Ethereum is now dealing with a essential check because it trades inside a decent vary, sitting under the $1,850 resistance and above the $1,750 assist. After a robust restoration from the $1,400 degree earlier this month, bulls have managed to stabilize value motion, however the true problem is now unfolding. To substantiate a sustainable bullish construction, Ethereum should decisively reclaim the $2,000 degree within the coming days.

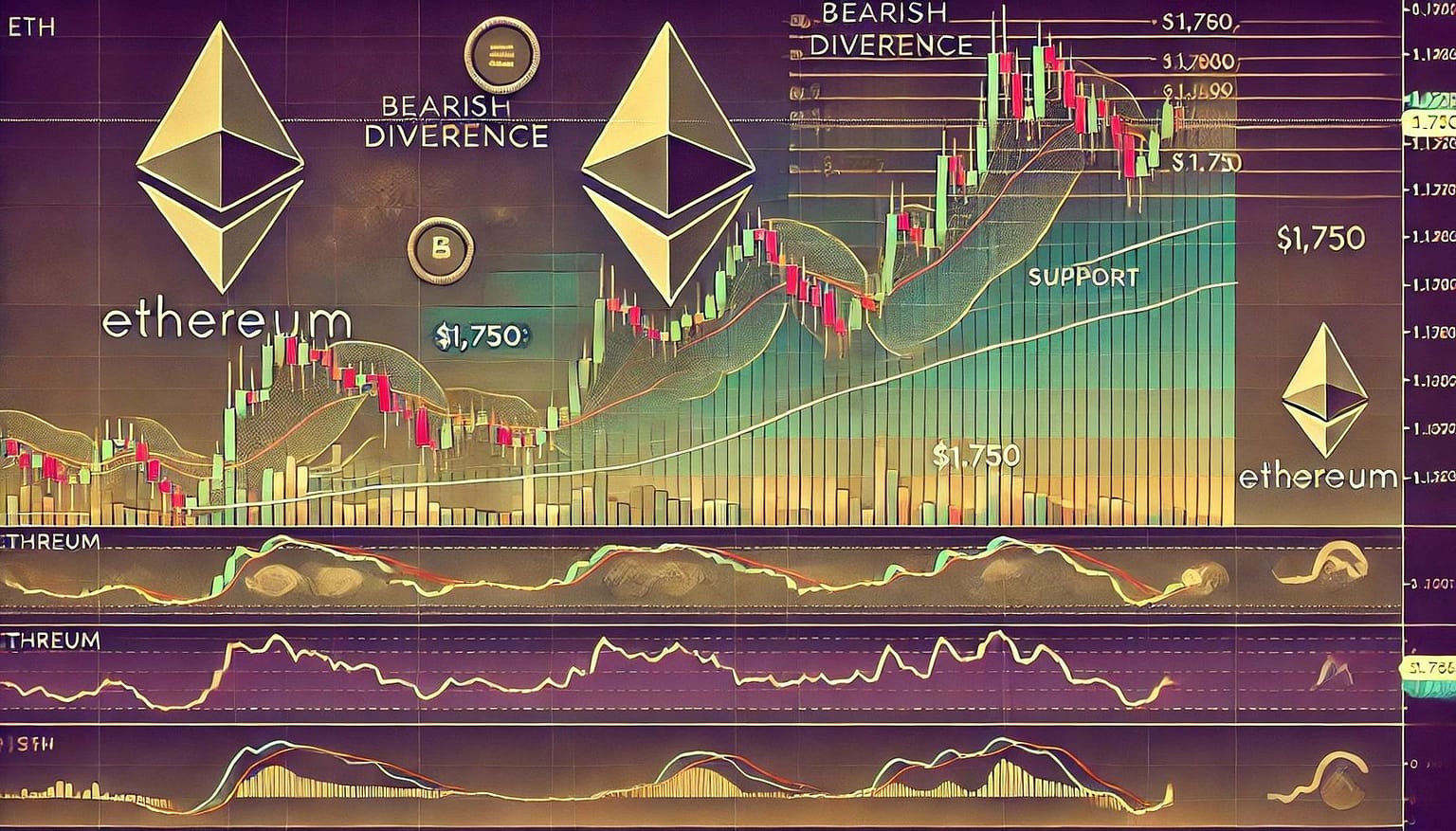

Market sentiment stays cautious as Ethereum consolidates under resistance whereas macroeconomic uncertainty continues to weigh on danger belongings. High crypto analyst Large Cheds shared insights on X, highlighting a technical concern: Ethereum is displaying a 4-hour bear divergence on the On-Steadiness Quantity (OBV) indicator, together with an higher shadow construction.

With volatility anticipated to rise and merchants intently awaiting a breakout or breakdown, the approaching classes might outline Ethereum’s trend for the subsequent a number of weeks. Bulls must act shortly to keep up momentum and forestall bears from regaining management.

Ethereum Battles Resistance As Bulls Attempt To Maintain Management

Ethereum is beginning to present early indicators of a bullish construction on low time frames, giving bulls hope for a broader restoration. After pushing from the $1,400 native low, ETH has managed to carry above key transferring averages and consolidate inside a decent vary. Nevertheless, the market stays extremely cautious, and promoting stress might enhance shortly if bulls fail to reclaim greater ranges.

Momentum has shifted in Ethereum’s favor over the previous few days, and a number of other analysts are calling for a possible large breakout if key resistance ranges are breached. A confirmed breakout above $1,850 might open the door for a swift transfer again to the $2,000 psychological degree. However, dangers stay elevated, and an opposing bearish view means that Ethereum might revisit the $1,300 zone if bulls lose management.

Ched’s critical insights level out that Ethereum is forming a 4-hour bearish divergence on the On-Steadiness Quantity (OBV) indicator. This, mixed with the looks of an higher shadow on native construction, indicators weakening shopping for stress. In response to Cheds, a brief place might be triggered if Ethereum loses the $1,750 assist zone, which might affirm a breakdown from the present consolidation sample.

Technical Particulars: Key Ranges To Change Construction

Ethereum is buying and selling at $1,815 after days of tight consolidation and modest upward motion. Bulls have managed to defend the $1,750-$1,800 assist vary, however the true check stays forward. To shift the broader bearish construction right into a confirmed bullish pattern, Ethereum should reclaim the $2,100 degree. With out this breakout, any rallies are prone to be seen as non permanent reduction inside a broader downtrend.

Holding above the $1,800 degree is essential within the coming days. A agency base above this zone would assist construct robust demand and create the situations wanted for a sustained restoration rally. Bulls are gaining some short-term momentum, however they nonetheless face a market clouded by macroeconomic uncertainty and cautious sentiment.

If Ethereum fails to keep up assist at $1,750, draw back dangers will develop quickly. Breaking under this zone might set off a pointy sell-off, seemingly sending ETH towards the $1,500 mark. Because the market exhibits indicators of energy, Ethereum’s subsequent transfer can be decisive. It can decide whether or not it will possibly be a part of a bigger restoration pattern or proceed struggling inside a unstable and unsure setting.

Featured picture from Dall-E, chart from TradingView