The tokenization of conventional finance is again within the information, as fits in boardrooms throughout the US are discussing the advantages and dangers of integrating cryptocurrency into their enterprise. The time period “tokenization” refers to deploying conventional monetary property on cryptocurrency rails, digitizing analog monetary property (together with foreign money), and thus allow the monetary business to learn from the pace and transparency that blockchains present. However is that this one other crypto fad, or is there a elementary downside that the younger business is addressing for the legacy monetary world?

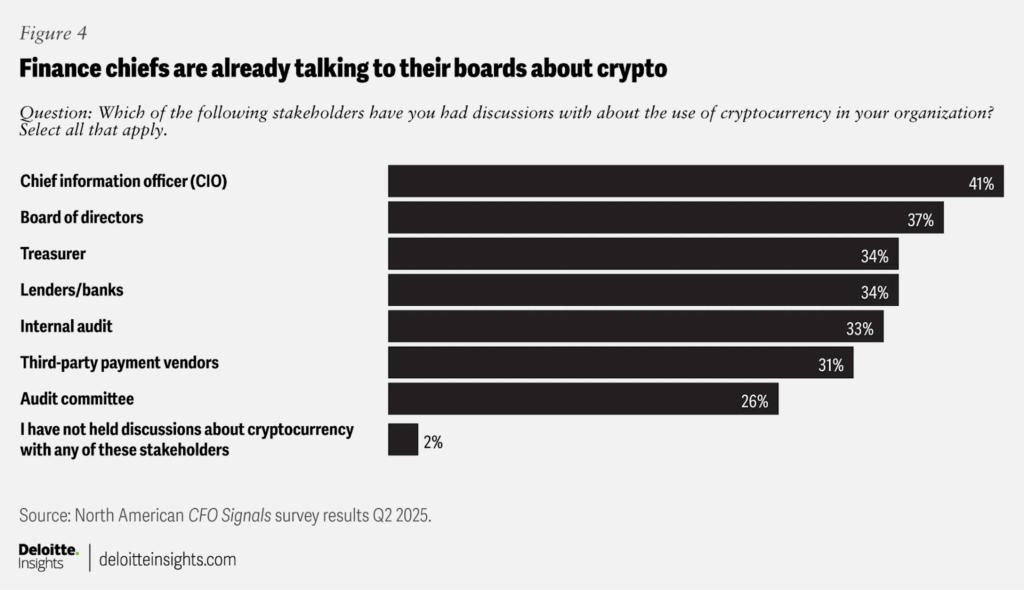

A Deloitte survey revealed in July polled 200 Chief Monetary Officers working at corporations with at the very least US$1 billion in revenues on the subject of tokenization. The survey confirmed that the majority CFOs count on their enterprise to make use of “cryptocurrencies for enterprise capabilities in the long run.” Only one% of these polled mentioned they didn’t envision it. And 23% mentioned their treasury departments “will make the most of crypto for both investments or funds inside the subsequent two years,” a proportion which is nearer to 40% for CFOs at organizations with US$10 billion in revenues or extra. Additionally, of these surveyed, solely “2% of respondents mentioned they haven’t had any conversations about cryptocurrency with key stakeholders”.

Tim Davis, a Principal at Deloitte advised Bitcoin Journal that there are two narratives making their means by means of American finance, “one is whether or not to have Bitcoin on the stability sheet and the opposite is a broader appreciation of tokenization’s future, which appears more and more inevitable.” He added that “step one is commonly stablecoins—learn how to undertake them, whether or not to difficulty their very own coin. Extra corporates are having this broader technique dialog in the present day than these committing to Bitcoin on the stability sheet.”

Stablecoins specifically have captured Wall Street and Washington’s interest, as a device that may serve the pursuits of the US each at dwelling and overseas. The survey bolstered this rising development, displaying that fifteen % of CFOs count on their organizations to simply accept stablecoins as cost inside the subsequent two years, a proportion that’s “larger (24%) for organizations with at the very least US$10 billion in income.”

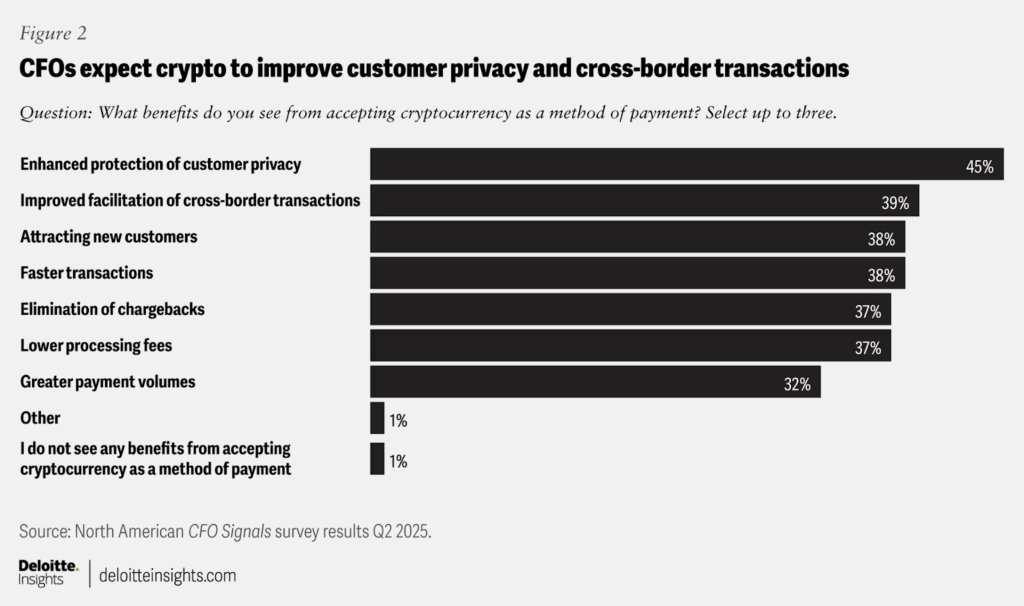

When requested about the advantages of “accepting cryptocurrency as a way of cost”, CFOs cited enhanced buyer privateness as essentially the most priceless _____, recognizing the large harm done to user privacy by legacy know-your-customer (KYC) model information assortment legal guidelines, and their unintended consequences in the digital age.

Davis says the monetary business can be monitoring coverage actions like “the SEC’s Challenge Crypto and comparable efforts by the CFTC which are mapping out market construction.” He additionally talked about the CLARITY Act, which “handed by the Home and is beneath Senate consideration, bolstered by regulators as defining needed buildings” and which goals to supply regulatory readability for crypto-related companies, together with tokenization-related operations. In response to Davis, corporations see this infrastructure transition as inevitable. “It’s possible a 12 months out — and individuals are eager about what it means for his or her enterprise,” mentioned Davis.

Davis added that “pre-COVID, blockchain was thought-about useless, however we’re rising from that disillusionment. Capabilities have improved, the regulatory atmosphere is best, and corporates see friends discussing this. Board members, typically CEOs or CFOs from different corporations, deliver these strategic discussions again to their groups, spreading the inevitability of it, and the strategic decisions wanted.”

Step-by-step, the Bitcoin and crypto business is merging with conventional finance, and the implications are extra profound than most individuals assume. Phrases like “tokenization” and “actual world property” or RWAs are sometimes mentioned in the identical breath, virtually handled as synonyms. However what does “tokenization” actually imply for Wall Road and CFOs throughout America, and why are they so intrigued by it?

Davis says stablecoins and real-world asset tokenization aren’t about being stylish, reaching youthful prospects, or increasing into overseas markets, however they’re about upgrading elementary layers of the monetary infrastructure, with new qualities like larger velocity of cash, extra privateness for customers, whereas additionally growing transparency and real-time information about transactions throughout the market.

Satoshi Nakamoto on the Issues with Conventional Finance

The curiosity proven by CFOs relating to the “tokenization” of finance is a subject Bitcoiners is likely to be underappreciating and misunderstanding. Actually, the issues that conventional finance (TradFi) appears to be like to unravel with ‘tokenization’, may not be too removed from these Satoshi Nakamoto recognized and sought to deal with in his authentic Bitcoin white paper — the technical doc that gave delivery to Bitcoin and the trendy cryptocurrency business.

”Commerce on the Web has come to rely virtually solely on monetary establishments serving as trusted third events to course of digital funds. Whereas the system works effectively sufficient for many transactions, it nonetheless suffers from the inherent weaknesses of the trust-based mannequin,” Satoshi Nakamoto wrote in late 2008 in his seminal work.

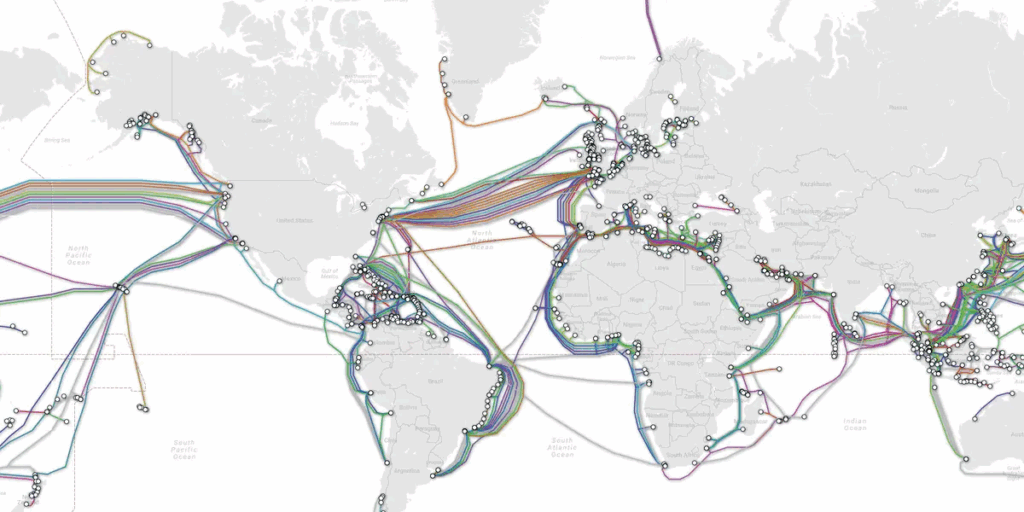

This quote strikes on the coronary heart of the matter. The expertise that underpins TradFi was thought out earlier than the invention of the web. Earlier than computer systems orders of magnitude extra highly effective than the Apollo II have been within the pockets of over half of the world’s inhabitants, earlier than web fiber traces thick as whales have been rolled out throughout the ocean sea beds to attach the world, earlier than decrease orbit satellites embellished the night time sky, raining data right down to dwelling antennas and again, as if a brand new constellation had entered the pantheon, born of man’s envy of the Gods.

Earlier than all that, the brick-and-mortar, high-trust, worldwide banking membership made sense. However within the daybreak of the digital age, a whole lot of the previous methods of doing enterprise can profit from a shift; Bitcoin invitations them to evolve.

So, maybe Wall Road’s curiosity in tokenization isn’t only a fad. Davis defined that “it’s not about onboarding youthful generations or increasing exterior of the U.S., it’s about remodeling how enterprise is finished in the present day utilizing tokenized blockchain rails, and there’s growing appreciation for the way current rails may be improved.”

The upside to upgrading monetary infrastructure “is big,” Davis added. “Quick-term implications embrace elevated velocity of cash. Sooner commerce settlement and world cash motion. It frees up capital held in inefficient techniques.”

Blockchains have already remodeled buying and selling schedules all through the world, as they perform 24/7, which isn’t the case in TradFi, Davis famous.

As a particular instance, Davis defined that the way in which the worldwide motion of cash works in the present day.

“Should you’re a financial institution, you mainly should pre-fund these cost channels,” he defined.

“Let’s say you’re anticipating about $100 million of motion in a day in a sure channel, you need to fund that to the extent of 120% simply in case. So, you’ve bought over time $20 million of useless cash that’s sitting there, however doesn’t want to sit down there. It’s not solely growing the pace, you’re additionally liberating up cash that’s in any other case trapped in an archaic system”.

Diving deeper into how trades get settled in tradFi in the present day, Davis defined that “the SEC has lengthy had this program in place to speed up the timeline by means of which securities trades get settled.”

“As we speak we’re engaged on a T+1 mandate, including a day of delay to settle a commerce. However more and more — and it’s actually been with the shift within the administration within the White Home — there’s this realization that we do have to be wanting extra significantly at blockchain rails, if we’re ever going to get to this T+0, which is the settlement of transactions inside the identical day, ideally in hours, if not minutes,” he added.

On the coverage entrance, Davis highlighted that “there’s a very concerted shift occurring from regulators, these monetary intermediaries that work on these sorts of settlements in addition to all of the arms of presidency to push the way in which that our monetary markets work, to comprehend the advantages of this new expertise.” The advantages to the financial system as an entire can be vital, Davis advised Bitcoin Journal that beneath this new paradigm it “turns into dramatically extra environment friendly for corporations and people to handle their cash and their positions — be it shares, bonds, or actual property.” It will permit folks to make essential monetary selections “while not having a whole lot of these archaic techniques that add price and in some instances even add threat,” Davis added.

Why Satoshi Nakamoto Selected Proof of Work

There’s one major downside with the blockchain and tokenization coming from Wall Road, and that’s that almost all blockchains are merely not safe on the consensus degree. So as to obtain excessive ranges of transaction pace and throughput, many cryptocurrency initiatives put the CPU and reminiscence burdens of working blockchain infrastructure on skilled ‘node runners’ elevating the prices infrastructure dramatically. That is in distinction to Bitcoin’s layered strategy, which retains layer one small and straightforward for anybody to run a duplicate of, whereas settling excessive pace funds on the Lightning Community.

So as to skip the gradual and dangerous build-up of a proof of labor mining group, many cryptocurrency initiatives launch these networks as proof of stake protocols as a substitute, which has coin holders vote on consensus selections with their stability, as a substitute of mining. These votes symbolize energy on the community, and might resolve issues corresponding to which transactions make it into the blockchain, and even reverse transactions altogether. The result’s but once more a trusted system that, whereas presumably extra environment friendly and fraud-proof than TradFi, nonetheless begins centralized and will keep that means, making it probably susceptible to litigation.

Satoshi Nakamoto understood the added prices and systemic dangers of trust-based settlement techniques deeply, which is why he selected proof of labor as Bitcoin’s consensus protocol. “Fully non-reversible transactions aren’t actually potential, since monetary establishments can not keep away from mediating disputes. The price of mediation will increase transaction prices — with the potential for reversal, the necessity for belief spreads,” he wrote within the first paragraph of the Bitcoin white paper.

“Retailers should be cautious of their prospects, hassling them for extra data than they’d in any other case want. A sure proportion of fraud is accepted as unavoidable. These prices and cost uncertainties may be averted in particular person through the use of bodily foreign money, however no mechanism exists to make funds over a communications channel with out a trusted occasion,” he added.

Whereas Wall Road will possible ignore Bitcoin because the superior blockchain on high of which to construct out its tokenization and settlement plans, if the consensus layer issues in any respect, they are going to ultimately study the arduous means, by means of litigation and disputes, that having finality — or as bitcoiners name it, immutability — has its advantages. Those that begin constructing on Bitcoin now will most likely have an edge.