The Ethereum (ETH) blockchain is experiencing a renewed surge in community exercise, lately reaching a contemporary all-time excessive (ATH) in day by day transactions. Nevertheless, regardless of this improve in on-chain fundamentals, ETH’s worth continues to commerce beneath main resistance ranges, elevating issues that bullish momentum could also be fading.

Ethereum Community Exercise Picks Momentum

In line with a CryptoQuant Quicktake put up by contributor CryptoOnChain, Ethereum’s day by day transaction depend – highlighted in pink within the beneath chart – has surged to a brand new ATH of roughly 1,550,000 transactions per day.

This sharp improve in day by day transactions, notably noticeable over the previous few months, factors to intensified on-chain utilization and total community engagement. Along with transaction depend, different metrics additionally replicate a spike in exercise – most notably, the variety of distinctive Ethereum addresses.

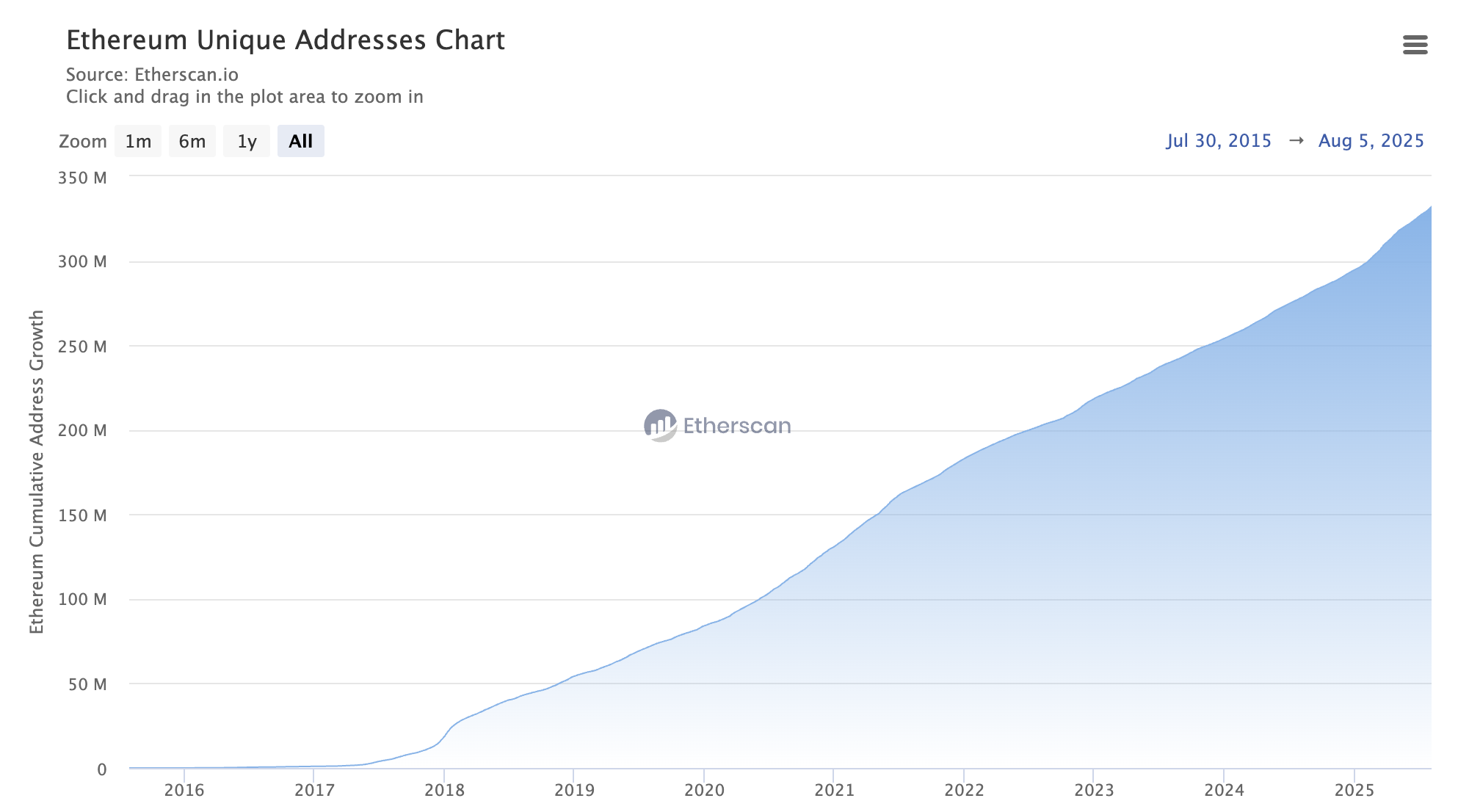

As of August 5, the whole variety of distinctive Ethereum addresses stood at 332,122,674, marking a rise of 207,454 new wallets in comparison with the day gone by. Whereas a few of these could belong to current customers creating new addresses, the bulk possible characterize new contributors getting into the Ethereum ecosystem.

Associated Studying

CryptoOnChain emphasised that regardless of these bullish on-chain indicators, Ethereum’s worth has not adopted go well with. As proven within the above chart, ETH’s worth – highlighted in orange – stays subdued, failing to interrupt above prior highs or key resistance zones.

This disconnect between rising community fundamentals and lagging worth motion could point out that the market is in an accumulation part, the analyst mentioned. CryptoOnChain additional instructed that Ethereum may very well be setting the stage for a major bullish breakout, with potential upside targets reaching as excessive as $5,000.

Is ETH Worth Headed For A New ATH?

In a separate evaluation posted on X, crypto analyst Titan of Crypto shared the next ETH month-to-month chart, noting that the asset is “compressing inside an enormous month-to-month triangle.” In line with the analyst, a profitable breakout from this sample may doubtlessly drive ETH towards $8,000.

For the uninitiated, the triangle sample is a chart formation that happens when worth motion consolidates between converging trendlines, forming a form that resembles a triangle. It sometimes signifies a interval of indecision that always resolves with a breakout within the path of the prior development, signaling continuation or reversal relying on the context.

Associated Studying

One other well-known analyst, Gert van Lagen, echoed an analogous outlook. He famous that ETH could also be positioning for a robust breakout, with a projected worth goal of as much as $9,000, citing rising technical and elementary help.

In the meantime, on-chain alternate knowledge additionally helps a bullish narrative. Over the previous two weeks, greater than 1 million ETH has been withdrawn from centralized exchanges – fuelling speculations a couple of potential provide crunch. At press time, ETH trades at $3,590, down 1.1% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, Etherscan, X, and TradingView.com