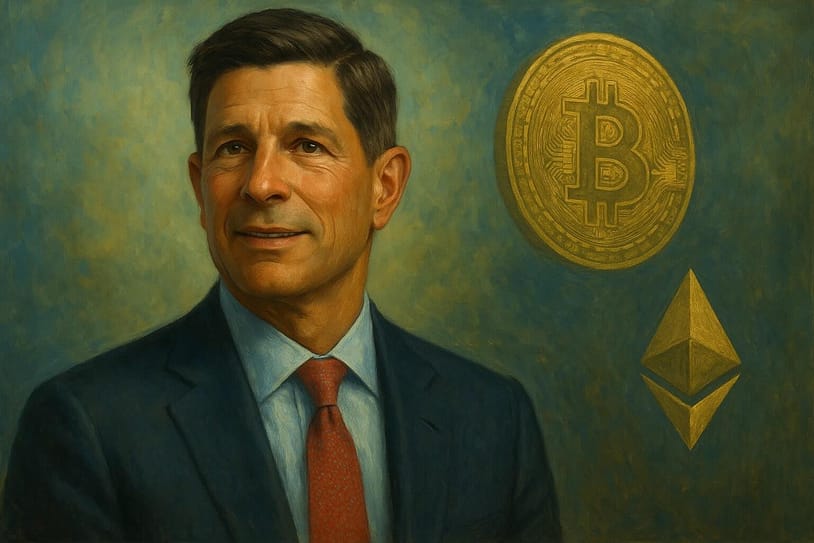

Charles Schwab CEO Rick Wurster confirmed the brokerage plans so as to add Bitcoin (BTC) and Ethereum (ETH) buying and selling for its prospects throughout an interview with CNBC on July 18.

In accordance with Wurster, the transfer comes amid heavy consumer demand to see all their asset publicity in the identical dashboard.

He mentioned:

“Our purchasers are invested in crypto at the moment.”

He defined that the agency’s prospects already maintain greater than 20% of all crypto change‑traded merchandise (ETPs) within the US, price roughly $25 billion. Nevertheless, this quantity quantities to solely roughly 0.2% of the agency’s $10.8 trillion in complete consumer balances.

Wurster’s remarks affirm reports from early May in regards to the agency’s curiosity in crypto buying and selling providers.

Purchasers search one‑cease custody

Wurster framed the spot Bitcoin and Ethereum entry as a consolidation instrument somewhat than a enterprise into speculative buying and selling.

He mentioned many households already maintain 98% of their wealth at Schwab however preserve a small “one or two %” slice at specialist crypto platforms to allow them to maintain cash straight.

Charles Schwab’s CEO famous:

“They actually need to carry it again to Schwab as a result of they belief us.”

Moreover, he mentioned that prospects desire to view crypto alongside equities, bonds, and money on a single dashboard.

Wurster expects the rollout to “speed up our progress” as a result of balances parked elsewhere would migrate as soon as Schwab gives direct custody. He didn’t specify a launch date, saying solely that the service will arrive “someday quickly.”

Direct rivalry with Coinbase

Requested whether or not the addition units up a head‑to‑head contest with Coinbase, Wurster answered “completely.”

He mentioned Schwab needs prospects who at the moment purchase cash at Coinbase to switch these holdings again to Schwab, the place the brokerage already gives spherical‑the‑clock service, analysis instruments, and built-in portfolio reporting.

Schwab’s upcoming service will complement the crypto publicity it already helps by way of change‑traded merchandise.

Wurster didn’t talk about charges, commerce execution companions, or pockets structure, however he emphasised that the agency will apply the identical custody requirements it makes use of for conventional securities.