Bitcoin Value Weekly Outlook

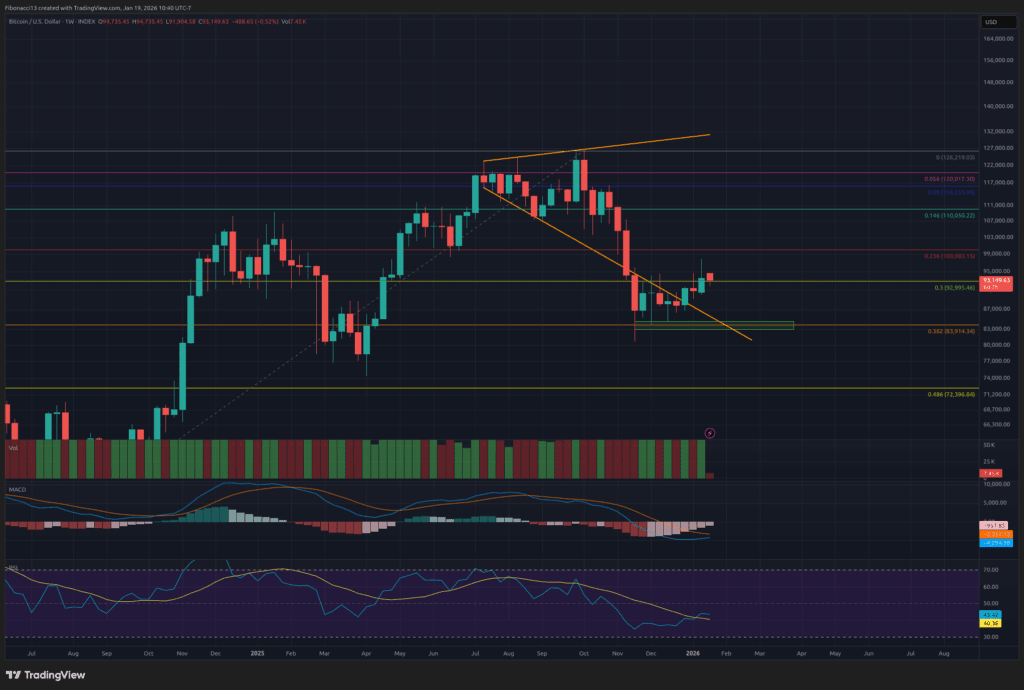

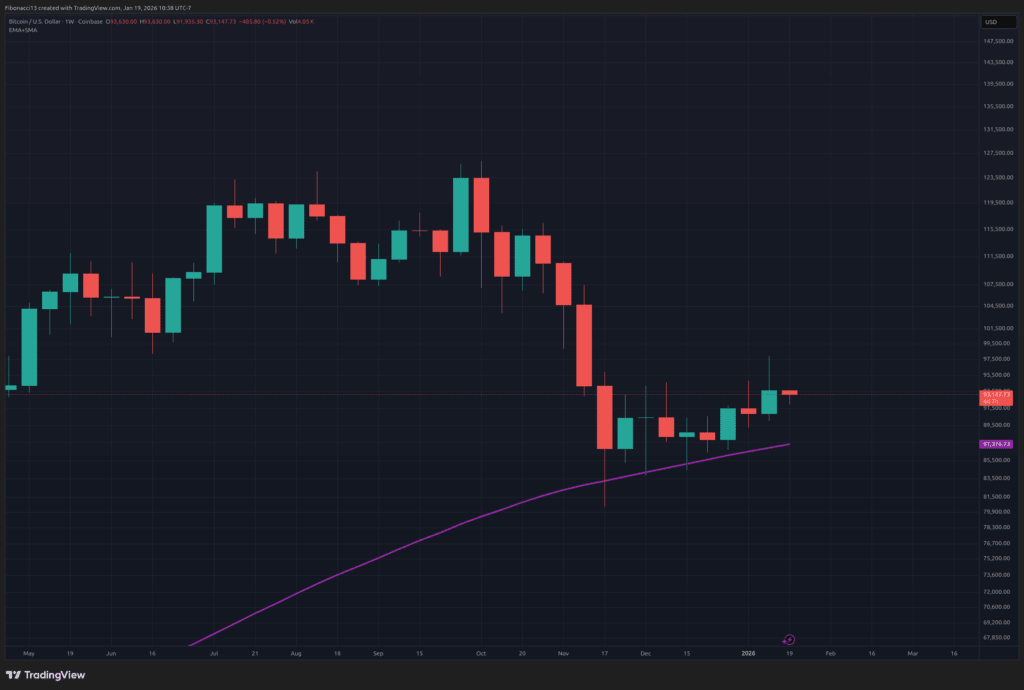

Properly, the bitcoin worth motion was trying fairly bearish after final week’s shut, however the bulls managed to keep up the bullish construction across the $90,000 stage and made that push as much as $98,000 resistance. The value retreated from there and closed the week out at $93,638. Count on the bulls to take one other run on the $98,000 resistance stage this week and intention for the higher finish of this resistance zone at $103,500 if they will maintain worth motion above $98,000. Early within the week, assist at $91,400 could also be examined and should maintain for the bulls to proceed their cost.

Key Assist and Resistance Ranges Now

The bulls have lastly made some progress, chipping away at overhead resistance. The bulls will look to regain the $94,000 stage as short-term assist this week. If they will preserve the momentum going, they’ll as soon as once more problem the $98,000 resistance and attempt to push to the higher finish of this zone at $103,500. Closing days on the higher finish of this zone ought to usher in a transfer as much as the subsequent main resistance zone at $106,000 to $109,000. This space ought to be very sturdy resistance, however $116,000 lies past this vary on the 0.786 Fibonacci retracement if the bulls’ energy can persist.

Search for bulls to defend the $91,400 stage with authority, as shedding this stage would give the bears some renewed confidence to push the worth down even decrease. $87,000 would look to comprise worth motion under there, and act as a doorway to the key $84,000 assist stage. Breaking $84,000 assist opens up the low $70,000 space for a check.

Outlook For This Week

Bulls ought to try and capitalize on their latest resolve heading into this week. Search for one other check of $98,000 if they will handle to regain $94,000 early this week. Nevertheless, a extra bearish check of the $91,400 assist is feasible right here as effectively, however so long as bulls can maintain this stage, bullish bias stays, and re-challenging $98,000 is within the playing cards. Closing a day above $98,000 ought to lead the worth in the direction of $103,500.

Market temper: Barely Bullish – The bulls lastly managed to indicate some resilience right here as they defended the $90,000 space final week. Value motion leans of their favor heading into this week.

The subsequent few weeks

The bulls have held onto some momentum over the previous week, however they’re getting into some heavier resistance areas now. If bulls can push even greater, above $100,000, they’ll begin getting into an space the place we may see a serious worth reversal. $103,500 to $109,000 ought to be a troublesome zone to beat, and we shouldn’t be shocked to see worth kicked again down with authority from this space over the approaching weeks. Holding assist from there could be important in figuring out whether or not this rally can preserve going to new highs or if it lastly offers strategy to new lows under $80,000.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the worth to go greater.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Assist or assist stage: A stage at which the worth ought to maintain for the asset, at the very least initially. The extra touches on assist, the weaker it will get and the extra possible it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of assist. The extent that’s prone to reject the worth, at the very least initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the worth.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).