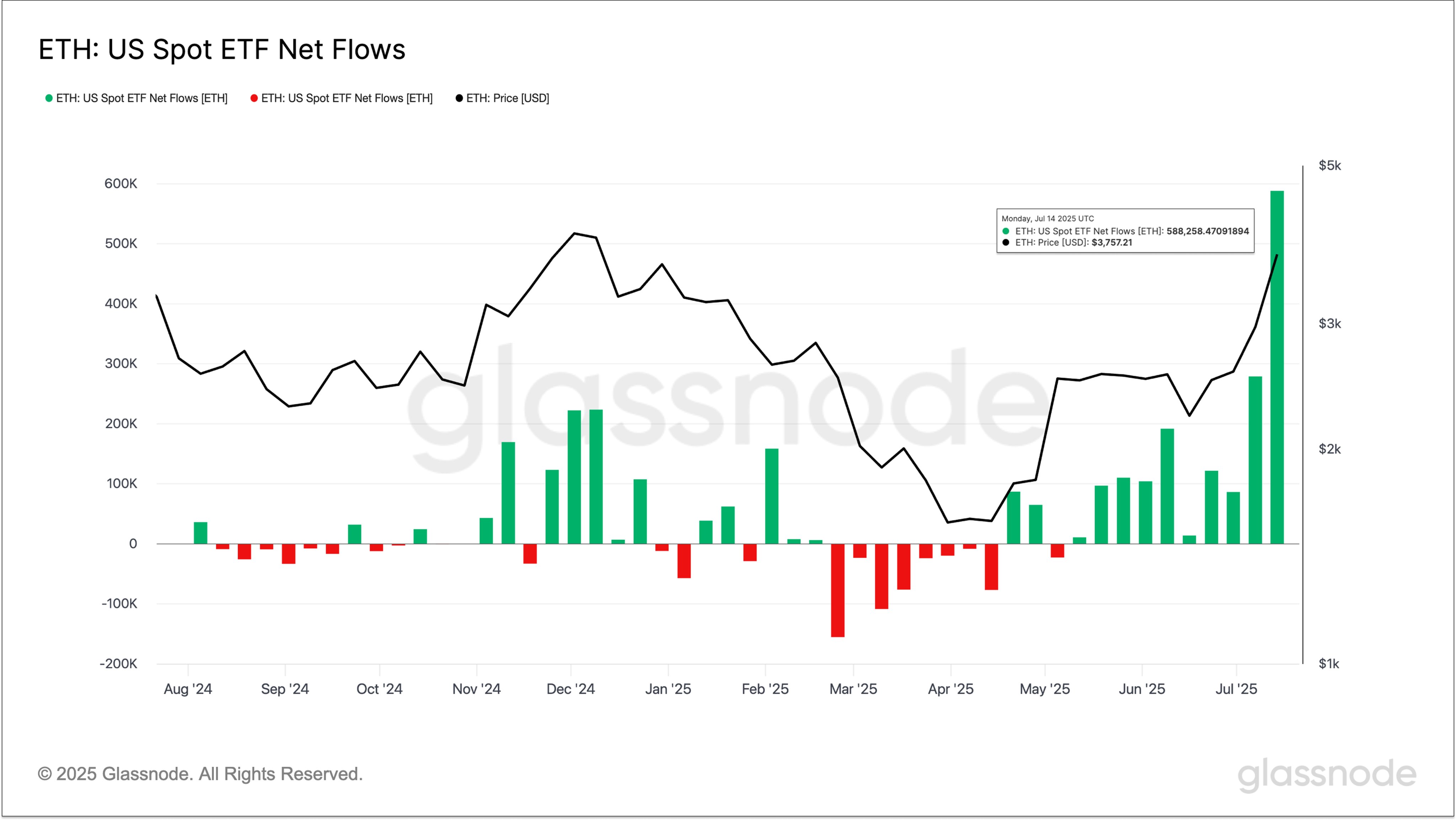

In another information, the US Ethereum spot exchange-traded funds (ETFs) have simply seen a record-breaking week, as analytics agency Glassnode has identified in an X post.

The development within the netflow related to the US ETH spot ETFs | Supply: Glassnode on X

From the chart, it’s seen that the Ethereum spot ETFs have been seeing inexperienced weeks for some time now, however the newest one stands out for the sheer scale of inflows witnessed throughout it.

“Final week, Ethereum spot ETFs noticed inflows of over 588K ETH – almost 17x the historic common and greater than double the earlier document,” notes Glassnode.

ETH Worth

On the time of writing, Ethereum is buying and selling round $3,730, up 2% over the past week.

Appears to be like like the value of the coin has been climbing up not too long ago | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.