The blockchain abstraction layer continues to shut the hole between conventional and DLT markets.

This newest characteristic will deliver tokenized US equities and ETFs to the blockchain, making entry to those belongings simpler and out there across the clock.

Advancing The Tokenization Market

Chainlink, a bridge between real-world information and blockchain, shared yesterday a few flagship product – Information Streams for the US Fairness and ETF market. A number of DeFi protocols are already on board, resembling GMX, GMX Solana, and Kamino.

Already built-in into main equities and exchange-traded funds (ETFs), the Information Streams present real-time pricing for conventional finance (TradFi) belongings, together with CRCL, QQQ, NVDA, MSFT, and plenty of extra, throughout 37 blockchain networks.

Builders can now entry dwell, contextual information for these markets straight on-chain, enabling tokenized inventory buying and selling, perpetual futures, and artificial ETFs, all backed by institutional dependability. The development additionally brings a roster of novel options, resembling market hours enforcement, staleness detection, and high-frequency pricing.

“With Chainlink Information Streams’ quick, dependable, and context-rich market information, production-ready tokenized monetary merchandise tied to U.S. equities and ETFs can now be launched straight on-chain.

This represents a major leap ahead for tokenized markets, closing a vital hole between conventional finance and blockchain infrastructure.

We’re excited to be collaborating with Kamino and GMX, two forward-thinking DeFi groups whose work continues to speed up the convergence of TradFi and DeFi.” – Johann Eid, Chief Enterprise Officer at Chainlink Labs.

To ascertain a dependable on-chain change for these belongings would require quick and high-integrity market information. Crypto markets function 24/7, whereas conventional ones don’t, and so they can moreover endure from occasional interference, which poses a problem for continuous, decentralized purposes (DApps). This could embrace value gaps, inaccuracies in off-market information, and outages.

How Will it Work

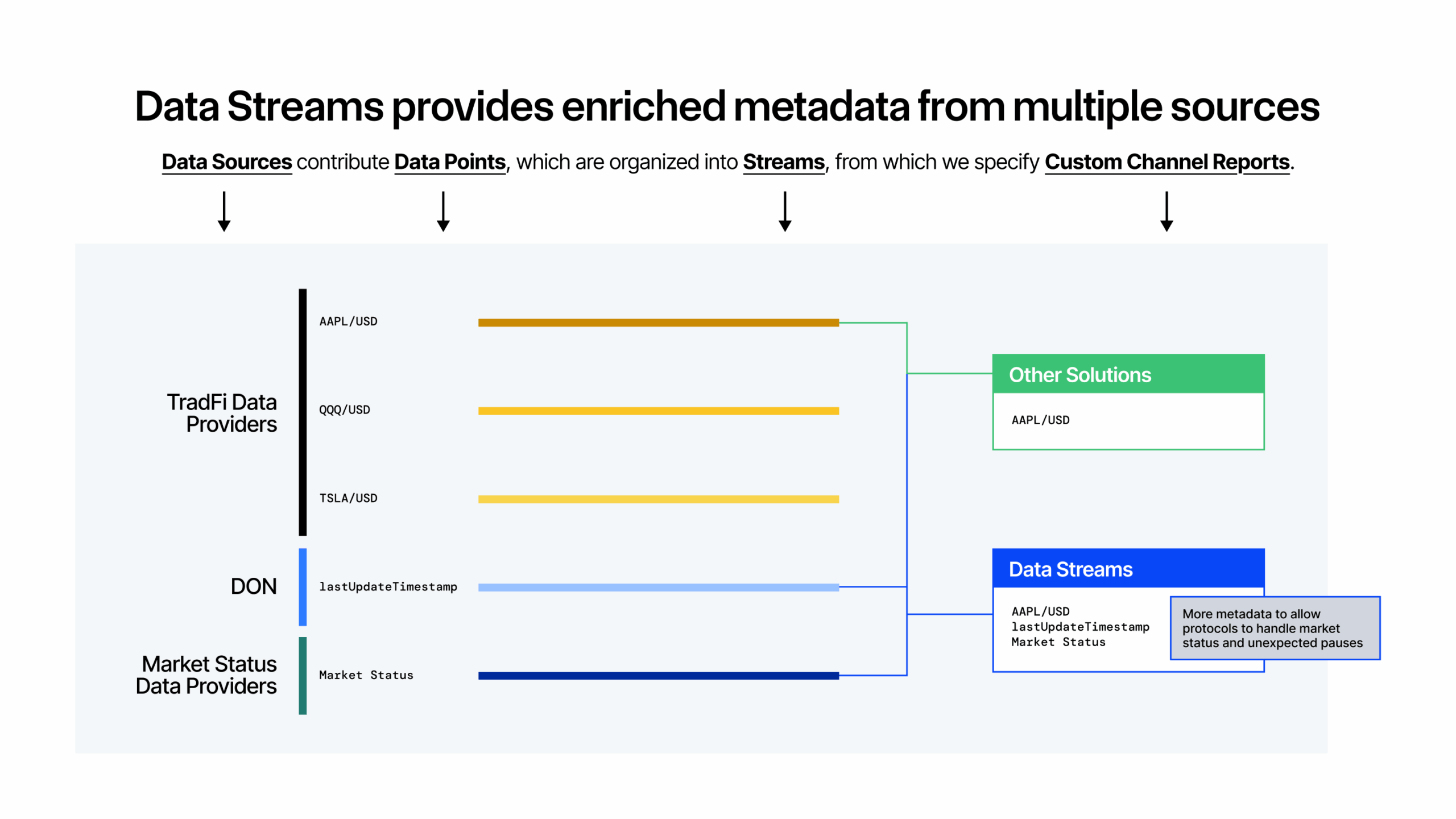

Chainlink Information Streams will combination enter from a number of major and backup information sources, thereby enhancing uptime and reliability. This aggregated information will then be processed by decentralized oracle networks (DONs) and transmitted on-chain by way of a structured schema.

Every information level shall be timestamped, permitting protocols to establish the variations between present and historic costs, pause robotically throughout market off-hours, and implement real-time danger administration.

This information schema is designed for superior DeFi composability, because it gives structured pricing that aids in correct liquidations, commerce halts, technique changes, and collateral valuation. It is going to additionally be capable to distinguish between real-world costs taken from conventional, open markets and costs of tokenized shares out there 24/7. This could open the door for arbitrage alternatives and danger administration methods.

Some use circumstances for the merchandise enabled by the Information Streams are perpetuals, lending/borrowing, vault protocols, brokerage platforms, and extra.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome supply on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!