A stark line within the sand has emerged for Dogecoin. Market analyst Ali Martinez (X: @ali_charts) argues that the meme-coin’s near-term trajectory is binary across the $0.18 deal with, pairing a channel-based worth map with an on-chain URPD readout that concentrates threat immediately under. His warning is unambiguous: “Dogecoin destiny might hinge on $0.18. If it fails, $0.07 may be subsequent.”

Dogecoin Wants To Bounce Now

Martinez published a one-day chart on November 1 depicting DOGE oscillating inside an ascending channel and presently testing its decrease boundary. The chart print exhibits Binance’s perpetual pair close to $0.187 on the time of seize, with a dotted path that both springs from this “buy-the-dip” zone towards the channel’s midline close to $0.26 and in the end the upper rail around $0.33, or, if the help snaps, ejects right into a materially decrease vary.

Associated Studying

He summarized the bullish path succinctly in a separate put up hooked up to the identical chart: “$0.18 appears like a powerful buy-the-dip zone for Dogecoin earlier than a possible run towards $0.26 or $0.33.” Pressed by a consumer on what had modified, Martinez replied: “Nothing has modified. On each posts every part depends upon the $0.18 help stage.”

On-Chain Knowledge Confirms Crucial Scenario

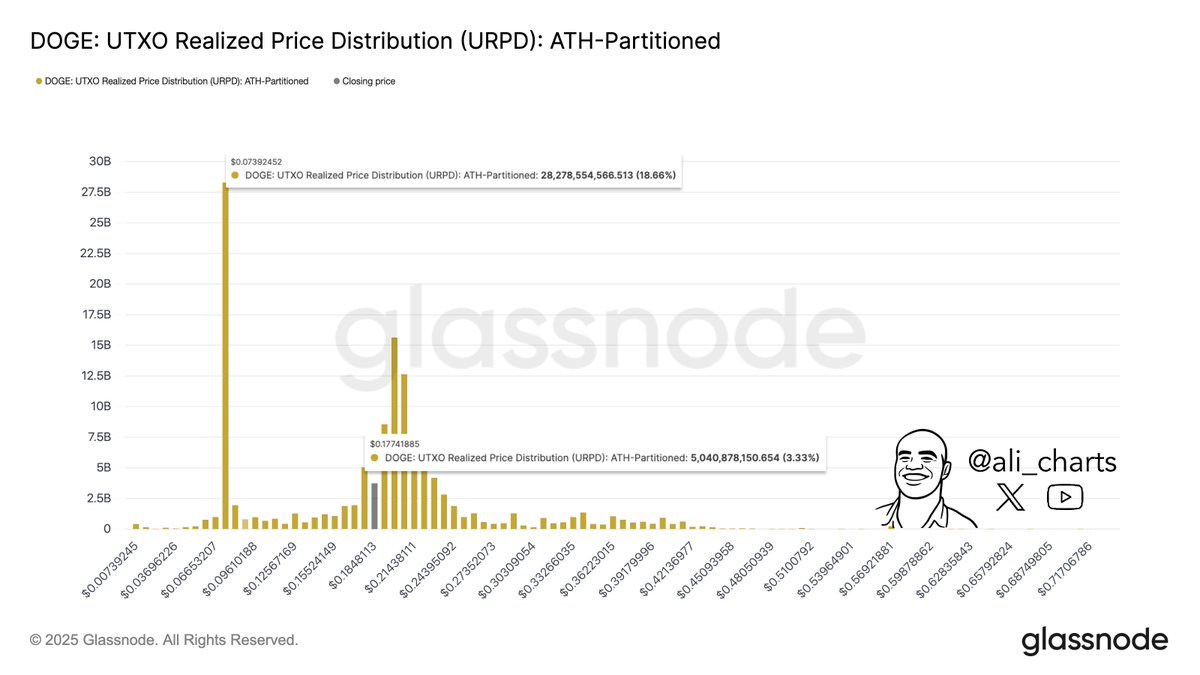

The technical map is bolstered by on-chain positioning. Martinez shared a Glassnode UTXO Realized Price Distribution (URPD) for DOGE partitioned by the all-time-high epoch. URPD bins provide by the final on-chain transaction worth, highlighting cost-basis clusters that usually perform as help and resistance when these cohorts are confronted with drawdowns or break-evens.

Associated Studying

The histogram Martinez posted incorporates a conspicuous bulge round $0.073, labeled at 28,278,554,566.513 DOGE (18.66%), and a secondary native node centered close to $0.17741885, labeled at 5,040,878,150.654 DOGE (3.33%). Furthermore, the chart exposes a heavy 36+ billion DOGE cluster throughout $0.18–$0.21 — a essential zone that worth has already damaged under, including stress to the draw back.

The implication is easy: there’s a seen pocket of realized-price liquidity at roughly $0.18 which may catch worth on first take a look at; however ought to that shelf fail, the subsequent dense cohort sits far decrease, close to seven cents, the place practically a fifth of provide final modified palms.

This pairing of a technical threshold with an on-chain vacuum is what underpins Martinez’s either-or framing. The channel examine delineates $0.18 as structural support on the every day timeframe; the URPD exhibits why the draw back air pocket may very well be deep if sellers pressure capitulation under that stage.

Conversely, a protection of $0.18 would align along with his mapped rebound towards the channel’s median close to $0.26, with stretch potential to the higher boundary round $0.33 if momentum persists. In Martinez’s phrases, “every part depends upon the $0.18 help stage.”

At press time, DOGE traded at $0.173.

Featured picture created with DALL.E, chart from TradingView.com