Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has lately regained bullish footing, climbing to $1,847 after dipping beneath $1,750 towards the tip of April. This rebound follows a interval of volatility, with worth actions fluctuating between $1,740 and $1,847 over the previous seven days.

Associated Studying

Amid the uncertainties within the wider crypto market, Ethereum’s potential to reclaim increased floor seems to align with shifting investor behavior, particularly on centralized exchanges, the place a noticeable variety of Ether have been withdrawn previously seven days.

$380M In ETH Pulled From Exchanges As Accumulation Development Will increase

In accordance to IntoTheBlock, the previous week noticed over $380 million price of Ethereum withdrawn from centralized buying and selling platforms. This web outflow exhibits an rising wave of accumulation amongst crypto traders. These traders are shifting their property into self-custody, which is usually an indication of long-term conviction.

The accompanying knowledge chart underscores this momentum, highlighting 5 consecutive days of adverse change netflows throughout aggregated platforms spanning 19 crypto exchanges.

Notably, the final time these exchanges noticed a constructive influx of Ethereum was on April 27, with $50 million price of ETH. Curiously, simply 24 hours prior, these aggregated exchanges witnessed a adverse 166.68 million price of Ethereum flows. Such an change circulation dynamic brings forth the concept that Ethereum traders could also be preparing for a rally.

Important change outflows are identified to precede notable bullish advances, and present the habits mirrors earlier worth motion the place reducing change balances acted as a precursor to sustained rallies. Notably, the present withdrawal pattern coincides with the Ethereum worth pushing back above the $1,800 mark.

Essential Ethereum Help Zone At $1,770

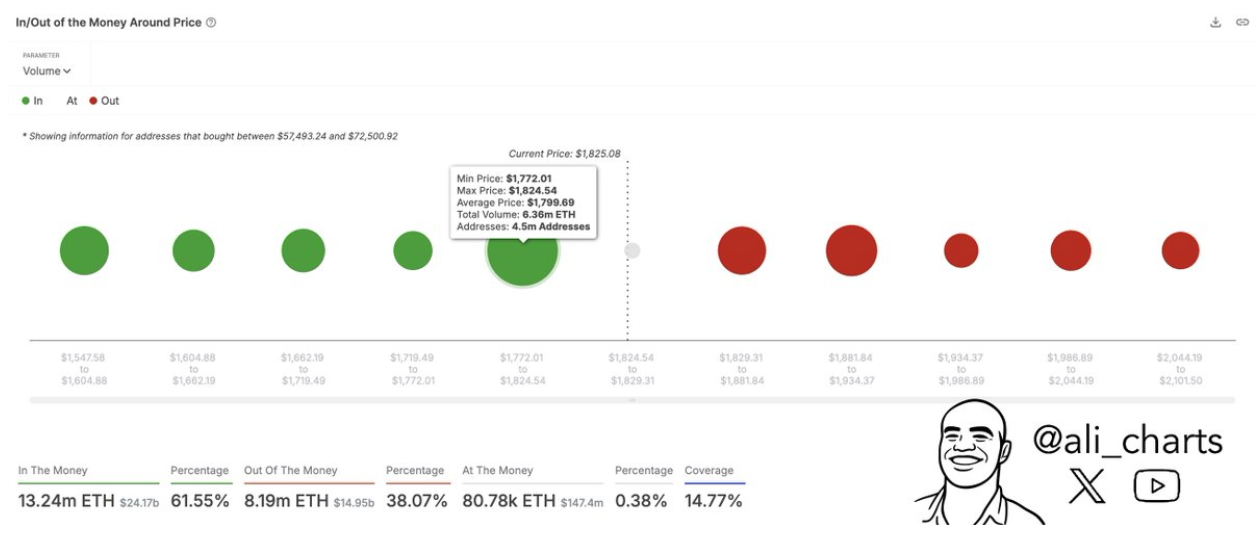

The continuing accumulation is additional supported by crypto analyst Ali Martinez, who lately identified an important Ethereum assist stage. Based on Martinez, the $1,770 area is at the moment probably the most important stage for Ethereum within the brief time period, citing knowledge from IntoTheBlock’s “In/Out of the Cash Round Value” mannequin.

The In/Out of the Cash Round Value mannequin exhibits a excessive focus of wallets (roughly 4.5 million addresses) having acquired 6.36 million ETH between $1,772 and $1,824. These holders are actually “within the cash” following Ethereum’s return to $1,845, which makes this zone a psychological stronghold.

The implication of this assist zone is evident. If Ethereum sustains above this demand cluster, the likelihood of additional upward motion will increase. Nonetheless, any retracement beneath $1,770 might invalidate the present bullish construction and expose Ethereum to draw back volatility.

For now, the web flows from exchanges point out that Ethereum may be able to hold its ground round this $1,770 stage. The much less Ethereum obtainable on exchanges, the much less promoting stress. Then again, the following resistance cluster to get above within the brief time period is at $1,881.

Associated Studying

On the time of writing, Ethereum is buying and selling at $1,845, up by 1% previously 24 hours.

Featured picture from Unsplash, chart from TradingView