TL;DR

- Following the supposed conclusion of the lawsuit towards the SEC, all eyes within the XRP military at the moment are centered on the potential approval of a Ripple ETF within the States.

- Nonetheless, sure merchants are nonetheless leaning bearish towards the asset, not less than based on knowledge from Kaiko.

ETF Hopes on the Rise

The approval of Bitcoin and later Ethereum ETFs within the States final 12 months opened the door for different altcoins to hope for such monetary automobiles. The huge change within the regulatory regime within the nation following the inauguration of Trump solely strengthened the sentiment that smaller cryptocurrencies would even be legitimized in entrance of institutional buyers.

Being the third-largest non-stablecoin cryptocurrency by market cap, XRP is positioned among the many leaders by way of ‘who’s subsequent?’ Presently, there are round ten completely different purposes from monetary firms to launch such merchandise in the US.

The US SEC has acknowledged the vast majority of them, whereas the probabilities for an approval in 2025 stand at 77% based on data from Polymarket (however the odds drop to 29% when the deadline is July 31).

Crypto analysts are adamant that the closure of the authorized case towards the SEC, which continues to be not fully official, would absolutely open the door for an XRP ETF. Whereas others believe the potential approval of those monetary automobiles might be the following catalyst for main positive aspects, a extra in-depth analysis exhibits that there are a number of warnings buyers shouldn’t ignore.

Choices Market Is Bearish

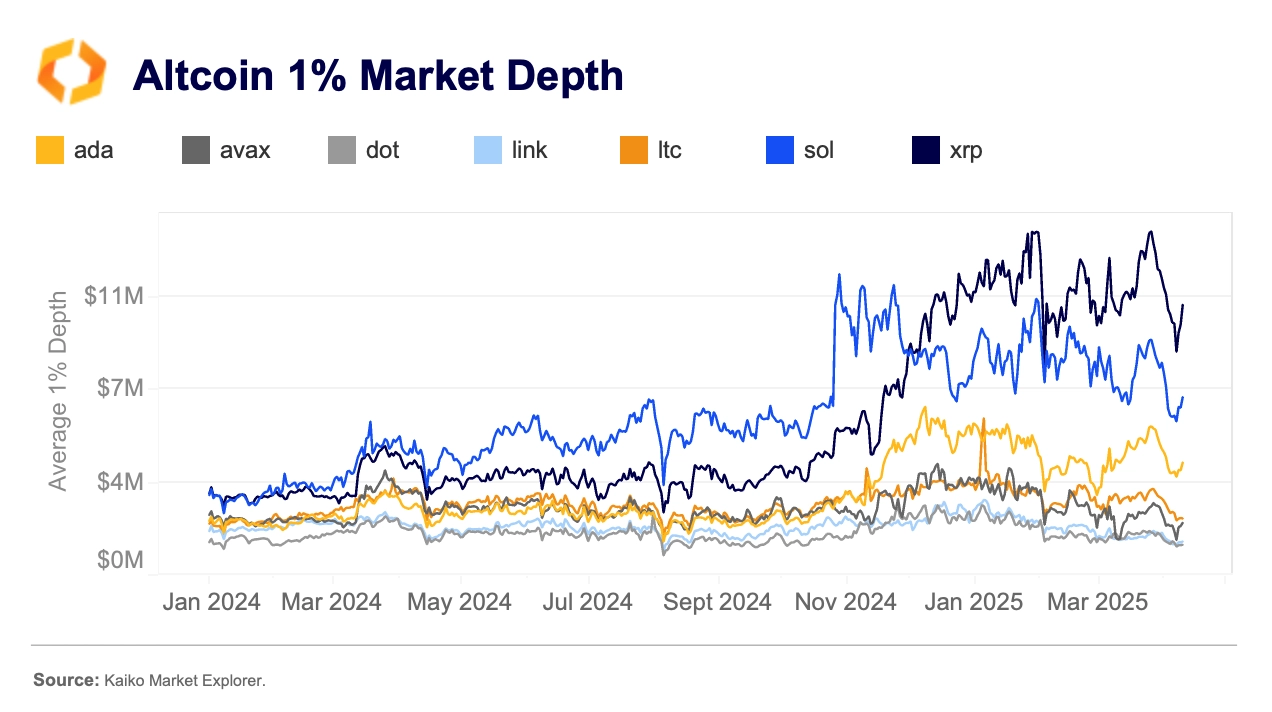

Kaiko’s current market report highlighted the substantial liquidity of XRP and SOL, as they’ve “the very best common 1% market depth.” Each belongings are among the many front-runners for ETF purposes.

XRP’s market depth exploded in late 2024, maybe pushed by the hopes of the political and regulatory adjustments within the US. It surpassed SOL and doubled that of ADA, which ranks third among the many ETF seekers.

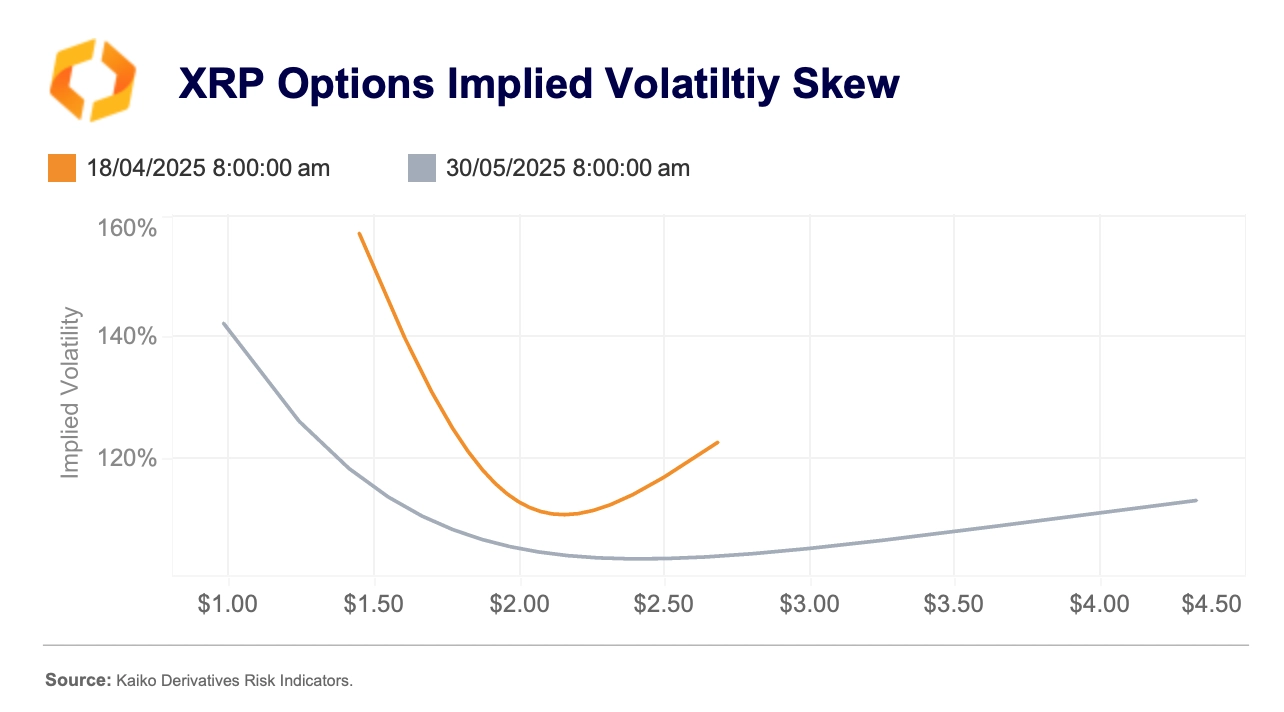

Regardless of the anticipation for an XRP ETF and all of the major developments round Ripple as of late, which embody an enormous $1.2 billion prime dealer acquisition, the choices market on Deribit is “skewed bearish.”

Kaiko stated that the volatility smile (a sample of implied volatility for plenty of choices which have the identical expiration date and underlying however completely different strike costs) for the April 18 expiration is “closely to the left,” which indicators “demand for draw back safety.”

Nonetheless, the report defined that the bearish outlook is “possible linked to broader market uncertainty at current resulting from macroeconomic issues.”

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome provide on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!