Raoul Pal is pushing again on the concept crypto’s present drawdown indicators a damaged market cycle, arguing as a substitute that bitcoin and high-beta danger are being hit by a short lived US liquidity air pocket tied to Treasury money administration and authorities shutdown dynamics.

In a weekend post on X framed as a takedown of “false narratives,” the World Macro Investor founder stated the prevailing story—“that BTC and crypto are damaged. The cycle is over”—has turn out to be an “alluring narrative lure,” particularly as “costs [are] puking each fucking day.” However Pal stated a separate query from a GMI hedge fund consumer about beaten-down SaaS equities prompted him to re-check the info and rethink the motive force.

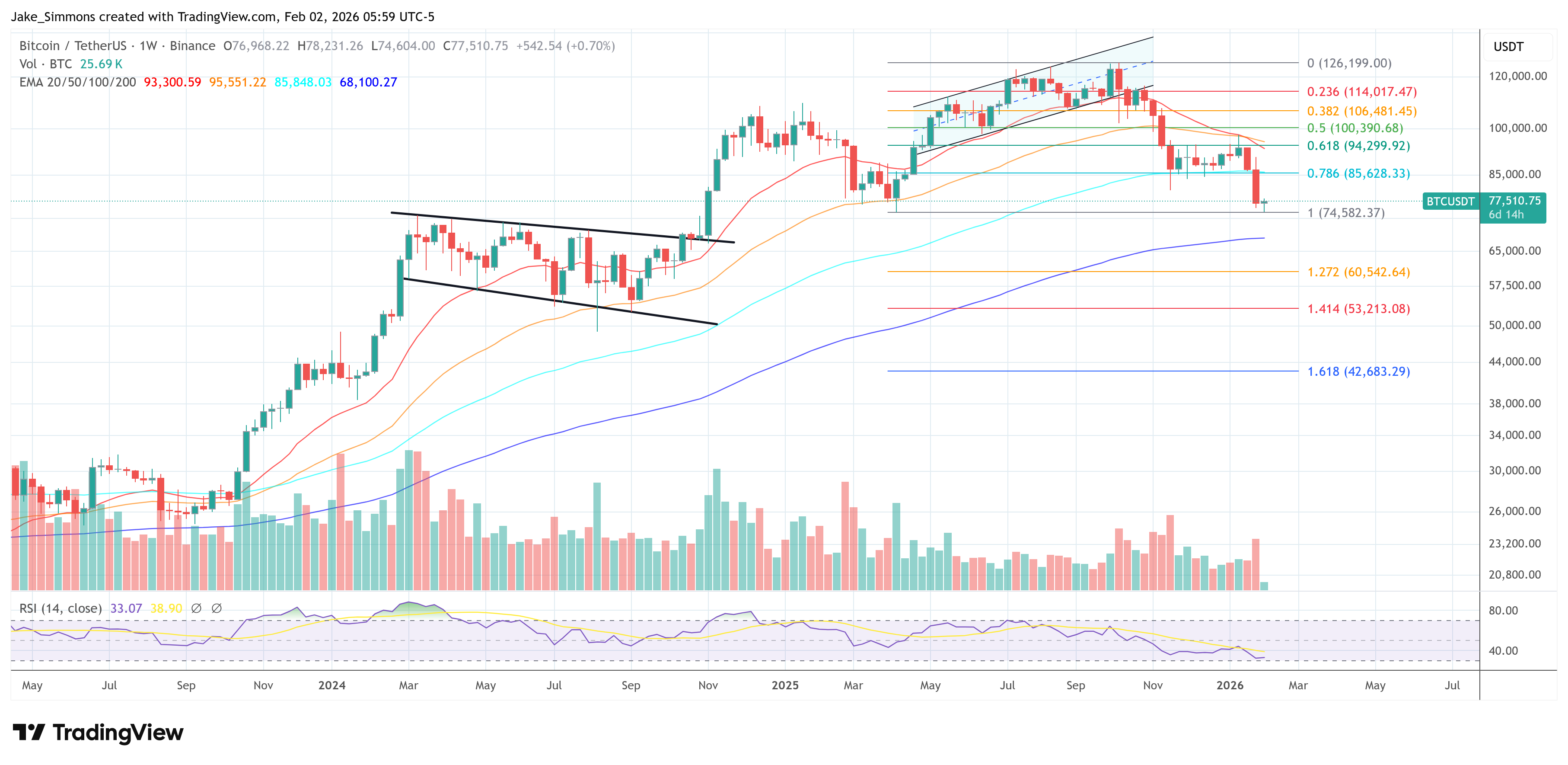

“What I discovered destroyed each the BTC narrative and the SaaS narrative,” Pal wrote. “SaaS and BTC are the EXACT identical chart. Huh? Which means there’s one other issue at play that we have now all missed…”

Crypto Slide Due To US Liquidity Drain?

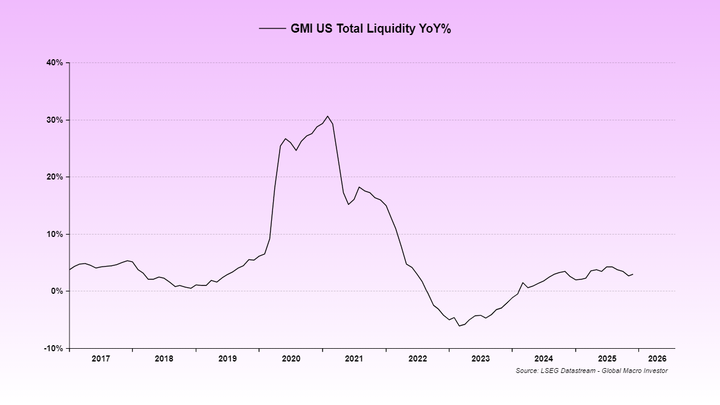

Pal’s reply is liquidity. He argues US liquidity has been “held again” by two shutdown episodes and “points with US plumbing,” including that the drain of the Fed’s reverse repo facility was “basically accomplished in 2024.”

Associated Studying

That, he stated, left the Treasury General Account (TGA) rebuild in July and August with out the type of offset that may usually soften the affect, turning it right into a web drain. In his telling, the identical lack of liquidity helps clarify why macro exercise gauges have regarded weak, writing that “lackluster liquidity is the rationale why the ISM has been so low.”

Whereas Pal stated he usually tracks world total liquidity due to its long-term correlation with bitcoin and US tech, he argued the US measure is dominating this part of the cycle as a result of the US stays the system’s key liquidity provider. That issues, he stated, as a result of the belongings most uncovered to a withdrawal of liquidity are long-duration, high-volatility exposures—precisely the place bitcoin and SaaS sit in lots of portfolios.

“These are each the longest period belongings that exist and each obtained discounted as a result of liquidity was quickly withdrawing,” Pal wrote, tying their drawdowns to the identical macro impulse slightly than project-specific failure or a damaged crypto “cycle.”

He additionally pointed to gold’s rally as an extra constraint on marginal flows. “The rally in gold basically sucked all marginal liquidity out of the system that may have flowed into BTC and SaaS,” Pal stated. “There was not sufficient liquidity to help all these belongings, so the riskiest obtained hit.”

Pal described the newest shutdown as an additional headwind, claiming the Treasury “hedged” by not drawing down the TGA after the prior shutdown and as a substitute “added extra to it,” deepening the drain. That, he stated, is the “present air pocket” behind the “brutal worth motion” throughout danger.

However he additionally argued the squeeze is near clearing. “Nonetheless, the indicators are that this shutdown will get resolved this week and that’s the FINAL liquidity hurdle out of the way in which,” Pal wrote, including that the subsequent part may convey a “liquidity flood” from components he listed together with modifications round eSLR, partial TGA drawdowns, fiscal stimulus and price cuts.

Associated Studying

He prolonged the “false narrative” theme to Fed expectations, rejecting the concept Kevin Warsh would run coverage as a hawk. “With reference to price cuts, there’s one other false narrative going round that Kevin Warsh is a hawk,” Pal wrote. “It’s utter fucking nonsense. These have been feedback primarily from 18 years in the past.”

Pal argued Warsh’s mandate would align with what he known as the “Greenspan period playbook”—chopping charges, letting the financial system run hotter, and leaning on productiveness positive aspects to restrain core inflation—whereas avoiding balance-sheet strikes that would collide with reserve constraints and destabilize lending.

Pal included a mea culpa, acknowledging GMI “was not seeing the US liquidity as the present driving issue,” after years of emphasizing world measures. “There is no such thing as a disconnect,” he wrote. “It’s simply that the confluence of occasions Reverse Repo drained >TGA rebuild > Shutdown > Gold rally > Shutdown was not forecastable by us, or in any occasion we missed the affect.”

His backside line was much less about calling the precise backside and extra about time-in-cycle. “Typically in these full cycle trades, it’s time that’s extra essential than worth,” he wrote, urging “PATIENCE!” and reiterating he stays “HUGE” bullish on 2026 if the coverage and liquidity playbook he expects materializes.

At press time, BTC traded at $77,510.

Featured picture created with DALL.E, chart from TradingView.com