Castle, a bitcoin treasury platform for small and medium-sized companies (SMBs), introduced it has raised $1 million in an oversubscribed pre-seed spherical to develop bitcoin entry for companies, per a press launch despatched to Bitcoin Journal. The spherical was led by Increase VC, with backing from Winklevoss Capital, Park Rangers Capital, Epoch VC, and different angel buyers.

“Most financial savings merchandise utilized by small and medium companies, regardless of being framed as high-yield, truly lose cash after accounting for inflation. Enterprise homeowners are waking as much as this and deserve higher,” said the CEO of Citadel, Stephen Cole. “Bitcoin, with its strictly restricted provide, has been one of the best performing asset of the previous decade and we’re excited to carry it to firms throughout America.”

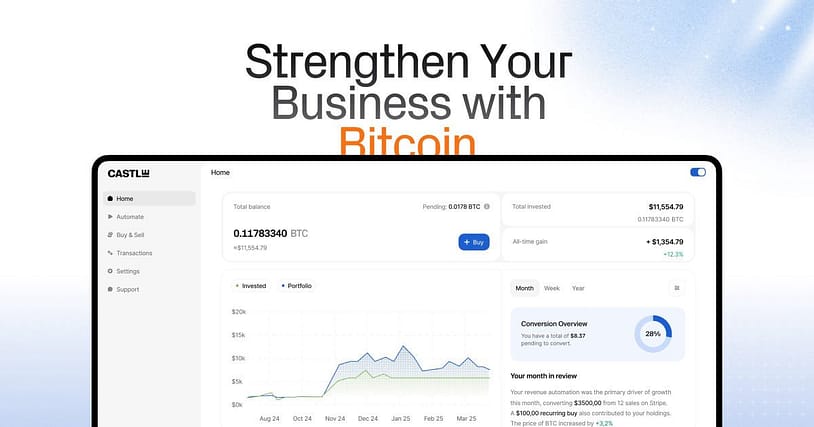

The funding will probably be used to speed up Citadel’s rollout of its automated bitcoin treasury answer, which integrates with instruments like QuickBooks, PayPal, Sq., and Stripe to assist SMBs shield their wealth from inflation by mechanically changing parts of income into bitcoin.

“By integrating with instruments like QuickBooks, PayPal, Sq., and Stripe, our platform provides companies clever bitcoin publicity aligned with their operational necessities,” CTO João Almeida mentioned. “Citadel is constructed to be invisible so homeowners can give attention to what they do greatest and know their bitcoin treasury will look the best way they need.”

Citadel additionally affords technique choices starting from conservative to aggressive, permitting companies to align their bitcoin allocations with their danger tolerance. Present clients embody firms throughout sectors corresponding to eating places, health, accounting, e-commerce, SaaS, actual property, and tremendous artwork.

“We see bitcoin because the world’s strongest financial savings know-how, and Citadel is making it simple and accessible for small and medium companies,” said the Managing Associate of Increase VC Brayton Williams. “The founders are veteran bitcoiners and tech leaders, combining a uncommon sense of mission and execution means, and Increase VC is worked up to help them.”

Citadel’s platform consists of automated recurring bitcoin allocations based mostly on mounted quantities or income percentages, money thresholds that set off automated purchases or gross sales to take care of liquidity, and settings to outline minimal and most bitcoin publicity.

“Bitcoin is the last word retailer of worth,” mentioned the Founders of Winklevoss Capital Cameron and Tyler Winklevoss. “In contrast to fiat, it protects the worth of your life’s work. Citadel lives as much as its identify by serving to companies safeguard their stability sheet by mechanically changing a portion of each sale into bitcoin.”