The crypto market has erased greater than $19.5 billion in leveraged positions up to now 24 hours, making it probably the most chaotic 24-hour interval in crypto historical past. This crash, which noticed 1.6 million merchants pressured out of positions, was attributable to sudden US tariff announcements on China and amplified by dangerous leverage throughout exchanges.

Bitcoin alone witnessed a $20,000 day by day swing and erased $380 billion in market capitalization in a single day. This liquidation surpassed all earlier data by practically tenfold, surpassing data set throughout the FTX collapse and the March 2020 crash.

Associated Studying

Liquidations Ripple By means of Whole Crypto Market

The latest crypto market crash took many crypto traders without warning. Notably, data shared by The Kobeissi Letter on the social media platform X revealed {that a} complete of $19.5 billion was liquidated between October 10 and 11, 2025, over 9 occasions bigger than any prior occasion. To place that into context, the February 2025 liquidation occasion noticed solely $2.2 billion erased, whereas the Could 2021 crash cleared $1.2 billion.

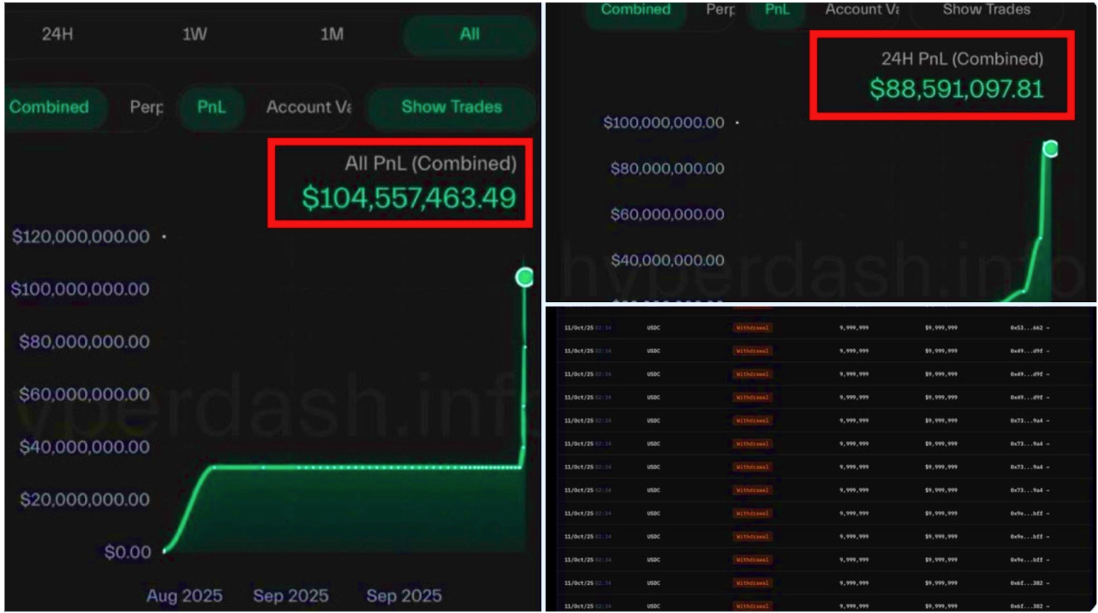

Information throughout main exchanges confirmed that the sell-off was closely one-sided. Out of the $19.38 billion in complete liquidations, $16.7 billion got here from lengthy positions, which is a 6.7-to-1 ratio in comparison with shorts. Almost each change, from Binance to Bybit, noticed over 90% of liquidations hitting longs, with Hyperliquid alone recording $10.3 billion.

Crypto Exchange Liquidations. Source: @KobeissiLetter on X

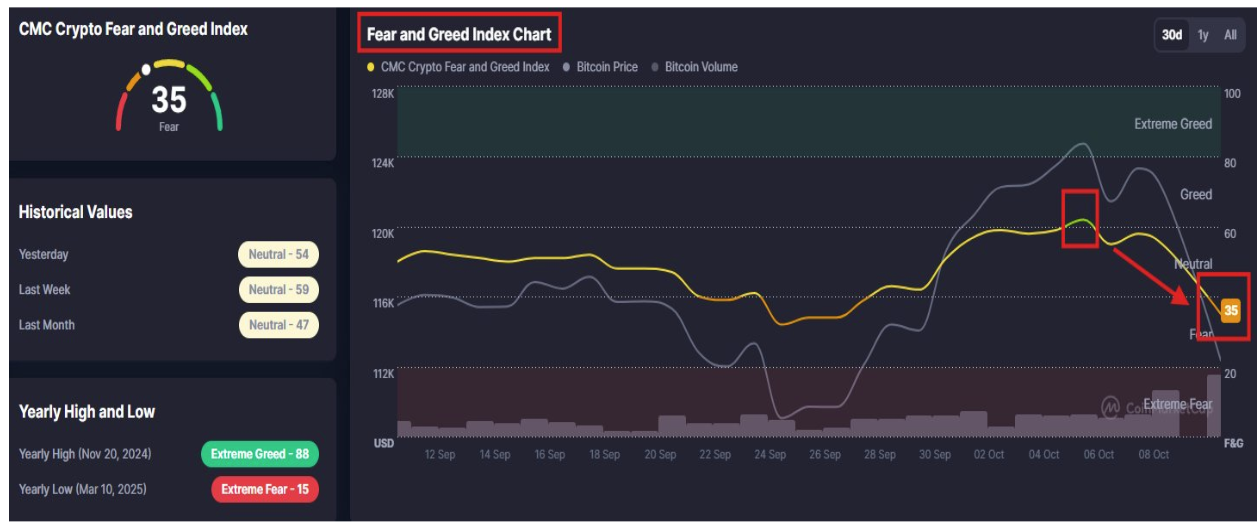

This fast downturn is sort of notable, contemplating the crypto market’s greed index had climbed above 60 when Bitcoin’s value motion broke above $126,000 for the primary time.

Crypto Fear and Greed Index. Source: @KobeissiLetter on X

What Induced The Crash?

The rationale behind the crash will be attributed to a mixture of prolonged market corrections following Bitcoin’s all-time excessive and rising tensions over new US tariffs on China. In accordance with The Kobeissi Letter, the selloff unfolded by means of a collection of completely timed occasions that tied geopolitical shocks to fragile market sentiment.

At 9:40 AM ET, some giant Bitcoin holders began selling off mysteriously, greater than an hour earlier than former U.S. President Donald Trump posted a couple of huge China tariff menace at 10:57 AM. Later within the day, at 4:30 PM, a big whale opened multi-million-dollar shorts, seemingly anticipating the approaching drop. Simply 20 minutes later, Trump formally introduced a 100% tariff on China, and this delivered the ultimate blow to bullish sentiment.

Timeline Of Events. Source: @KobeissiLetter on X

Trump’s tariff publish dropped late on a Friday after US markets had closed, however the crypto market was extensive open. As such, crypto costs fell right into a vacuum as quantity spiked, creating the right setup for one of many quickest collapses in crypto historical past. By 5:20 PM, complete liquidations had reached $19.5 billion, and the whale closed positions for a $192 million revenue.

Regardless of the carnage, The Kobeissi Letter famous that this occasion was technical moderately than elementary. The crash is a crucial reset that doesn’t have long-term implications. A commerce deal between the US and China would put an finish to the uncertainty, and based on the staff, crypto remains strong.

Bitcoin Price Chart. Source: @KobeissiLetter on X

Associated Studying

On the time of writing, Bitcoin has recovered a bit from its plunge and is now buying and selling at $111,790.

Featured picture from Unsplash, chart from TradingView