Regardless of current fluctuations in the price of Ethereum, accumulation appears to be holding sturdy, which is noticed within the Spot Ethereum Alternate-Traded Funds (ETFs). With extra ETH leaving exchanges and ETFs stacking ETH, the main altcoin might be poised for a vital shift in market dynamics, which can be good for its value trajectory.

Good Cash Strikes Quietly Through Ethereum Spot ETFs

The broader cryptocurrency market is shifting in the direction of a bullish state as soon as once more, and the Ethereum institutional story is subtly transitioning into a brand new chapter. Whereas value motion stays comparatively subdued, on-chain and fund stream information present a powerful undercurrent as Spot Ethereum ETFs are steadily stacking.

According to Everstake.eth, the pinnacle of the Ethereum phase at Everstake, the ETH spot ETFs have been quietly growing, reaching unprecedented ranges. This silent accumulation raises the chance that main firms are positioning themselves nicely forward of the competitors, creating long-term publicity whereas retail consideration remains to be dispersed.

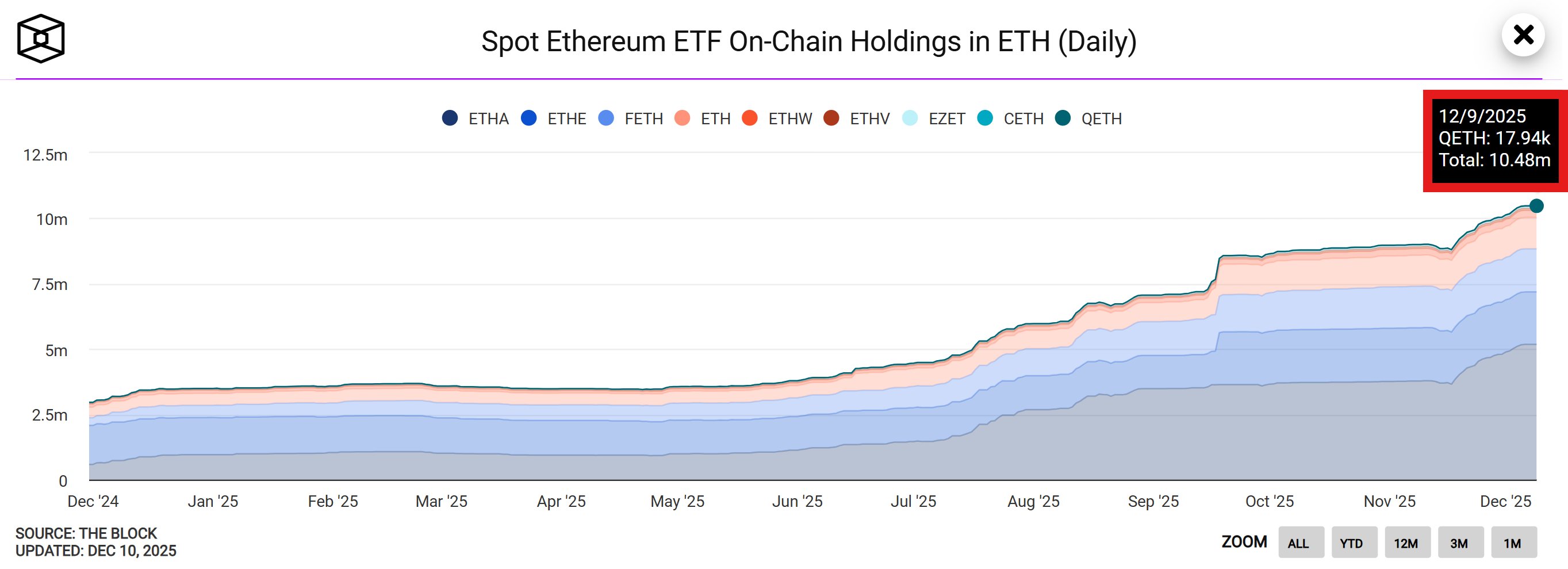

Knowledge shared by the professional reveals that spot Ethereum ETF on-chain holdings have now reached roughly 10.48 million ETH. Everstake added that this is among the strongest, most constant accumulation traits ever recorded because the launch of the funds a few 12 months in the past.

Given the substantial development of the funds, the professional has declared that “the longer term is bullish, and the longer term is Ethereum.” As ETF holdings rise to beforehand unheard-of ranges, the query now is just not whether or not sensible cash goes in, however reasonably what they anticipate.

The regular development is just not noticed amongst different metrics, just like the Funding Charges. Presently, the derivatives marketplace for ETH is beginning to cool, and funding charges are clearly reflecting this transformation. Nonetheless, this isn’t solely a nasty factor for the altcoin and its value trajectory.

As reported by Sina Estavi, the Chief Government Officer (CEO) of Bridge Capital, a declining ETH funding rate is just not merely an indication of a cool market. Relatively, it’s the construction that usually seems on the chart previous to a sustained transfer.

When funding resets within the absence of aggressive shorting, it often implies that leverage is just not overcrowded, the rally is just not overheated, and spot-driven demand can carry the value additional. Ought to ETH register even a modest development in demand, the market could have room to increase this bullish leg.

Institutional Demand For ETH Is Returning

Ethereum’s current sideways value actions don’t appear to have swayed institutions from acquiring the altcoin. Large companies akin to Bitmine Immersion, a number one treasury firm run by trade chief Tom Lee, are nonetheless scooping up ETH at a considerable price and scale.

The report from Arkham exhibits that as of Tuesday, Bitmine has purchased over 138,452 ETH valued at roughly $431.97 million since final week. Following the acquisition, the corporate’s crypto holdings now increase about $12.05 billion in ETH. Regardless of this huge holding of ETH, the agency nonetheless has $1 billion left to build up extra of the altcoin.

Featured picture from Freepik, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.