Ethereum’s value and its short-term holders are at the moment and concurrently exhibiting bearish exercise. Whereas the downward value pattern has continued, the exercise of short-term ETH holders has adopted intently, because the group has merely transitioned right into a selling mode.

Unfavourable Provide Movement For Ethereum Quick-Time period Holders

As Ethereum’s value loses its upside momentum, on-chain information at the moment are flashing a cautionary sign, one which calls for shut consideration throughout unstable market circumstances. This cautious sign is coming from the aspect of short-term ETH holders, who’re collectively exhibiting bearish exercise.

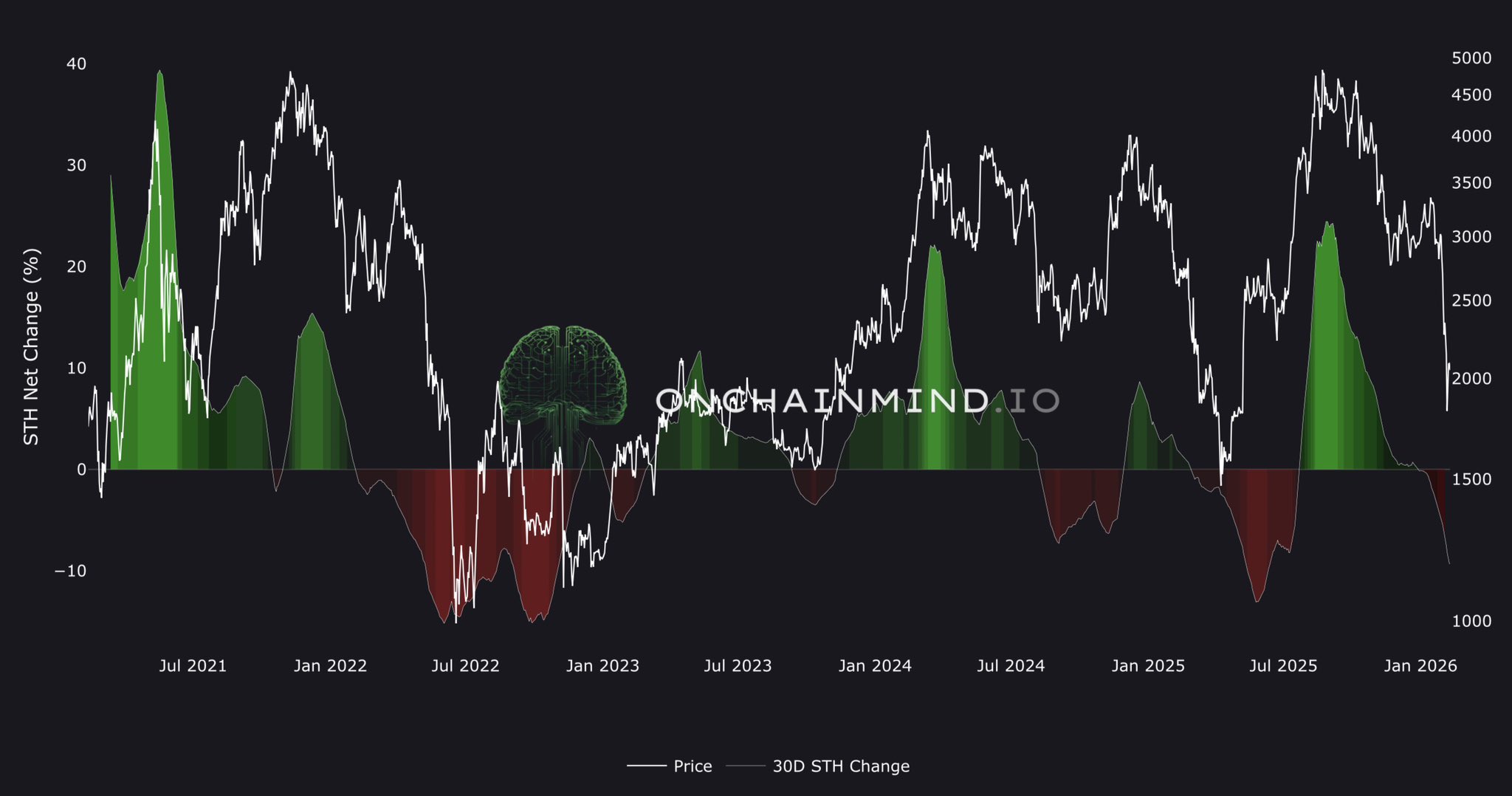

On-Chain Thoughts, a crypto and information analyst, has confirmed that Ethereum is shifting into unfavourable territory on short-term holder provide move. A pattern of this sort means that the newest consumers of ETH are selecting to promote their holdings, including recent provide again into the broader market in intervals of uncertainty.

The evaluation carried out utilizing the Ethereum Quick-Time period Holder Internet Change metric primarily tracks speculative positioning over a 30-day period. When short-term holders start to distribute ceaselessly, it’s a sample that usually hints at a decline in confidence and an increase in volatility sensitivity.

Information from the STH Internet Change chart reveals that current consumers are beginning to distribute their holdings, and short-term capital is rotating out, not flowing in. Throughout such situations, On-Chain Thoughts advocates a technique that performs in opposition to the short-term crowd.

Whereas short-term holders are displaying worry and uncertainty by promoting their ETH stash, large holders or whales proceed to discover a cause to carry on to the altcoin and even purchase extra. CW on the X platform stated that Ethereum has dropped beneath the realized value of the buildup pockets addresses.

Regardless of dropping this key threshold, ETH whales have continued their shopping for exercise. The skilled highlighted that the full-scale accumulation of the altcoin by whales began again in June 2025. In the meantime, the present value has now fallen beneath the worth at which these buyers kicked off their accumulation course of.

This drop didn’t cease them as their shopping for spree is continuing much more aggressively this time. On the similar time, the newest value of ETH will doubtless seem enticing to whales.

Shopping for ETH Now Is An Alternative

Even with a bearish state, Michael Van De Poppe has expressed bullish concentrate on Ethereum. Following an evaluation of the ETH Market Value to Realized Value Ratio (MVRV), the market skilled and MN Fund founder and CIO, declares that “it’s a large alternative to be ETH now.”

Van De Poppe acknowledged that the most important cause for it is a large hole between the truthful value and the market value. Based mostly on the MVRV ratio, ETH’s current valuation is simply as underpriced because it was through the extraordinarily unstable instances, such because the April 2025 crash, the June 2022 bottom after Luna tanked, the March 2020 crash triggered by COVID, and the height bear market of December 2018.

In all of these circumstances, this supplied a incredible alternative to buy the main altcoin, and this specific sign has unfolded as soon as once more within the present market cycle.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.