TL;DR

- Whales, hackers, and the Ethereum Basis wallets moved over $500M in ETH by giant gross sales and withdrawals.

- Ethereum transfers rose to 4.6M ETH, nearing the month-to-month excessive of 5.2M recorded in July.

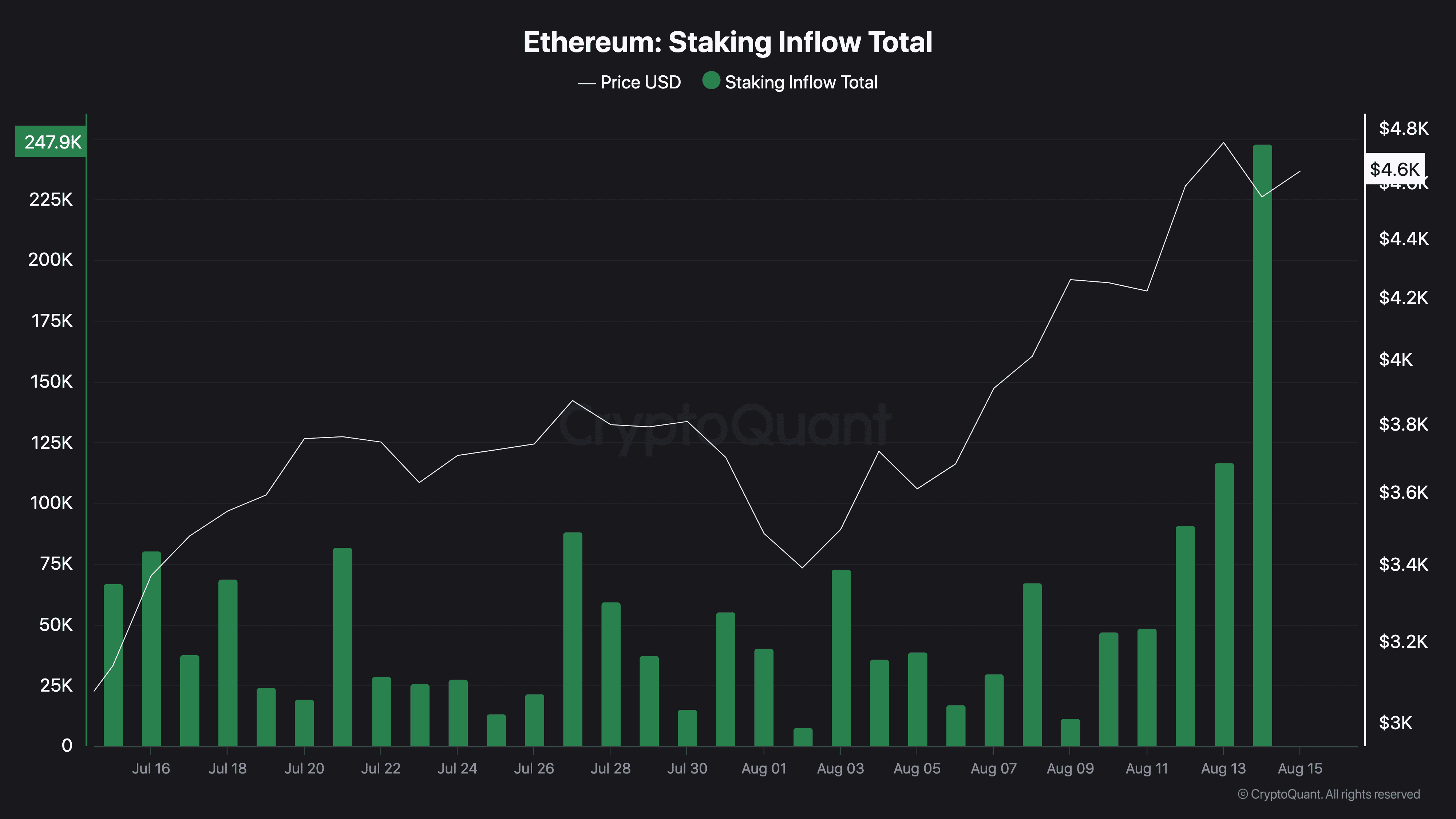

- Staking inflows hit 247,900 ETH, the best in a month, locking extra provide from buying and selling.

Massive Withdrawals and Whale Exercise

Ethereum (ETH) has seen heavy motion from main wallets over the previous few days. On-chain knowledge from Lookonchain shows a newly created pockets pulled 17,591 ETH, value $81.62 million, from Kraken in simply two hours.

Over three days, two new wallets withdrew a mixed 71,025 ETH, valued at $330 million, from the alternate.

One in all these wallets, deal with 0x2A92, has withdrawn 53,434 ETH, value $242.34 million, in two days. This features a latest buy of 30,069 ETH, valued at $138.46 million, throughout a market drop.

Main ETH Holders Offload Hundreds of thousands Amid Worth Rally

In distinction, a number of separate entities have been disposing of some ETH holdings. A pockets tied to a hacker deal with 0x17E0 sold 4,958 ETH for $22.13 million at $4,463, securing a revenue of $9.75 million. Earlier this yr, the identical deal with bought 12,282 ETH at $1,932 and later purchased again a part of the quantity at greater costs.

A unique whale sold 20,600 ETH for $96.55 million over the previous two days, producing a revenue of greater than $26 million after holding the place for 9 months.

In the meantime, an Ethereum Basis-linked pockets, 0xF39d, bought 6,194 ETH value $28.36 million within the final three days at a mean worth of $4,578.

Current gross sales from the identical pockets included a further 1,100 ETH and 1,695 ETH for over $12.7 million mixed.

The #EthereumFoundation-linked pockets(0xF39d) bought one other 1,300 $ETH($5.87M) at $4,518 ~11 hours in the past.

Over the previous 3 days, this pockets has bought a complete of 6,194 $ETH($28.36M) at a mean worth of $4,578.https://t.co/4hfCWymHVG pic.twitter.com/ErUyEY8SJy

— Lookonchain (@lookonchain) August 15, 2025

Community Exercise on the Rise

CryptoQuant knowledge exhibits Ethereum’s complete tokens transferred have been climbing since August 9. After ranging between 1 million and three million ETH by late July and early August, transfers have risen to 4.6 million ETH, approaching the month-to-month excessive of 5.2 million recorded in mid-July. This enhance has occurred alongside a worth rally from about $3,400 to $4,600.

Curiously, staking inflows typically stayed between 20,000 and 80,000 ETH per day over the previous month. On August 14, inflows jumped to 247,900 ETH, the best within the interval.

On the time, ETH was buying and selling close to $4,600. Massive staking deposits cut back the quantity of ETH obtainable for fast buying and selling, as staked cash are locked for a set interval.

Within the meantime, ETH trades at $4,647 with a 24-hour quantity of $68.25 billion, down 2% on the day however up 19% over the week.

The submit Ethereum Foundation, Whales, and Hackers: What’s Driving the ETH Sell-Off? appeared first on CryptoPotato.