Ethereum saw a bounce back above the $3,000 price market, with bullish sentiment gaining momentum amongst traders, particularly these on centralized exchanges. Even with the market experiencing sideways actions, the general provide of ETH on crypto exchanges has fallen sharply, hitting unprecedented ranges.

Lowest Provide Of Ethereum On Exchanges

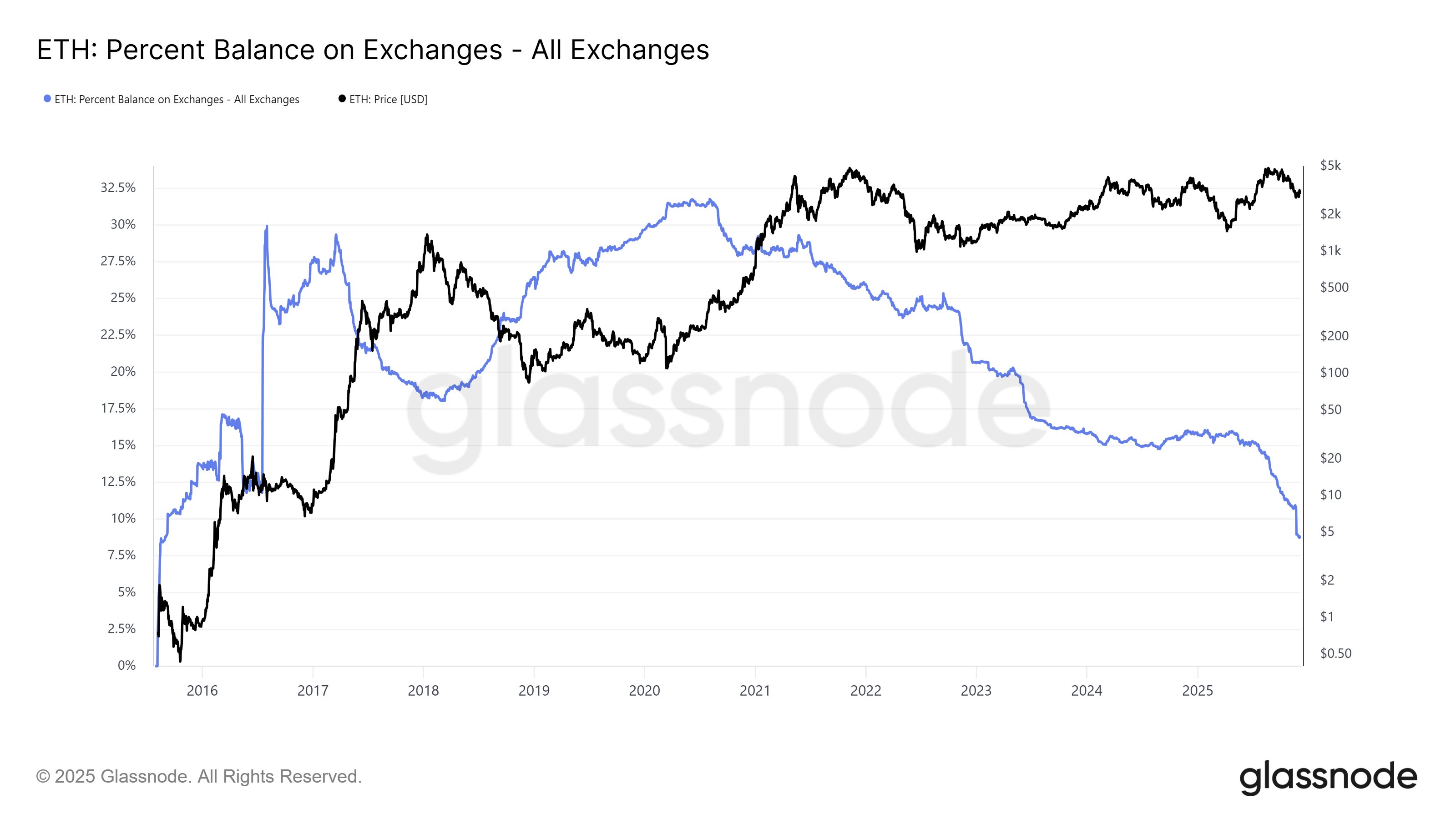

Latest alerts from on-chain metrics point out that the Ethereum market surroundings is present process a quiet but important transformation. This unfolding pattern is because of the sharp drop within the provide of ETH accessible on cryptocurrency exchanges.

Associated Studying: Ethereum Network Fatigue? Monthly On-Chain Transactions Drops As Activity Slows Down

As reported by Coin Bureau on the social media platform X, ETH provide on centralized exchanges has hit ranges not seen in years. With extra holders selecting long-term storage, staking, and self-custody over preserving their property accessible for commerce, this important provide drain signifies a change in investor conduct.

Knowledge from the ETH Percent Balance on Exchanges metric exhibits a complete of 8.7% of Ethereum provide accessible on exchanges, marking the bottom stage since ETH’s launch in 2015.

As trade reserves lower, the structural stress on ETH’s circulating provide is rising, which may create a state of affairs for a extra explosive worth surroundings. Coin Bureau acknowledged that a number of crypto analysts are at the moment warning that tightening liquidity would possibly trigger a robust rally when demand recovers.

Mid-Measurement Whale Holders Are Nonetheless Present In The Market

Regardless of a pointy withdrawal of ETH from exchanges, promoting stress nonetheless stays available in the market as indicated by the Ethereum Accumulation Heatmap. After analyzing the metric, Alphractal, a complicated funding and on-chain knowledge analytics platform, uncovered that pockets addresses holding 1,000 ETH to 10,000 ETH, or mid-size whales, are offloading their holdings, signaling weakening sentiment among the many group on account of ongoing market fluctuations.

In response to the metric, these traders carried out heavy distribution simply close to the worth prime. The cohort was the one who took benefit of the euphoria to safe earnings whereas others have been celebrating on the all-time excessive.

What’s fascinating is that these traders are nonetheless promoting, mounting heavy bearish stress available on the market, which is probably going fueling the present bearish wave. In the meantime, pockets addresses holding a minimum of 10,000 ETH or mega whale holders proceed to be significantly extra impartial, with comparatively mild distribution, demonstrating no panic, no aggressive shopping for, a minimum of not but.

Such a pattern suggests that provide conduct will not be fully aligned with the euphoria of retail traders. These accumulation and distribution patterns are very important to gauge those that are literally driving ETH’s worth strikes. It additionally determines those that are quietly heading for the exit, whereas others are nonetheless coming into.

On the time of writing, the worth of ETH was buying and selling at $3,135, demonstrating a greater than 3% rise within the final 24 hours. Bullish sentiment appears to be returning strongly, as evidenced by an over 142% improve in buying and selling quantity over the previous day.

Featured picture from Freepik, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.