Ethereum is now at a pivotal second following final week’s explosive rally that pushed costs above a number of key resistance ranges. After surging previous $2,700, ETH has pulled again and is now consolidating above the $2,400 mark. This zone has change into a vital battleground between bulls seeking to verify a breakout and bears eyeing a deeper correction.

To maintain the present bullish momentum, Ethereum should maintain above $2,400 and retake the $2,800 stage—an space that marks the higher boundary of the present consolidation vary. A confirmed breakout above $2,800 may ignite a broader rally and sign the beginning of a long-awaited altseason.

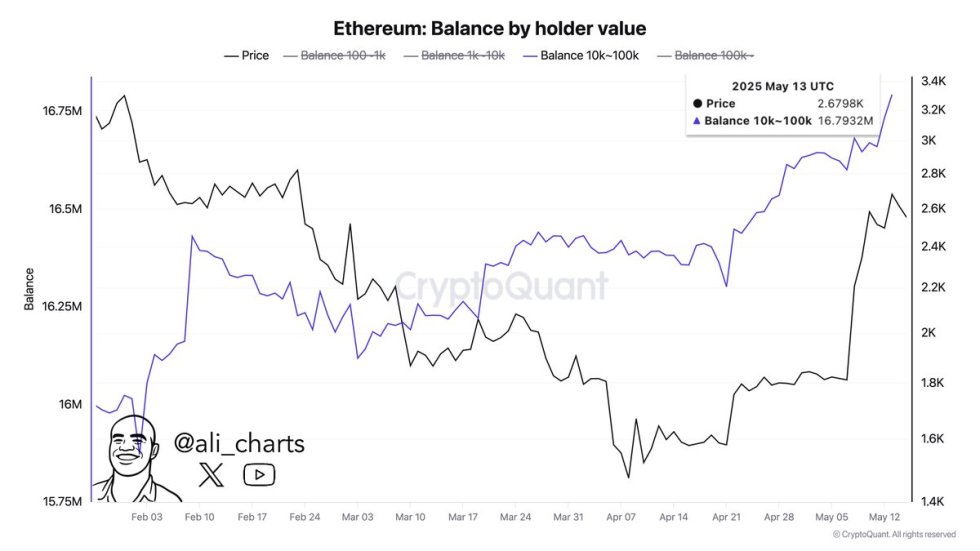

Including power to the bullish case, new information from CryptoQuant reveals that good cash is accumulating ETH rapidly. This huge-scale accumulation suggests rising confidence amongst institutional gamers and long-term buyers, even amid heightened volatility.

All eyes at the moment are on how Ethereum reacts at these ranges. A profitable protection of assist and a breakout above resistance may set the stage for a robust continuation. However failure to carry above $2,400 would seemingly invite extra draw back strain and delay additional bullish advances.

Sensible Cash Backs Ethereum As Bulls Defend Key Help

Ethereum is exhibiting renewed bullish power as market sentiment turns optimistic throughout the crypto panorama. After surging greater than 50% in current weeks, ETH is holding above the $2,400 stage, a key assist zone that merchants and analysts alike are watching carefully. To solidify a bullish section and make sure the beginning of a sustainable rally, bulls should push Ethereum decisively above the $2,800 mark. This may set off recent momentum and probably unlock a path again towards the $3,000–$3,200 area.

Regardless of the constructive indicators, dangers stay. Ethereum continues to be down roughly 36% from its December 2024 excessive close to $4,100. This hole highlights the work bulls nonetheless must do to completely reverse the broader downtrend. The current pause under resistance is a pure cooling-off section, but when ETH fails to carry above assist, bearish strain may return rapidly.

Nonetheless, institutional confidence seems to be rising. In response to data shared by high analyst Ali Martinez, good cash has accrued over 450,000 ETH up to now month. This surge in whale accumulation suggests a longer-term bullish outlook, as giant holders sometimes purchase throughout moments of market consolidation to place for future upside.

If bulls reach defending $2,400 and break by way of the $2,800 ceiling, Ethereum may change into the catalyst for a broader altcoin rally—presumably marking the start of a brand new altseason.

Value Motion: Key Ranges In Focus

Ethereum (ETH) is at the moment buying and selling round $2,493 after failing to maintain momentum above the $2,700 mark. On the 4-hour chart, we will observe a transparent break within the steep uptrend that began in early Might. After an explosive surge from under $2,000, ETH rallied aggressively, however is now getting into a corrective section marked by decrease highs and rising promoting strain.

The value is approaching the $2,480–$2,460 area, which may function short-term assist. If that zone breaks, the subsequent confluence of curiosity lies close to $2,300. Quantity has barely declined throughout this retracement, suggesting that sellers are cautious relatively than dominant. Nonetheless, failure to carry above $2,400 may shift sentiment and invite deeper pullbacks.

The 200-period EMA and SMA on the 4-hour chart sit properly under the present value, at $2,084 and $1,936 respectively, indicating that ETH continues to be in bullish territory from a development perspective. These shifting averages may function dynamic assist if the correction intensifies.

Total, Ethereum stays in a robust uptrend, however the present pullback suggests a consolidation section is underway. Bulls must defend key ranges and break above $2,700 once more to regain upside momentum and intention for the $2,800–$3,000 vary.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.